|

|

|

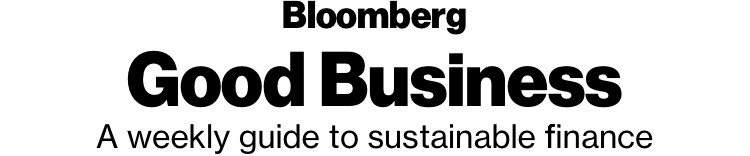

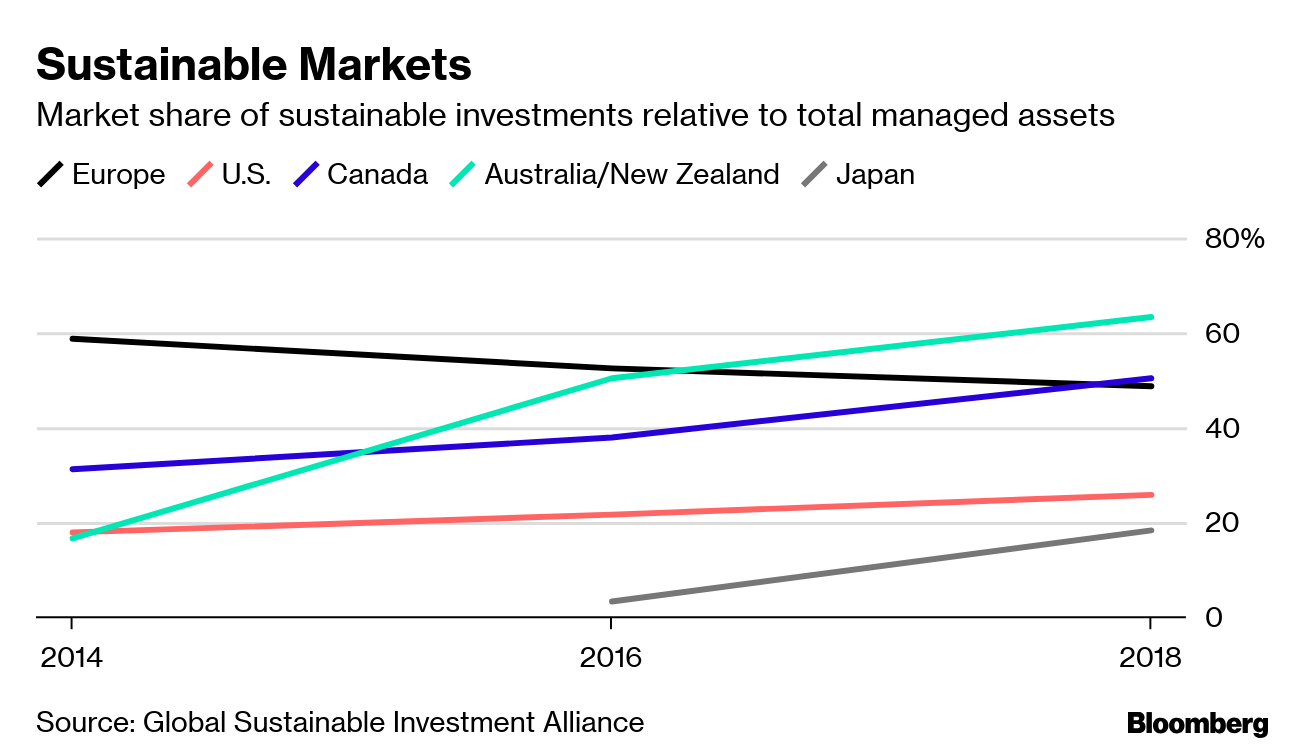

Inside: Predicting the weather is a growing business on Wall Street; Sustainable investing assets hit $30.7 trillion globally; It might be the top for oil drillers; Amazon has bested everyone this year — in shareholder proposals. — Emily Chasan Sustainable FinanceMeteorologists are heading to Wall Street. Blaming the weather for poor performance just doesn't work as well in a warming world where billion-dollar disasters from droughts and storms are common. That is making meteorologists the new high priests of finance as they help predict weather-related shipping delays or risks to floating oil rigs.

Disaster costs aren't just limited to banks. AT&T has also turned to 30-year climate modeling as natural disasters have cost the company $874 million since 2016. Miner Rio Tinto also said this week that it expects iron ore shipments at the lower end of guidance this year after a tropical cyclone in damaged a crucial port.

In Brief

Environment

Is it the top for oil drillers? Saudi Arabia's Aramco may be the world's most profitable company, but Norway's move to divest oil explorers is already raising pressure on investors around the world to do the same amid concerns that the world doesn't really need to find more oil.

This is how fast plastic straws are disappearing. In 2018, at one of the world's largest straw manufacturers, 90 percent of straws were made of traditional plastic. By the end of last year, plastic dropped to just a 60 percent share and as paper and biodegradable plastics ramped up. But biodegradable plastics are not a silver bullet for fixing the world's plastic pollution problem — they often don't degrade properly in landfills, writes Bloomberg Opinion's Adam Minter. Researchers are still nailing down new formulas, like this bio-plastic made from seaweed eating organisms. Burger King is now selling a plant-based burger. Separately, Olive Garden owner Darden Restaurants said it would commit to purchasing chicken raised without medically important antibiotics by 2023 and updated its animal welfare policy following shareholder pressure. SocialCitigroup ranked at the top of Arjuna Capital's gender pay gap corporate scorecard while most companies received "Fs", Arjuna Managing Partner Natasha Lamb told Bloomberg Television.

Google lost its Human Rights Campaign endorsement over an anti-gay "conversion therapy" app in its store. Then Google said it would pull the app. Separately, Google said this week that it would require benefits including parental leave, comprehensive health care, and a $15 per hour minimum wage for temporary staff and contractors who work for its vendors. Governance

Amazon.com has attracted the most shareholder proposals of any U.S. company this year, writes Bloomberg Law's Andrea Vittorio. The company faces 15 proposals from employees and investors on topics from food waste and facial recognition technology to the environmental effects of warehouses and its headquarters’ impact on local housing. Energy companies Exxon and Chevron are the only ones that have come close to that amount. Bankrupt utility PG&E is said to be near a deal with investors for a new CEO and board overhaul. There's a big reason to get the California utility out of bankruptcy quickly: The clock is ticking toward the next wildfire season. The U.S. Senate Committee on Banking, Housing and Urban Affairs held a hearing April 2 on conflicts of interest at proxy advisory firms.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Good Business newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |