|

|

|

|

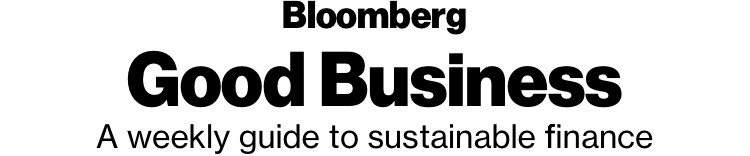

Inside: BlackRock sees a "Why not?" moment in sustainable investing; Calstrs, Soros take on new ESG talent; New York City is an unlikely place for solar growth but it's trying; CEOs are increasingly giving employees paid time off for Election Day. — Emily Chasan Sustainable FinanceBlackRock introduced a series of ESG ETFs dubbed iShares Sustainable Core. The firm predicted global ESG ETF assets will rise to about $400 billion by 2028. "We really feel as if we’re at a ‘why not?’ moment for sustainable investing,” Brian Deese, head of sustainable investing at BlackRock said at a press briefing. Investors when presented with portfolios of standard and ESG funds increasingly ask, "Why not invest in portfolios with lower carbon intensity?" Deese said. Flows to ESG ETFs have climbed in the past few years, but not as quickly as one might expect due to confusion about just what ESG means, writes Bloomberg Opinion's Nir Kaissar.  A prominent Tesla short seller changed his tune and sent the electric car maker's shares surging this week. Citron Research’s Andrew Left, a vocal and long-term Tesla short, said in a report Oct. 23 that the company is "smoking" the rest of the auto industry, snatching customers from BMW, Mercedes, Toyota and Honda. Separately, Tesla short Fahmi Quadir of Safkhet Capital, warned the carmaker faces risks to its supply chain due to unpaid vendors. Watch Left explain his U-turn on Bloomberg. Green bonds denominated in dollars have more evidence of a noticeable price advantage to regular bonds, versus euro-denominated securities, according to an analysis by Bloomberg Intelligence analyst Jaimin Patel. U.S. green bond issuance, however, is still lagging behind international issuance, Andrew Whiley, head of communications for the Climate Bonds Initiative said on Bloomberg Radio. Union-backed Amalgamated Bank said it will begin using a carbon accounting method to align its $3.4 billion loan portfolio with the science underlying the Paris Agreement. "This will align our loan book with the kind of businesses that will be successful in the future,” said Keith Mestrich, Amalgamated’s president and CEO. In Brief

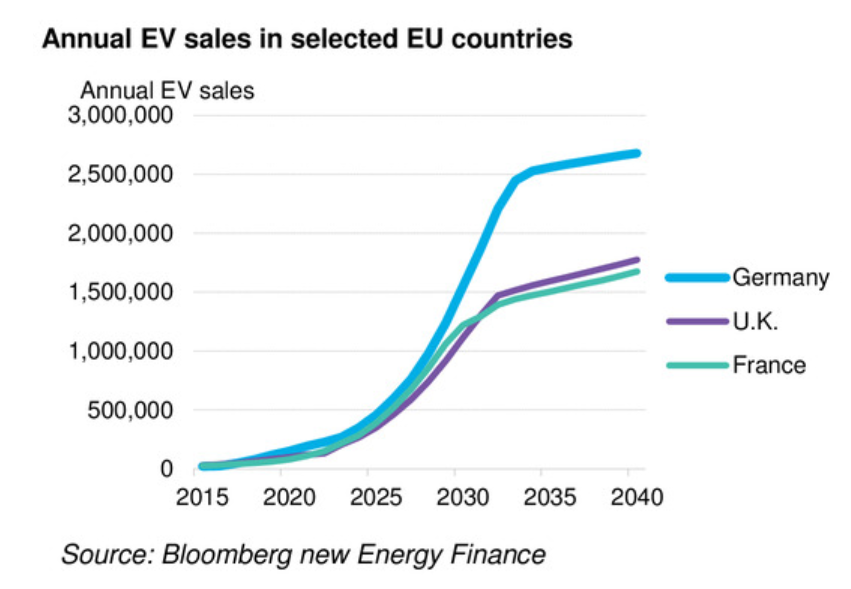

Environment Burger smoke is on the menu in California's air pollution fight, writes Bloomberg Law's Emily C. Dooley. Emissions from under-fired charbroilers at restaurants are contributing to air pollution and some areas aiming to reduce emissions are offering restaurants money to switch to greener technologies.  An Australian firm is promising that it can charge your electric car in 15 minutes. Veolia has been selected to operate and maintain Australia’s first waste-to-energy facility. It works just 65 percent of the time. Google purchases enough clean energy to offset its annual electricity demand, according to a new report from Bloomberg NEF, but due to intermittent solar and wind generation the tech giant's data centers are only met by renewables 65% of hours during the day.

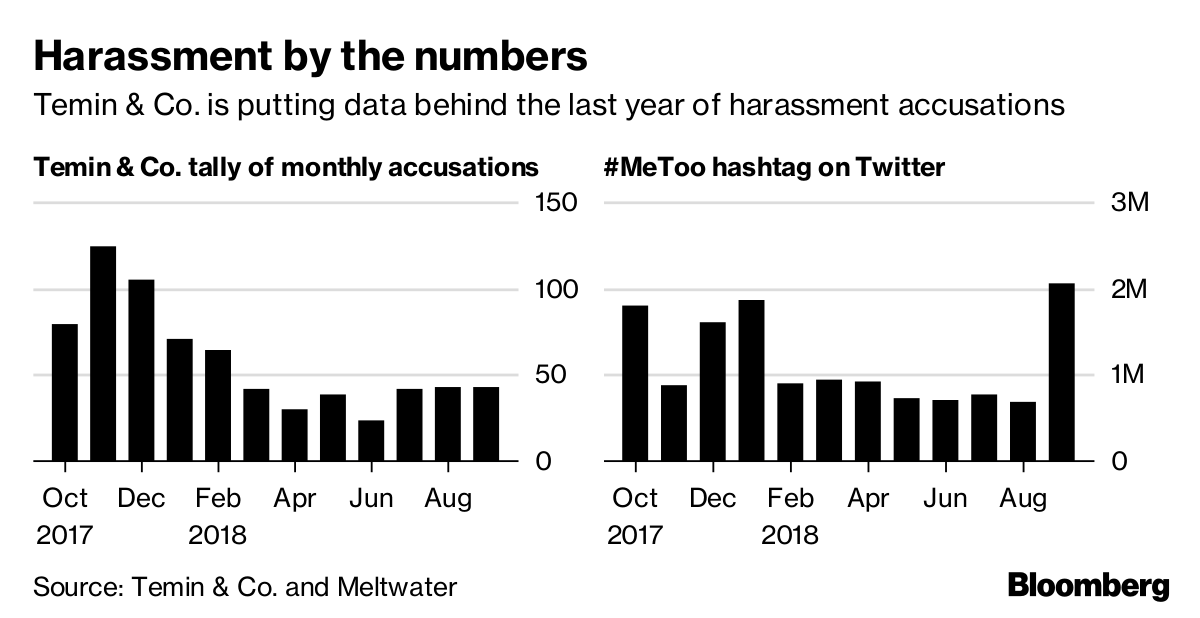

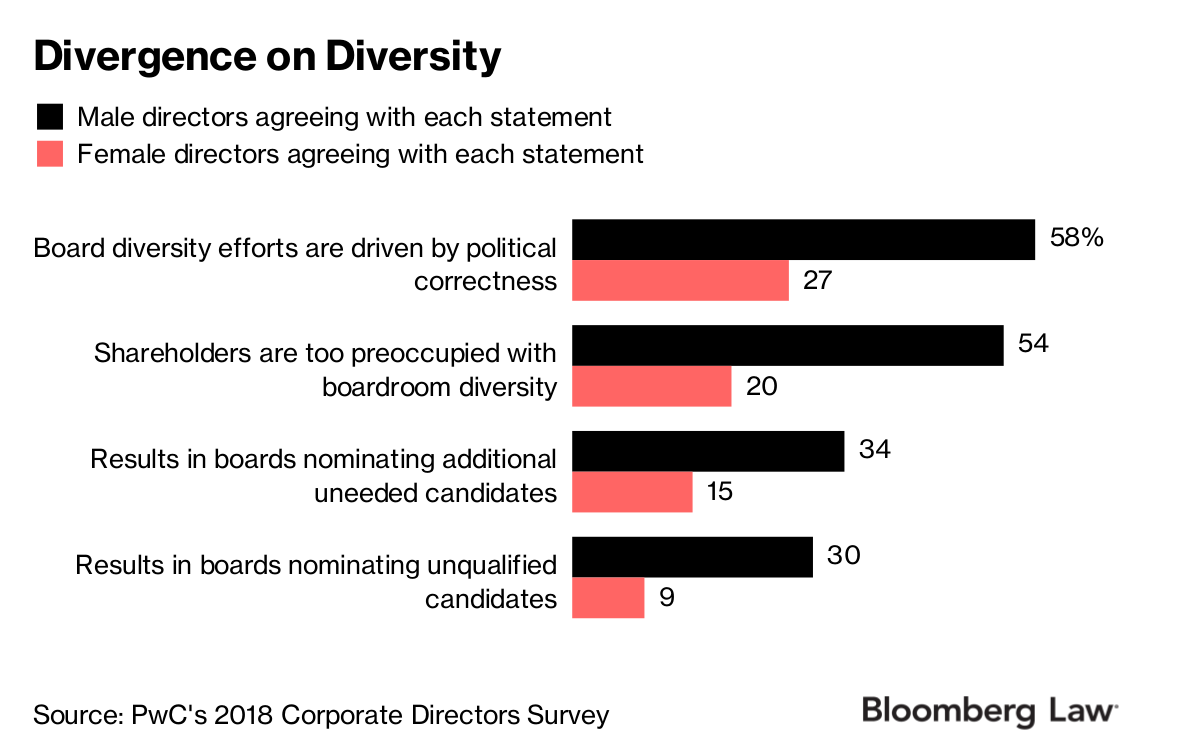

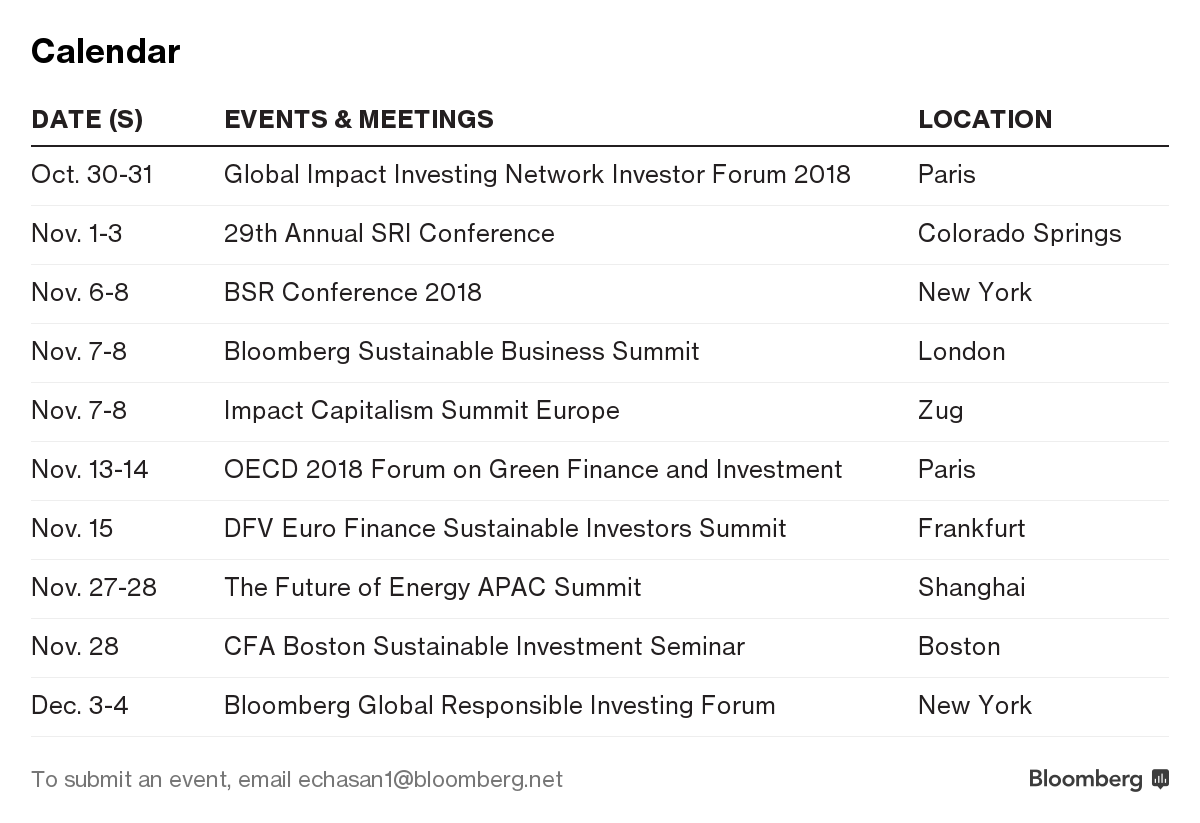

SocialCEOs are increasingly giving employees Election Day off. A record 44 percent of U.S. firms will give workers paid time off to vote November 6, up from 37 percent in 2016.  GovernanceThe U.S. Chamber of Commerce has deployed lobbyists to work on changing how the Securities and Exchange Commission regulates proxy advisers, writes Bloomberg Law's Andrew Ramonas. The SEC will hold a roundtable discussion on the casting and counting of proxy votes Nov. 15. The Council of Institutional Investors filed a petition with the New York Stock Exchange and Nasdaq asking the exchanges to require companies listing with dual-class share structures to sunset those unequal voting rights within seven years. New York City's pension funds will vote against the nominating and corporate governance committee members on boards this year if the percentage of women directors is less than 20 percent, New York City Comptroller Scott Stringer said at the International Corporate Governance Network Conference Oct. 22. Corporate boards may not be diversifying as quickly as investors want because male directors are more likely than female directors to question the reasoning behind a company's efforts to build diversity, according to a survey from PricewaterhouseCoopers.  Corporate oversight of conflict minerals is waning amid a relaxed regulatory environment, according to a report from the Responsible Sourcing Network.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Good Business newsletter. |

| Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |