|

|

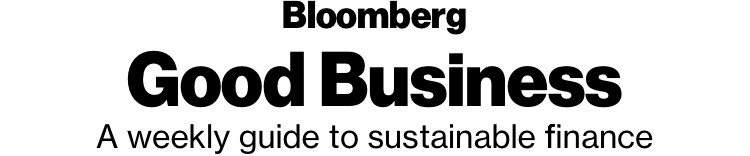

Inside: Chevron says it will cut emissions in line with the Paris agreement. Lines blur between activists and ESG investors. Dubai wants a solar-powered desalination plant. PG&E faces a fight over its board slate; SEC taps Roisman to oversee proxy plumbing overhaul. — Emily Chasan Sustainable FinanceChevron vowed to cut greenhouse gas emissions in alignment with the Paris climate accord, potentially averting a shareholder rebellion at its annual general meeting, write Bloomberg's Kevin Crowley and Eric Roston. The U.S. oil major pledged to reduce air pollution intensity by 25 to 30 percent by 2023 and said that metric will also be a factor in determining employee bonuses. Jeff Tannebaum, the former chairman of hedge fund Fir Tree Capital Management, is investing his own money in a new firm that advocates for clean energy to address climate change, write Bloomberg's Brian Eckhouse and Chris Martin. Shareholder activists are back in the boardroom and more active than ever, according to a review by law firm Schulte Roth and Zabel. The firm tracked 922 activist targets in 2018, up almost 8 percent from 856 in 2017 Shareholder rights proposals were up and the lines between financial and ESG activism are blurring, the firm said. Calstrs said this week it would invest $250 million with a new investment management firm, Impactive Capital, that aims to marry long-term activist investing with a focus on improving ESG policies.  In Brief

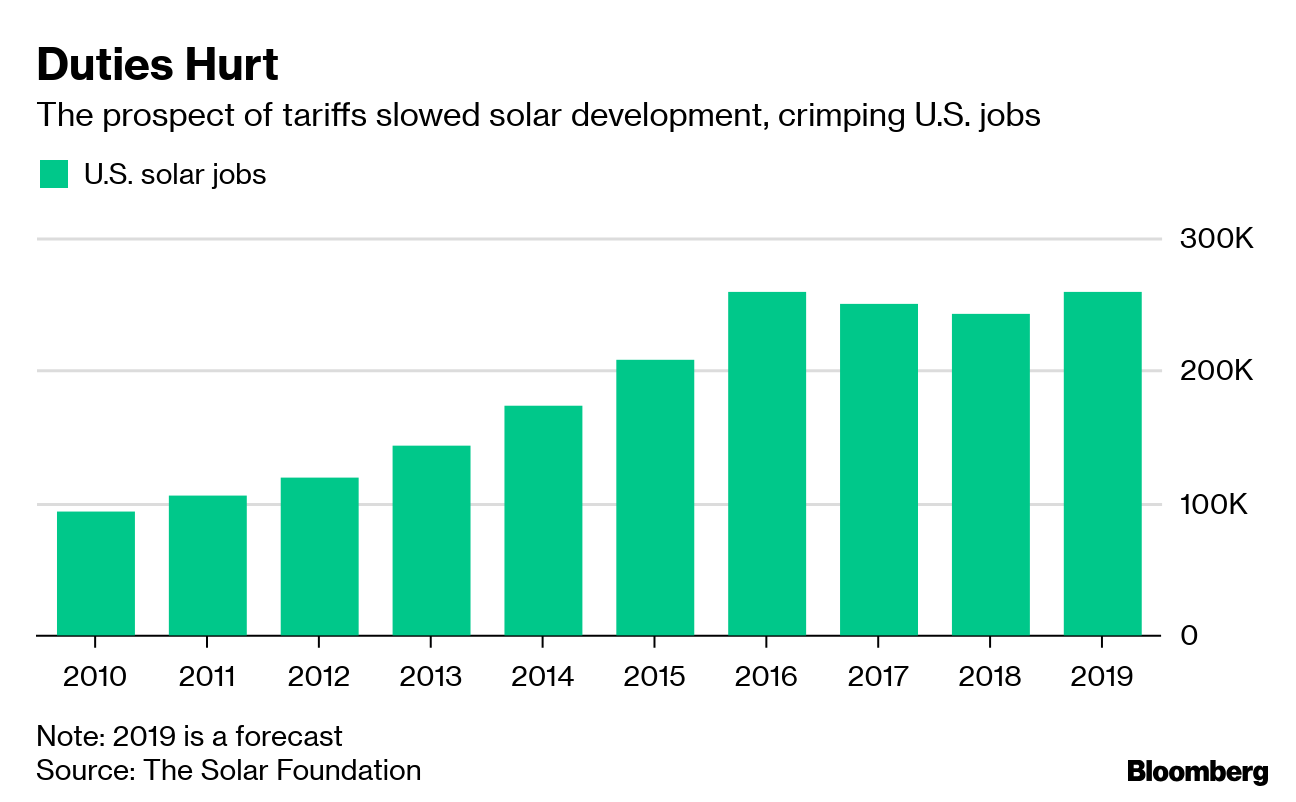

EnvironmentThe U.S. solar industry is forecast to add 17,000 jobs this year, growing again in 2019 after contracting for two consecutive years due to tariffs.  California's plan to require rooftop solar on all new homes is looking prescient after PG&E warned many more customers could see their electricity shut off in the future as part of the utility's wildfire season safety plan. Los Angeles is also trying to speed up its switch to renewables, ditching a plan to spend billions rebuilding three natural gas-fired power plants. Ontario proposed that large polluters should pay for excessive greenhouse gas emissions. Dubai will seek partners this year to build its first solar-powered desalination plant as the emirate tries to diversify away from burning fossil fuels to increase its water supply, the head of the Dubai Electricity and Water Authority said in an interview. Dominion Energy said it plans to slash its methane leaks from its natural gas pipelines and distribution network by 50 percent over the next decade. The first U.S. coal-fired power plant in years has opened in Alaska where there is no gas, little sun and few winds. Social New York City Comptroller Scott Stringer is urging U.S. securities regulators to investigate whether Oracle misled investors about alleged pay bias across its workforce. Despite a Labor Department lawsuit that claims Oracle systematically shorted women and minorities, the investor said that Oracle's board painted a rosier picture of its efforts to avoid gender pay gaps while trying to squash a shareholder proposal on the issue. Japanese women who want to raise families, work and get promoted need more options than just office jobs, writes Bloomberg Opinion's Nobuko Kobayashi. GovernanceJeff Bezos' selfie leak is triggering an alarm for billionaires and wealthy executives who often focus on physical safety but overlook digital security, write Bloomberg's Devon Pendleton and Anders Melin. Bezos said he won't be distracted by his fight with the National Enquirer publisher after he accused the company of trying to blackmail him. Shareholder Harrington Investments is pressing Coca-Cola on sugar-related health risks from its products with a new shareholder resolution.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Good Business newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |