|

|

|

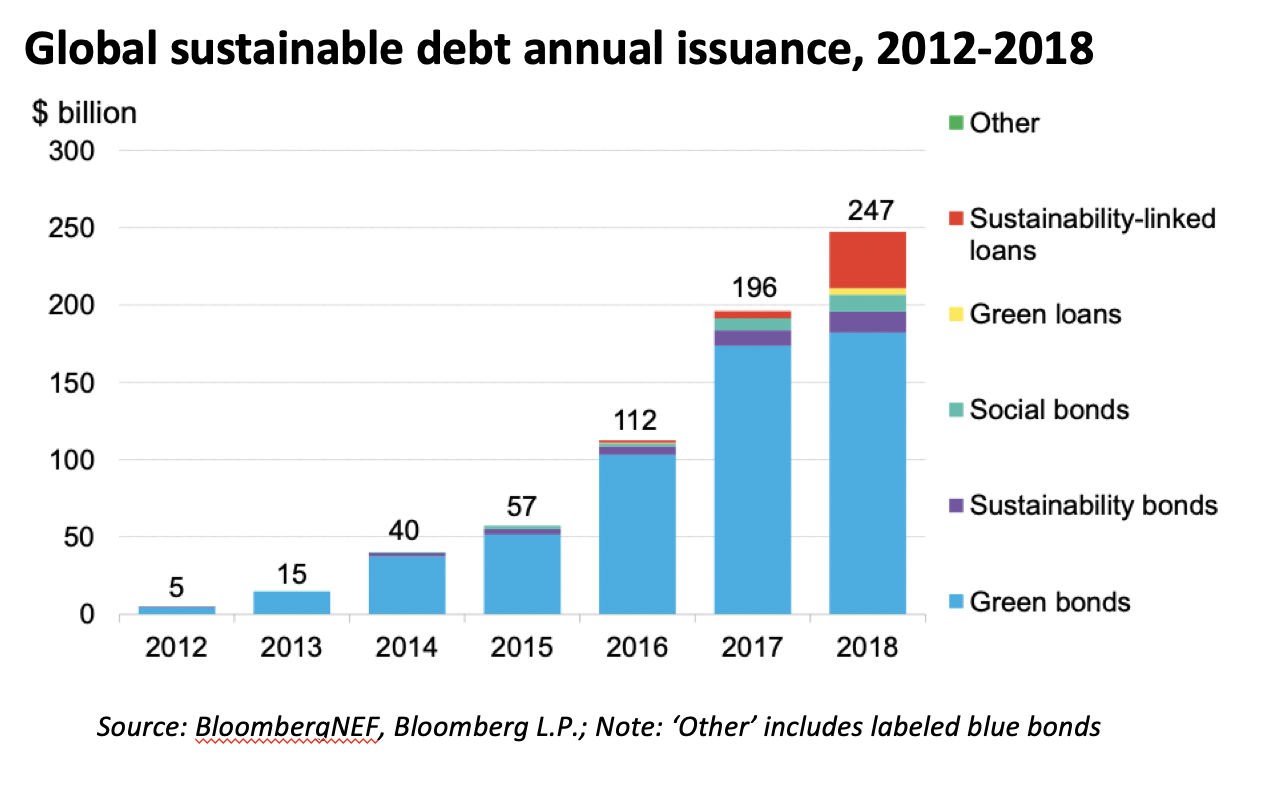

Inside: Speaker Nancy Pelosi promises new climate action; PG&E considers bankruptcy as it faces billions in potential wildfire liability; Fitch Ratings spells out how ESG factors influence credit-ratings; U.S. CO2 emissions rise by the second-biggest margin in 20 years; EVs have barely arrived and companies are already on to the next big thing. — Eric Roston Sustainable FinanceDebt instruments designed to promote sustainability goals jumped 26 percent in 2018, to a record $247 billion, according to BloombergNEF. Green bonds made up the bulk of that sum, totaling $182.2 billion. A single new product, sustainability-linked loans, hit $36.4 billion.

Fitch Ratings, the third-largest global credit grading company, said it will publicly disclose how environmental, social and governance factors influence credit-rating decisions. According to the firm’s research, about 3 percent of its current ratings actions have been directly triggered by an ESG issue. Another 19 percent of grades were influenced by at least one. The value of CO2 emissions trading programs around the world surged to $82 billion in 2018, with more growth on the way, according to an HSBC analysis. There are more than 50 national and sub-national carbon tax or trading systems either planned or already active that cover almost a fifth of global climate pollution. Progress toward a global carbon market is stalled by a dispute between two blocks of nations, led respectively by Germany and Brazil. They are sparring over who would be able to sell carbon credits into a system linked to the 2015 Paris Agreement.

In Brief

EnvironmentPG&E plunged 22 percent Monday on news that it’s exploring a bankruptcy filing in response to wildfire liabilities that could reach $30 billion, far exceeding the company’s market value of less than $10 billion. On Tuesday, the company fell as much as 17 percent after S&P Global Ratings downgraded the company’s long-term credit rating to junk, and said the utility remains on a negative watch. The bonds hit all-time lows. Gov. Gavin Newsome said he's working on PG&E matters "in real time." Speaker Nancy Pelosi put climate change atop her party's agenda in the U.S. House of Representatives, saying she'll return to legislation that stalled in the Senate nine years ago. Large automakers, start-ups, and oil and chemical companies are all racing to develop a more efficient successor to the lithium-ion batteries that power today's electric vehicles. Solid-state technologies overhaul the internal battery architecture and replace flammable liquids with solid materials. Which electric car is right for you?

Electric vehicles are coming to market with phenomenal speed, unless you consider that the first models were invented in the early 1830s. In 1900, electric cars accounted for about one-third of all vehicles on U.S. roads, and then almost disappeared from the landscape as gasoline-engine models took over. By 2040, more than half of all new cars worldwide will again be powered only by batteries — again. The dairy industry is about to flood America's schools with chocolate milk. Get ready for floating solar technology. The World Bank has estimated that floating solar farms globally could generate 400 gigawatts of power, which is more than all existing solar capacity in 2017. Pilgrim's Pride, a poultry producer, changed some website claims about the way it treats chickens, after a December complaint by the U.S. Federal Trade Commission alleged some statements were "misleading." The company said it was a coincidence that the material changed within two weeks of the FTC complaint, as the website update had been planned for months.

SocialGoldman Sachs reported progress on its pledge to fund more female entrepreneurs. It has made more than $100 million in investments in women-led companies, including a Chinese pediatrics company and a New York-based retailer. The move is aimed at correcting a lopsided ecosystem for entrepreneurs that’s stymied opportunities for women, who account for just one in 10 partners at venture capital firms. Managers tend to choose proteges who share their gender or race, according to a poll of more than 3,200 men and women in white-collar jobs. A report based on the survey also found that, while more than half of mentors say their proteges have leadership potential, less than a third are advocating for their promotion.

Women at HSBC earned 61 percent less on average compared with male employees at the lender, a wider gap than the 59 percent difference the firm reported a year ago, already the biggest in the banking industry. By comparison, Lloyds Banking Group most recently reported a 31.5 percent gender pay gap, and Nationwide Building Society reported a 28 percent difference in the average hourly wages paid to men and women. Actress Regina King vowed at the Golden Globes that within the next two years all the projects she produces would be staffed by 50 percent women. She challenged the rest of Hollywood to do the same. It won't be an easy task: White women represented 16.3 percent of producers on 300 movies between 2016 and 2018; women of color, just 1.6 percent. American workers have enjoyed wage gains, the largely predictable result of an economy "now in that part of the business cycle when steady and large gains show up," writes Barry Ritholtz of Bloomberg Opinion. "There is little or no evidence that the Tax Cuts and Jobs Act of 2017 had much of an impact on wages," he said. GovernanceOne of House Democrats' first bills in the new Congress would allow the Securities and Exchange Commission to require publicly traded companies to disclose their political contributions. Companies aren’t waiting for congressional action. Reporting on political giving has become the norm amid interest from investors. Mark Zuckerberg pledged in September 2017 to sell up to 75 million Facebook shares over 18 months as part of a plan to give away his fortune in his lifetime. Sales fell to zero in the fourth quarter, when the social media giant's stock fell 20 percent in a broader market rout.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Good Business newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |