The central bank brain trust

Microsoft’s secret weapon

Asia’s super-app entrepreneur

Big Oil’s big fan of renewables

The gene-medicine revolutionaries

The #MeToo legal guardians

New York’s socialist-elect

The woman behind the Wing

Asia’s richest mogul

The $8 billion hedge fund founder

The scalper-beating singer

Mr. Opportunity Zone

The guy driving self-driving cars

Canada’s trade warrior

Hollywood’s busiest leading lady

The music man

Netflix’s big hire

The Mideast’s Uber challenger

The global K-pop sensation

Boeing Defense’s defender

A convert to zero-fee funds

A record-setting painter

Fashion’s hottest exec

AI’s bias investigators

Xi’s economic guru

The Black Panther visionary

The ETF whisperer

The Brexit fixer

Corporate America’s environmental champion

Comcast’s dealmaking CEO

The Fortnite billionaire

Chef to the downtrodden

A Brazilian Charles Schwab

A hotelier for millennials

California’s Trump-antagonizing AG

Radical economists

The producer who wants parity

Silicon Valley’s top recruit

The students against gun violence

AMLO et al.

Europe’s investor protector

The queen bee at Bumble

A Nobel Prize-winning physicist

The anti-consumer-protection advocate

Vietnam’s airline tycoon

The turnaround tech bro

Australia’s bankbuster

The marijuana CEO

NYSE’s first female president

The funniest man in weather

The central bank brain trust

Microsoft’s secret weapon

Asia’s super-app entrepreneur

Big Oil’s big fan of renewables

The gene-medicine revolutionaries

The #MeToo legal guardians

New York’s socialist-elect

The woman behind the Wing

Asia’s richest mogul

The $8 billion hedge fund founder

The scalper-beating singer

Mr. Opportunity Zone

The guy driving self-driving cars

Canada’s trade warrior

Hollywood’s busiest leading lady

The music man

Netflix’s big hire

The Mideast’s Uber challenger

The global K-pop sensation

Boeing Defense’s defender

A convert to zero-fee funds

A record-setting painter

Fashion’s hottest exec

AI’s bias investigators

Xi’s economic guru

The Black Panther visionary

The ETF whisperer

The Brexit fixer

Corporate America’s environmental champion

Comcast’s dealmaking CEO

The Fortnite billionaire

Chef to the downtrodden

A Brazilian Charles Schwab

A hotelier for millennials

California’s Trump-antagonizing AG

Radical economists

The producer who wants parity

Silicon Valley’s top recruit

The students against gun violence

AMLO et al.

Europe’s investor protector

The queen bee at Bumble

A Nobel Prize-winning physicist

The anti-consumer-protection advocate

Vietnam’s airline tycoon

The turnaround tech bro

Australia’s bankbuster

The marijuana CEO

NYSE’s first female president

The funniest man in weather

50

The Bloomberg 50

What does Black Panther director Ryan Coogler have in common with Ben van Beurden, chief executive officer of Royal Dutch Shell? Or Representative-elect Alexandria Ocasio-Cortez with Michael Gelband, co-founder and CEO of ExodusPoint Capital Management? A place on the second annual Bloomberg 50, our look at the people in business, entertainment, finance, politics, and technology and science whose 2018 accomplishments were particularly noteworthy. Some who made the list are familiar faces up to new tricks, such as actor-producer Reese Witherspoon; others, like Sarah Friar, CEO of Nextdoor, the social network for neighbors, are just starting to make their mark. Once you’re done with 2018, go to the bottom of the page to find out which 20 people you might be reading about in 2019.

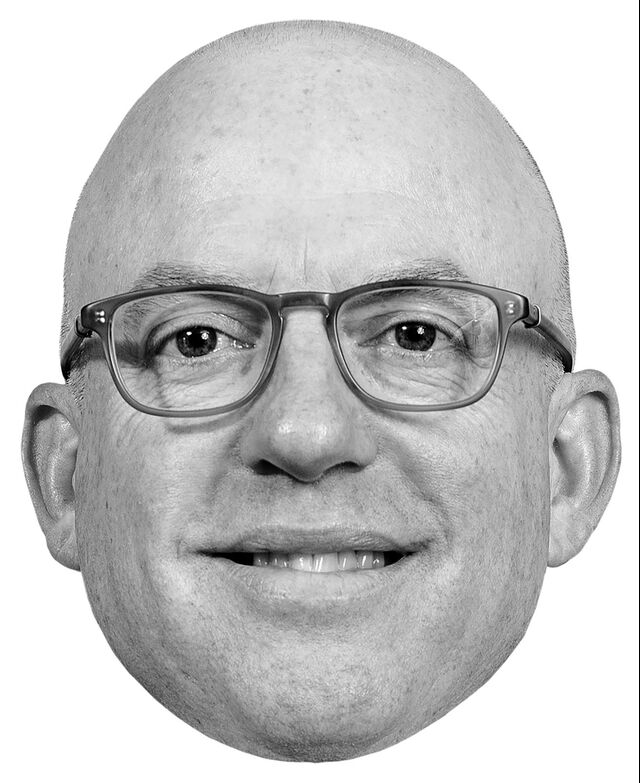

The Fed’s nucleus

Jerome Powell, chairman • Richard Clarida, vice chairman • John Williams, president, Federal Reserve Bank of New York, and vice chairman, Federal Open Market Committee • Randal Quarles, vice chairman for supervision • Lael Brainard, governor ●

In Powell’s first year as Fed chairman, the economy has experienced its fastest growth rate in 13 years, despite multiple interest-rate hikes, and is on course to achieve its longest-running expansion by mid-2019.

Things couldn’t be much better when it comes to the central bank’s twin goals of maximum employment and stable prices: Unemployment is at a 48-year low, and inflation is hovering near the Fed’s 2 percent target. This performance is even more impressive given that it’s come as the Fed has been scaling back policies that boost the economy: Powell & Co. have been steadily raising rates and slowly shrinking the central bank’s massive bond holdings, effectively withdrawing dollops of liquidity. So far that’s gone well, despite fears that the never-before-tried preplanned bond drawdown—which has already slashed holdings by more than $350 billion—would trigger widespread eruptions in financial markets.

Instead, the only eruptions have come from the White House. Breaking with more than two decades of presidential precedent, Donald Trump has openly and repeatedly chastised the Fed for raising rates; low ones, after all, goose homebuying, business investment, and, ultimately, growth. The criticism threatens to undermine the central bank’s ability to manage the economy free of political interference. Powell has responded by saying: “Control the controllable.” “We have been given our dual mandate from Congress,” he said in an email. “We are solely focused on trying to pursue it as best we can.”

A Republican who was nominated for the top job by Trump, Powell has met with dozens of lawmakers from both parties in an effort to shore up the Fed’s political independence. The unprecedented outreach has thus far proven successful: The congressional criticism that would be routine during rate hikes has been muted. As part of his strategy to protect his institution from Trump’s attacks, Powell has also sought to demystify the Fed through frank and frequent forays in public, providing plain-English descriptions of what it’s up to.

Next year will bring more challenges. With growth set to slow and inflation to top the target, Powell and his team must decide if and when to pause efforts to raise rates. As he put it, “We have to navigate between two risks—tightening too much and shortening the expansion or normalizing too little and risking imbalances,” such as overheated inflation. —Rich Miller and Jeanna Smialek

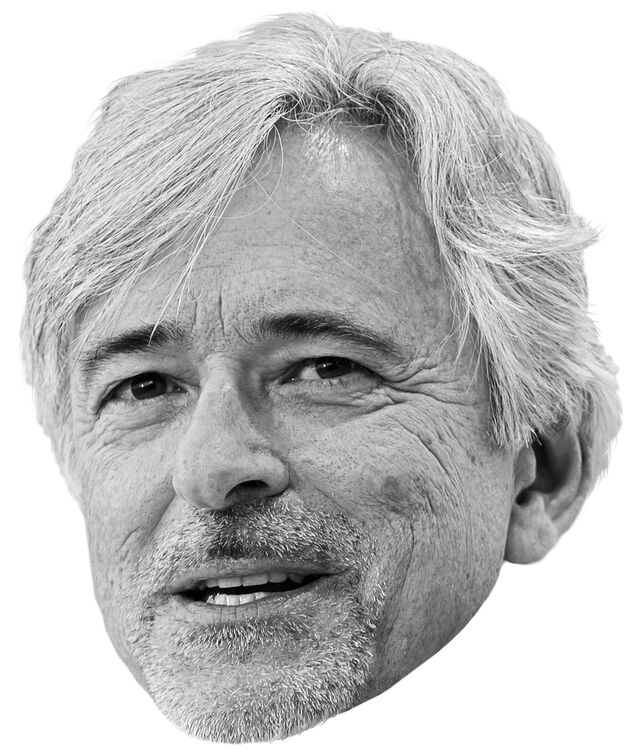

Amy Hood

Chief financial officer, Microsoft Corp. ●

In late November, Microsoft surpassed Apple Inc. as the world’s most valuable company by market capitalization.

Hood, who this year became the longest-serving CFO at Microsoft since the early ’90s, has collaborated with Chief Executive Officer Satya Nadella to reinvigorate the company, making it into the No. 1 cloud-based software supplier, according to KeyBanc Capital Markets Inc. She’s also reshaping the way Microsoft allocates spending and wins contracts by using machine learning tools to predict which types of hiring will have the greatest impact on sales. With one of those tools, the company started analyzing historical data from 750,000 customers to forecast sales opportunities for each product, customer, and city worldwide. Another system Hood installed predicts which customers need more attention and which are at risk of defecting. —Dina Bass

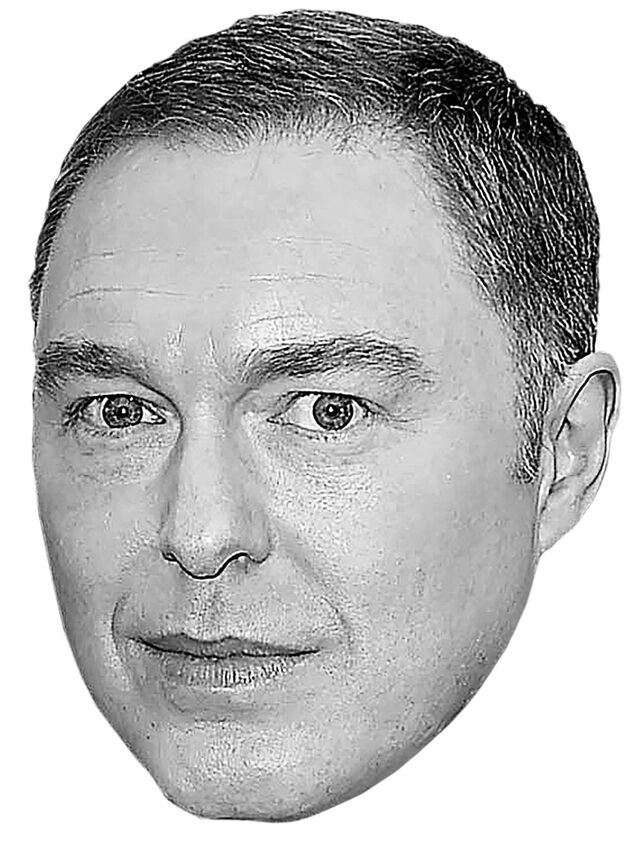

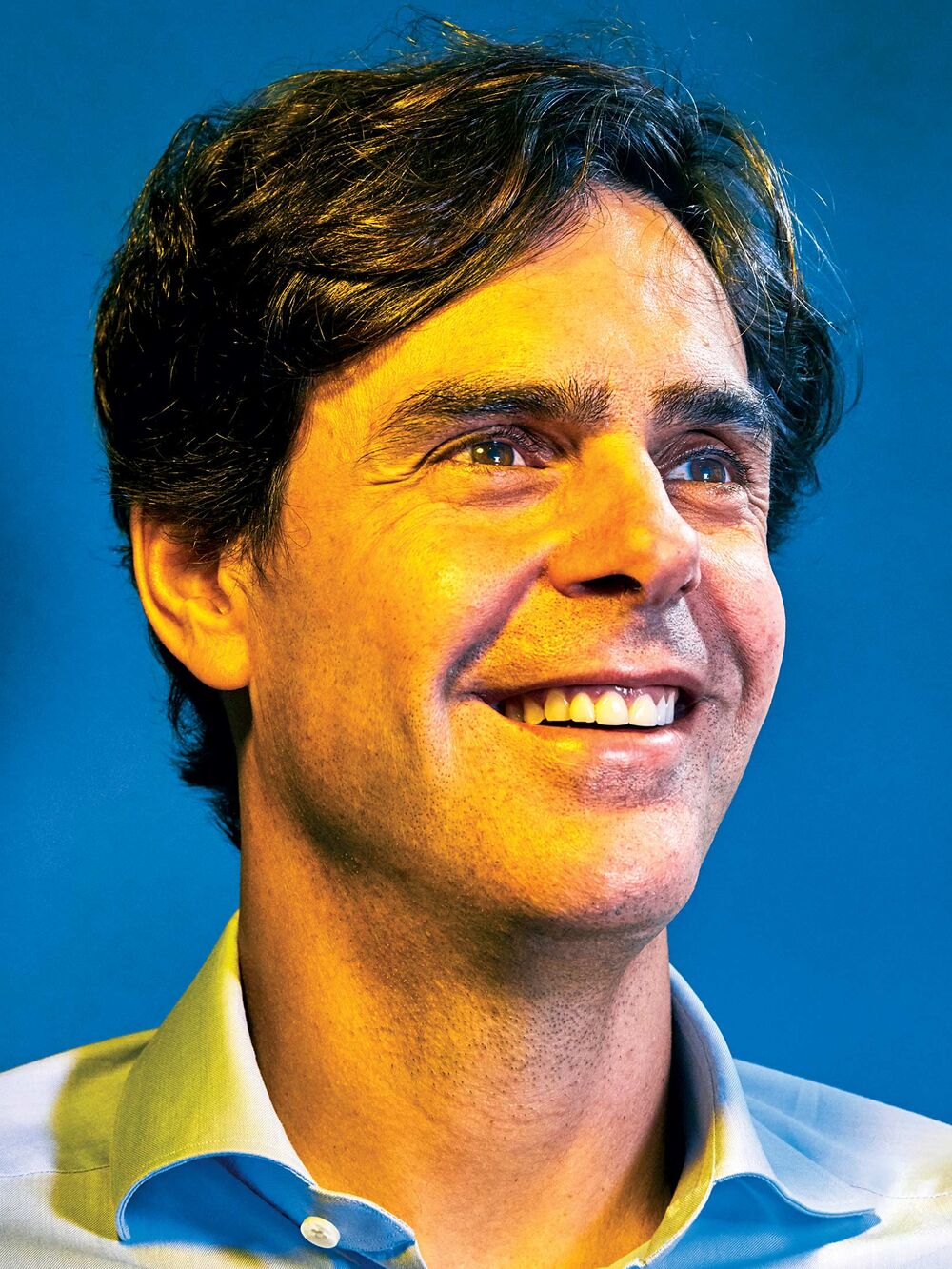

Nadiem Makarim

CEO, PT Go-Jek Indonesia ●

Indonesian “super app” Go-Jek—part ride-sharing service, part food-delivery business, part digital-wallet provider—secured a $1.5 billion investment in January to take on Singapore-based rival Grab.

No other app has altered Indonesian city life as swiftly and deeply as Go-Jek, which Makarim, a Harvard Business School grad, expanded from its 2015 focus on booking motorbike taxis into a way to pay bills, order lunch, or schedule a house cleaner. Now Go-Jek is making its first foray outside Southeast Asia’s largest economy, expanding into the Philippines, Singapore, Thailand, and Vietnam. The growth plan escalates its rivalry with Grab, which has parlayed massive funding from SoftBank Group Corp. and other investors into an aggressive push across the region, including into Indonesia. There’s a lot of business to capture: Southeast Asia’s ride-hailing market is forecast to almost quadruple, from $7.7 billion in 2018 to $28 billion by 2025, according to a report from Google and Singapore state-investment company Temasek Holdings Pte. Such opportunity may explain why Google, China’s Tencent Holdings Ltd., JD.com Inc., and other marquee investors wanted in. Their investments valued Makarim’s company at about $5 billion in January, and he’s confident about what the future holds. “Our collective imagination cannot be copied or outspent,” he says. —Yoolim Lee

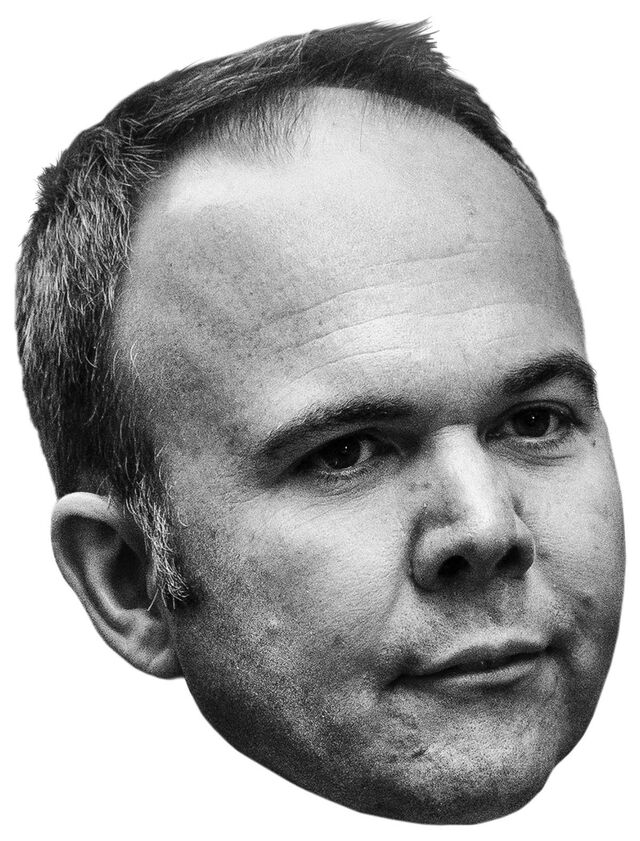

Ben van Beurden

CEO, Royal Dutch Shell Plc ●

Shell’s capital budget has allocated as much as 8 percent of spending, or $2 billion, to renewable energy projects, roughly four times what competitors BP Plc and Total SA spend.

Van Beurden is constantly questioned on the wisdom of pivoting away from oil and gas, Shell’s bread and butter, but he doesn’t see another option. If demand falls in the next decade, as some are predicting, Shell will shrink along with it if his company doesn’t diversify. Of course, Big Oil has tried and failed to become Big Clean Energy, making splashy bets that have left shareholders and environmentalists skeptical. In van Beurden’s view, however, the key is to make small investments in almost every type of low-carbon technology and see what wins. If it’s electric cars, he’s ready: In January, Shell bought a large utility in the U.K. that could help power them. —Kelly Gilblom

John Maraganore & Jeff Marrazzo

CEO, Alnylam Pharmaceuticals Inc. • CEO, Spark Therapeutics Inc. ●

Fifteen years after the human genome was mapped, biopharmaceutical companies introduced the first groundbreaking genetic treatments derived from this research: Alnylam’s Onpattro helps patients who have amyloidosis, which manifests in an abnormal protein buildup in tissue, and Spark’s Luxturna targets retinal dystrophy, an inherited form of blindness.

Bloomberg News reporters Michelle Cortez and Bailey Lipschultz spoke with Maraganore and Marrazzo about advances in treating genetic diseases and what their successes mean for patients and the field. Excerpts:

Onpattro silences a deadly gene that makes defective proteins, and Luxturna inserts a healthy gene into the eye. That seems like magic.

Maraganore - DNA makes RNA, which makes protein. If you want to stop the production of a bad protein, you can target the RNA. Onpattro can turn off the production of the bad protein. It’s given by intravenous infusion every three weeks.

Marrazzo - Luxturna is for people who have two bad copies of a gene called RPE65, which essentially means that your retina degenerates. Sufferers progress to complete blindness. A surgeon injects a solution that contains a normal copy of RPE65.

So one treatment is stopping the production of bad proteins, and one is making a missing protein?

Maraganore - The yin and the yang—exactly.

How are these different from conventional treatments?

Marrazzo - We’re giving instructions to a cell to manufacture a protein instead of just providing the protein. You’re fixing the underlying basis of the disease.

Maraganore - We’re able to stop the production of the disease-causing protein—basically, like turning off the faucet if you have a flood on your kitchen floor. Today’s medicines work by mopping up the flood.

For Luxturna, you settled on a one-time price of $425,000 per eye. What went into the decision?

Marrazzo - We asked ourselves, what is sight worth? We stand behind the product, not just its initial efficacy: We’ve offered to test again at 30 months. We picked what we thought was the right price to balance the concerns we heard from patients around access.

And Onpattro?

Maraganore - Our medicine costs $450,000 per year. A patient without treatment will lose the ability to walk, to feed himself, to button a shirt—and will die within a decade of diagnosis. The therapy we have essentially stops or in some cases reverses disease progression where patients currently have no treatment options.

Jeff, the payment scheme on the books right now dictates that you have to bill for Luxturna all at once—patients pay for it like they would any drug any doctor prescribes. Insurance companies are starting to cover it, but how can the system be reformed?

Marrazzo - The benefit we create lasts—perhaps for a lifetime. Currently, we have to fit that long-term benefit into a single upfront charge. That’s not the way it should work. We should be paid over time based on the continued benefit of the treatment.

It took a long time to get here—the genome was mapped in 2003. What’s next?

Maraganore - When you bring the first of a new category of medicine forward, you’ve paved the way to bring many more forward using the same basic approach. This is a watershed moment. That’s what makes this all so very exciting.

Time’s Up Legal Defense Fund

Tina Tchen, partner, Buckley Sandler LLP • Roberta Kaplan, partner, Kaplan Hecker & Fink LLP • Hilary Rosen, partner, SKDKnickerbocker LLC • Fatima Goss Graves, president and CEO, National Women’s Law Center ●

Established in the wake of the Harvey Weinstein sexual abuse allegations, the fund connects victims of workplace sexual harassment with lawyers, then helps pay legal bills with donations from 50 states and 80 countries that have swelled to $22 million from $13 million.

Bloomberg News reporter Rebecca Greenfield talked to Tchen and Kaplan about the Washington, D.C.-based fund, which gets public-relations assistance from Rosen’s firm and is administered through Goss Graves’s law center. Excerpts –

How has the money you’ve raised compared with what you thought you’d raise?

Tchen - I’d set a goal for $10 million. Kaplan - What was it George W. Bush said about the Iraq War? Shock and awe? I remember being in shock and awe as the money started coming in. Tchen - People like Steven Spielberg, Kate Capshaw, Shonda Rhimes, Oprah Winfrey—every donor is on the GoFundMe page.

How many claims have you gotten? How many lawyers are participating?

Tchen - We’re approaching 3,800 requests for help. We’ve had about 800 lawyers across the country volunteer to be part of the network. We’ve announced a couple of big sexual harassment cases, like against McDonald’s and Walmart. [In public statements, both companies have said they don’t tolerate workplace harassment.]

What types of women are reaching out?

Tchen - Two-thirds of the people are low-income—it’s first responders, it’s teachers, it’s fast-food workers.

Kaplan - We don’t just want people who follow people who follow people on Twitter. It’s become difficult, if not impossible, for low- and middle-income women who’ve been discriminated against or sexually harassed at their jobs to find lawyers. It’s not economical for them to take the cases. If you have one person who’s not earning much money, the verdicts aren’t that high.

How much do lawyers usually make off cases like this?

Kaplan - The way judges and juries calculate damages is you take the woman’s salary and figure out how much she lost as a result of the behavior and what kind of future salary would she lose. With someone not earning a lot of money, those numbers have not been very high. In the Southern District of New York, they were generally like $100,000 and below. The standard contingency fee is one-third of what’s recovered. So for multiple years of work on a case, a lawyer might get $30,000. A lot of the lawyers in the network have agreed to do this on a pro bono basis.

You don’t give out a ton of money per case.

Tchen - Any one case could overwhelm the resources of the fund. There’s a balance between being equitable and providing enough money that would actually draw lawyers.

How will you keep this sustainable?

Kaplan - I don’t even think we’re in the first half of the baseball game here. We’re in maybe the second or third inning. The pervasiveness of the problem has been stunning. There’s a lot more work that needs to be done and a lot more women out there who are going to want to tell their stories.

Alexandria Ocasio-Cortez

Representative-elect, New York’s 14th Congressional District ●

Ocasio-Cortez was one of 102 women elected to the U.S. House of Representatives, breaking the chamber’s previous record of 85 women elected two years ago.

On June 26 a visibly shocked Ocasio-Cortez saw on a watch-party TV screen that she’d won the Democratic primary for a district covering parts of Queens and the Bronx. Then 28, the democratic socialist politician had just beaten a powerful 10-term incumbent, Joe Crowley, all but ensuring she’d become the youngest woman ever elected to the House in November. Her surprise primary victory proved to be a bellwether: Women ran and won this fall in record numbers. The freshman class of the 116th Congress will have 36 newly elected women in the House, including 13 women of color, many of whom have made history in their own right. These trailblazers include Cindy Axne and Abby Finkenauer, the first women elected to the lower chamber from Iowa. Sylvia Garcia and Veronica Escobar will be the first Latina congresswomen from Texas, and Ayanna Pressley of Massachusetts and Jahana Hayes of Connecticut will be the first black women from their respective states. Rashida Tlaib of Michigan and Ilhan Omar of Minnesota will be the first Muslim congresswomen, and Sharice Davids of Kansas and Deb Haaland of New Mexico will be the first American Indian women. —Margaret Newkirk and Arit John

Audrey Gelman

Co-founder and CEO, the Wing ●

The women-focused co-working space opened three additional locations and announced six more for 2019, for a total of 11.

The new locales in Brooklyn, San Francisco, and Washington—and the planned expansion to Boston, Chicago, London, Los Angeles, Paris, and Toronto—come after Gelman and her co-founder and chief operations officer, Lauren Kassan, raised $32 million in November 2017, a sign that investors are finally getting bullish on female-led businesses. About 6,000 members pay as much as $2,700 annually for access to the workspaces, speakers and events, food and beauty products, and, as of October, child-care services. The Wing’s first location, in Manhattan, opened in 2016 and was inspired by the women’s club movement of the late 1800s, which sought to provide places to work and socialize. “We remixed and adapted those forms for the 21st century,” Gelman says. —Emma Kinery

Mukesh Ambani

Chairman, Reliance Industries Ltd. ●

Ambani overtook Jack Ma in July as Asia’s richest man thanks in part to the performance of his Indian conglomerate’s wireless unit.

Reliance Jio Infocomm Ltd.’s free nationwide 4G wireless service started in 2016, instantly roiling the world’s second-largest telecommunications sector. Two years later the subsidiary, which began charging for data in 2017, has 227 million users and has become profitable as it brings connectivity to remote Indian villages. Ambani’s next big bet is on e-commerce, a $30 billion market in India that’s expected to expand to $200 billion in about a decade, according to Morgan Stanley. He’ll say only that the platform he’s developing will combine online and conventional shopping and will leverage Jio wireless users, pitting it against Amazon.com Inc. and Walmart Inc. in India. —Bhuma Shrivastava

Michael Gelband

Co-founder and CEO, ExodusPoint Capital Management LP ●

At a time when hedge funds can’t even match returns from the S&P 500, he pulled off the biggest-ever debut in the industry by raising $8 billion.

BlackRock, Goldman Sachs, and Blackstone flocked to ExodusPoint because Gelband provided investors with consistent returns for about a decade at Millennium Management—and because he’s taking only a 13 percent to 17 percent share of profits instead of the standard 20 percent. Many interpret the name of the fund, with its obvious Biblical reference to leaving for the Promised Land, as a way of sticking it to Millennium’s founder, Izzy Englander, with whom Gelband had a falling out before setting up his rival company. About two dozen Millennium employees followed Gelband. Englander tried to stop the poaching, but a three-arbitrator panel ruled that Gelband could hire the individuals in question. —Yalman Onaran

Taylor Swift

Pop star ●

Her Reputation Stadium Tour grossed $266 million in the U.S., more than any other tour this year—and a record for a female artist.

To celebrate her 28th birthday, Swift tested the limits of her power with a creative solution to one of the music industry’s most intractable challenges: scalpers. Artists lose out on millions of dollars to brokers, who use bots to vacuum up tickets and then resell them at inflated prices. So Swift tried a new model, offering tickets to thousands of fans who’d attended previous shows and selling the rest for sky-high prices to lessen potential profit for the scalpers. (The experiment had its detractors, many of whom claimed she was gouging concertgoers.) Right after the North American leg of her tour, Swift took on another foe: Republicans in her home state of Tennessee. On Oct. 7 she threw her support behind two Democrats running for office (one won, one lost), prompting the highest number of voter registrations anywhere in the country in a 24-hour period. —Lucas Shaw

Tim Scott

Senator, South Carolina ●

Thanks to him, about 8,700 low-income census tracts are now designated as “opportunity zones,” and they’ve become the next big investing fad as Wall Street discovers the potential tax savings.

Last year, when Republicans rammed through a controversial tax package stuffed with big cuts for corporations and the wealthy, Scott’s contribution to the overhaul barely drew notice. He’d managed to codify an idea that Silicon Valley luminary Sean Parker and a coterie of lawmakers and policy wonks have been floating in Washington for years. The main perks: Investors who fund businesses or real estate in these zones can defer and reduce taxes on capital gains from previous unrelated investments—and if they keep their money in the zones for at least a decade, they can eliminate taxes on the additional appreciation. Goldman Sachs Group Inc. is already investing near New York’s Long Island City, where Amazon.com Inc. recently announced it’s opening a major office, and other companies are setting up dedicated funds for the purpose, some seeking a half-billion dollars. Treasury Secretary Steven Mnuchin has predicted that $100 billion in private capital could eventually flow into poor neighborhoods. When Scott toured some of the zones this year, his first stop was his childhood home of North Charleston, where his single mom raised him, working 16-hour days as a nurse’s assistant. Now “communities that have not seen the type of economic recovery that the rest of the country has seen have a chance to be hopeful,” he said in an interview on Bloomberg Television in July. Yet as the final rules take shape, researchers and nonprofits are sounding alarms. They point out that investors could use the tax breaks for projects they would’ve pursued anyway—or that their projects might displace low-income residents, further speeding up gentrification. —Noah Buhayar

John Krafcik

CEO, Waymo LLC ●

Waymo’s autonomous fleet has driven more than 5 million miles since February, outpacing the automotive industry, including rivals such as Uber Technologies Inc. and GM Cruise LLC, to earn the Alphabet Inc. division a $175 billion valuation from Morgan Stanley in August.

Krafcik runs the undisputed leader in driverless-car technology. Waymo, which is developing self-driving software but isn’t building its own vehicle, has deals with Fiat Chrysler Automobiles NV and Jaguar; the contracts give the company the option to buy 82,000 cars, outfit them with the software, and deploy them as a robo-taxi fleet. “We see ourselves as enablers, not disrupters, in transportation,” he said in an email. Waymo is testing about 600 Chrysler Pacificas on the road, and the majority of those were assigned to a free program for members of the public in Phoenix in April 2017; a limited, paid autonomous ride-hailing service was scheduled to begin in the city in early December. “We’re prioritizing safety and being thoughtful and measured in our launch,” Krafcik said. He’s pursuing other business models, too, including driverless trucks, e-commerce delivery, and public-transportation partnerships. —Alistair Barr

Chrystia Freeland

Minister of foreign affairs, Canada ●

Freeland squared off in trade talks with the Trump administration, reaching a last-minute deal to preserve a North American trading zone that exchanges more than $1 trillion in goods annually.

Freeland is a Rhodes scholar, an ex-journalist, a staunch Russia critic, and an avowed defender of NATO, foreign aid, and global trade—hardly Trumpian. So it’s not surprising that there was friction between Canada and the U.S. throughout the negotiations. When President Trump hit Canada with tariffs, Freeland fired back with her own, and her country, rather than Mexico, slowly became his target. Then Mexico struck its own deal with the U.S., pressuring Freeland to do the same to keep the three-country accord in place. Deadlines came and went under threat of even more tariffs. Finally, on Sept. 30, Canada and the U.S. agreed to terms, preserving Nafta, which will be renamed the United States-Mexico-Canada Agreement. Freeland isn’t without her critics, who accuse her of needlessly rubbing liberal values in Trump’s face. They also wondered if her occasional grandstanding—she accepted a diplomacy award in Washington, for example, and used her speech to critique Trump’s policies—made Canada a target unnecessarily. Although each country’s legislative body has yet to vote on the deal and some tariffs remain in place, it’s an agreement nonetheless, and it’s made Freeland into Prime Minister Justin Trudeau’s star minister. —Josh Wingrove

Tiffany Haddish

Actor and producer ●

Anyone who hasn’t heard of Haddish will have plenty of opportunity to change that—she’s involved with more than a half-dozen projects next year after working on 10 this year.

Her breakout role in last year’s Girls Trip, which grossed more than $140 million worldwide, opened up a lot of opportunities for the actor, who spent time as a foster child and was homeless before making her name on the Los Angeles comedy circuit. She hosted Saturday Night Live in November 2017 (a performance that earned her an Emmy in September), and her memoir, The Last Black Unicorn, spent 16 weeks on the New York Times best-seller list. —Anousha Sakoui

- 4 movies (Uncle Drew, Night School, The Oath, Nobody’s Fool; through mid-October, they had grossed more than $145 million combined)

- 1 Super Bowl ad (for Groupon in February)

- 1 presenting role (the Oscars in March)

- 1 leading role in a sitcom (Shay in The Last O.G., which premiered in March)

- 1 role in a music video (a cameo in Drake’s Nice for What, which was released in April)

- 1 hosting gig (the MTV Movie & TV Awards in June)

- In January, Simon & Schuster Inc. will publish her memoir in paperback.

- 4 movies (The Kitchen, Limited Partners, The Lego Movie 2, The Secret Life of Pets 2)

- 1 Netflix comedy special

- 1 animated Netflix TV series (voicing one of the lead characters in Tuca & Bertie)

- 1 HBO comedy series (Unsubscribed is in development)

Daniel Ek

CEO and co-founder, Spotify Ltd. ●

Spotify’s stock climbed as much as 49 percent after the company listed shares on the New York Stock Exchange in April, giving Ek more clout in his talks with record labels.

Ek rescued the music business from its war with the internet. He’s persuaded more than 80 million people to pay a monthly fee for a bottomless library of songs, playlists, videos, and podcasts. Industry sales, once decimated by piracy, have climbed four years in a row. That success allowed Ek to skip the conventional path to an initial public offering: hiring bankers, going on a roadshow to entice potential investors, and then listing new shares within a prescribed price range. Instead, upending decades of standard practice, he chose to do a “direct listing.” Starting on April 3, existing shareholders could sell their stakes with little control over pricing. (Ek did this because he thought the private market had properly valued the company.) The gambit worked. Spotify’s value surpassed $30 billion for several months, boosting Ek’s net worth to almost $3 billion before the company’s stock tumbled this fall in the tech rout. Now Ek is trying to get artists to forgo record labels altogether, which could turn Spotify into the first self-sufficient online music company and transform the industry for a second time. —Lucas Shaw

Kenya Barris

Showrunner, Netflix Inc. ●

The Black-ish creator and Girls Trip screenplay writer in August signed a three-year deal, reported by Variety to be valued at $100 million, with Netflix to develop projects through his Khalabo Ink Society.

David Walters talked to Barris—whose Emmy-nominated and Peabody Award-winning show tackles sensitive topics such as the N-word and the social injustices of the Trump administration, sometimes to the dismay of ABC executives—about his deal, the difference between Netflix and network TV, and the evolution of the family sitcom. Excerpts:

You’ve been honest about the excitement and fear that came with your contract. Which emotion is winning out?

Fear! It will never not be fear. But that’s OK. It makes me figure things out in a more cautious way and also fuels my creativity.

And the excitement?

Friends are here helping me with the writing. I saw the Alexander McQueen documentary, McQueen. He was this street kid who went to Paris to take over Givenchy, and the only way he would do it is if he could bring his crew. That’s what I want this office to be—a creative bungalow.

Netflix represents a paradigm shift in the industry. How will networks adapt?

Network television will continue to thrive, because it can still speak to the everyday man. I would walk in airports and have older Asian women come up and tell me Black-ish reminds them of their family.

What’s the biggest difference between creating for network TV and Netflix?

I’m used to knowing that 10 million people see my show a week. You don’t hear the numbers at Netflix. That’s harder for me. I’m a populist. I like the idea of a lot of people consuming my work. There are a few shows on Netflix that do get those big hits. We see the digital footprint of Stranger Things, House of Cards, Master of None. That’s my goal: to make sure my people can see my tracks in the mud.

Netflix produced 676 hours of original programming in the third quarter of 2018 alone. To binge that, you’d have to stay awake for 28 straight days. How are you going to set yourself apart?

I know how to market what I want to do. Netflix has thus far been receptive to hearing ideas, and the business of this business is something I take pride in. You walk into the lobby at Netflix, you see everyone from Cardi B to Barack Obama. That’s an interesting pool to splash into.

Your exit from ABC was graceful. What’s your bridge-burning policy?

I’m still an executive producer on Black-ish and [Black-ish spinoff] Grown-ish. I’m doing a Bewitched pilot for ABC and another show on the Freeform network called Besties. I still want to be part of that world. It’s important to have families sit down and watch network television. ABC [parent Disney] acquired Fox, so it’s going to be the biggest media company in the world. That would be like burning a bridge while you’re standing on it. Not something I was looking to do.

What kinds of stories do you want to tell in a non-network family sitcom?

On Black-ish, the more we said, “We’re just trying to figure this parenting thing out,” the more it resonated with our audience. I want to take that even further. Real life isn’t “My boss is coming over, and my wife burned the pot roast.” Sometimes it’s “My boss is coming over, my wife burned the pot roast, and we accidentally took ecstasy.”

Mudassir Sheikha

Co-founder, Careem Networks FZ LLC ●

Ride-hailing startup Careem, already the Arab world’s first unicorn, raised $200 million in October to expand into mass transit and deliveries.

Sheikha’s six-year-old company has more than 1 million drivers in the Mideast and northern Africa, allowing customers to book bikes, golf carts, rickshaws, and boats, in addition to cars. This has made Careem an attractive potential purchase for Uber Technologies Inc., which Bloomberg News reported in September is in discussions to acquire it for as much as $2.5 billion. Sheikha is also using his clout to support One Million Arab Coders, an initiative that offers online courses in website and mobile-interface development, and he puts on a hackathon in Ramallah and an artificial-intelligence-oriented summer camp in the United Arab Emirates. “Technology is enabling regional economies to leapfrog traditional infrastructure challenges around transportation, banking, and communication,” he says. —Gwen Ackerman

BTS

K-pop boy band ●

In June, BTS became the first Korean pop band to top Billboard’s album charts with Love Yourself: Tear, and then it had another No. 1 in August with Love Yourself: Answer, achieving an unprecedented level of success in the U.S.

BTS owes its popularity to its willingness to address social issues, mental health, and politics, despite being in a genre often painted as bubble gum. Tickets for its first worldwide stadium tour sold out in minutes, another sign that audiences are ready for bands with Korean sensibilities. Based on BTS’s success, Big Hit Entertainment, which manages the band, is expanding into movies, games, and original YouTube content; in March it said revenue more than doubled last year, to $86 million. —Sohee Kim

Leanne Caret

President and CEO, Boeing Defense, Space & Security ●

She reversed years of declining sales at the division by landing three of 2018’s biggest military contracts, which together are worth $25 billion.

At Boeing’s Chicago headquarters in November, Caret recalls the afternoon two months earlier when she put on her best poker face and strolled into an auditorium. Inside, some 300 defense workers were waiting to hear if they’d snapped a losing streak. At stake was a $13 billion deal to build drones that refuel U.S. Navy planes, the first of three bids that would determine Boeing’s future in military aircraft.

In front of the microphone that day in St. Louis—where Boeing assembles its F/A-18 Super Hornet and F-15 Eagle fighters, and where it would build the drone if the bid prevailed—Caret read from an article predicting the company would lose. Then she tacked on her own ending: “And the Navy has selected as its contractor: the Boeing Co.” The place erupted, Caret says, with people jumping on chairs and storming the stage. “Then we were off,” she adds. “We had meetings that night.”

It was the start of a Boeing sweep, as the company won Pentagon contracts to build a training jet called the T-X and to militarize an Italian commercial helicopter to serve as a Bell Huey replacement. The victories were much needed. Although Boeing’s commercial plane business is awash in cash, Caret’s division was struggling when she was named defense chief in 2016.

Caret, whose parents met while working on the Saturn V rocket for NASA, is the latest caretaker of the company’s 101-year military heritage, which stretches from the B-17 Flying Fortress bombers that helped win World War II to the still-flying B-52 bombers that her father worked on as a systems engineer during the Cold War. In 1997 this history entered a new phase when Boeing bought McDonnell Douglas Corp., an acquisition that promised to make its defense division a true equal to its commercial plane-making empire. But trouble began just four years later, when the company missed out on a critical contract for the $406.5 billion Joint Strike Fighter, the largest-ever U.S. weapons program. Business grew patchy into the 2010s, as Congress capped military spending and sales dwindled for the aging fighter lineup Boeing had inherited from McDonnell Douglas. Not long before Caret took over, Boeing lost out on an $80 billion contract to build a stealth bomber that would replace the B-52.

Even the sporadic deals the company has landed haven’t always gone smoothly. In October it blew its latest delivery deadline on a 2011 contract to convert its 767 passenger jet into an aerial fuel-hauler for the U.S. Air Force; cost overruns on the project are approaching $4 billion. Caret’s team has worked to shore up the project and find new sources of revenue, drawing on executives from across the company, including Chief Executive Officer Dennis Muilenburg, to help nail down a strategy for its drone and jet contracts.

In placing its bids, Boeing relied on a new manufacturing process it’s honed for more than a decade across its commercial and defense businesses, which the company was convinced could save time and money. While she won’t divulge much about the technology, Caret says it allows factory workers to rivet together the main fuselage sections of the T-X trainer in less than an hour, compared with a day and a half for the Super Hornet. “We wanted to become lean and efficient,” she says.

The new process led Boeing to base its proposals on the potential long-term windfall rather than the costs to develop and build the first batches of aircraft. It aggressively underbid, absorbing a $700 million earnings hit after winning the contracts. The company’s offer of $9.2 billion for the T-X, for example, was less than half the amount the Pentagon had anticipated spending. Boeing is banking on eventually selling and servicing thousands of the aircraft. However, bidding so low is a highly risky and unusual strategy. If the manufacturing savings don’t materialize or there are delivery delays, losses could mount.

The pressure to evolve comes with the job, Caret says. The payoff is a place in history. She gets choked up thinking about how the projects she’s involved with may endure for a half-century or more, much like the B-52s her father worked on. “Somebody asked me how I would know that the strategy we deployed in 2016 was working, and I said, ‘When we start winning,’ ” Caret says. “And these teams, well, they earned this. This wasn’t given to us.” —Julie Johnsson

Abigail Johnson

CEO, Fidelity Investments ●

Mom and pop investors poured almost $1 billion into Fidelity’s two zero-fee index funds in their first month on the market.

The funds, which track broad U.S. and international stock markets, were the latest escalation in a long-running price war whose participants include Vanguard Group, BlackRock, and Charles Schwab. That the move to zero was made by Fidelity—a company known for its stockpickers, not its index funds—was a signal that Johnson is willing to take the family business in a new direction. (Her grandfather founded the company.) “We need to find other ways to get people to give us a try,” Johnson told Bloomberg Markets. “Having a no-minimum, no-fee offering seemed like a pretty good way.” Craig Siegenthaler, an analyst at Credit Suisse Group AG, likened the company’s no-fee funds to the free toaster that banks once offered to entice customers. If they become a gateway to higher-cost Fidelity products—an actively managed Fidelity fund costs from 75¢ to 85¢ per $100 invested—then Johnson may have hit on a winning formula. —Annie Massa and Charles Stein

Jenny Saville

Artist ●

When her Propped sold at Sotheby’s London in October for $12.4 million, it became the highest price paid at auction for an artwork by a living woman.

Saville has been famous since 1992, the year she graduated art school and painted Propped, one of her fleshy nudes. Early on, Saville, who lives in Oxford, was grouped with other so-called young British artists such as Damien Hirst and Sarah Lucas. Recently, in what’s been the most prominent stretch of her career, she’s had a much-lauded solo show at the Scottish National Gallery of Modern Art in Edinburgh and an exhibition of new work at the Gagosian Gallery in New York. Auction sales might be meaningless to an artist’s bottom line—an anonymous collector sold Propped, so Saville got only a €12,500 ($14,000) resale royalty—but for established midcareer artists, the winning bids can be powerful signifiers. They’re not just market speculation on an up-and-comer; they’re affirmation of a career and a bet on an artist’s future. The collector, the buyer, and the auction house might have set the record, in other words, but the prestige belongs to Saville alone. —James Tarmy

Stuart Vevers

Executive creative director, Coach ●

Vevers turned the bagmaker into a modern fashion house, increasing sales 3 percent for the fiscal year ended in June after four years of declines.

The midmarket leather goods label had struggled in recent years because of heavy discounting and increased competition from Michael Kors and Kate Spade—until Vevers transformed Coach into a full-fledged fashion brand with accessories, clothes, and runway shows. His designs, including the buzzy $795 Rogue bag, have boosted revenue and helped parent company Tapestry Inc., which acquired Kate Spade last year, right its own sales numbers. —Kim Bhasin

Joy Buolamwini & Timnit Gebru

Founder, Algorithmic Justice League • Research scientist and technical co-lead, Ethical AI Team, Google ●

Their paper at a February artificial intelligence conference showed that popular facial recognition software misidentified dark-skinned female faces as much as 35 percent of the time and dark-skinned males as much as 12 percent of the time, whereas the technology worked with precision on white men.

Buolamwini first got interested in the idea of AI and discrimination while working with robots as a computer science major at Georgia Tech in 2011. She discovered that the machine she was using couldn’t make out her face even though it had no trouble identifying her white roommate. Later, as a grad student programming facial recognition software at MIT, she resorted to wearing a white costume mask just to get her coding done.

It didn’t seem like an optimal solution to debugging what was an obvious issue with the technology. And it raised even more questions when she read that police departments and the FBI use the software to match photos—some from driver’s licenses—to databases of suspected criminals; a 2016 report by Georgetown Law School’s Center on Privacy & Technology found that half of U.S. adults are in law enforcement facial recognition networks.

This year, Buolamwini’s concerns echoed beyond her research labs. The paper she co-presented with Gebru—who arrived at similar conclusions through work on image recognition using Google Street View while at Stanford—undermined the notion that popular AI programs are ready to handle law enforcement and surveillance duties, even as government agencies increasingly embrace them.

Buolamwini and Gebru’s findings helped catalyze a year of protest. The American Civil Liberties Union demanded that Amazon.com Inc. stop selling its Rekognition software to police departments (Amazon declined), and employees at Google protested contracts that could give image recognition capability to U.S. defense agencies (Google pulled out of the contract). At Microsoft Corp., where Gebru worked at the time the paper was released, Chief Executive Officer Satya Nadella ordered researchers to fix the problem in its Face API software (Microsoft said in a June blog post that it had); the company, citing the research, then called for the government to regulate facial recognition technology. Buolamwini and Gebru have briefed lawmakers on their conclusions and given talks at the United Nations and the European Commission as those bodies look at AI governance. Senator Kamala Harris (D-Calif.), a likely 2020 presidential contender, has referenced the research in taking up the cause of AI discrimination. “This conversation is top of mind now, and this is so different from what I saw a year or a year and a half ago,” says Gebru, co-founder of the group Black in AI, which seeks to increase the number of black people in the field.

For their paper, Buolamwini and Gebru tested how software from Microsoft, International Business Machines Corp., and Megvii Technology performs when determining if an image is of a male or female, a key method of quantifying effectiveness. Testing for sex is an easy way of putting these programs through their paces: If they can’t do something right when there’s a 50 percent chance of being successful, why trust software to help identify who robbed a bank? The error rate they found further confirmed earlier reports of biases. In 2015, Google apologized after its photo program identified a black man and his girlfriend as gorillas.

Separately, in July the ACLU ran photos of Congress members through Rekognition and tried to match them to images of known criminals to prove how error-prone the software could be. It found 28 matches to a database with 25,000 publicly available arrest photos, disproportionately selecting lawmakers of color, including civil rights hero John Lewis. “We did a follow-on study where Amazon was not even classifying the face of Oprah Winfrey correctly, yet you want to sell this technology to police departments?” Buolamwini says. (Amazon said the ACLU didn’t use the proper settings. Regarding Winfrey, an Amazon spokesperson says, “We encourage experimentation with our services and are grateful to anyone who points out opportunities for improvement.”)

One important reason these algorithms perform poorly is that they’re mostly trained with images of white faces. When you don’t give AI software a diverse enough data set, it doesn’t perform as well. The goal of their paper was to get the big tech companies to be more sensitive to this problem, and their individual efforts—Buolamwini’s Algorithmic Justice League highlights bias in data analysis formulas—continue to do so. The work “has empowered all the people who work in fairness, accountability, and transparency,” Gebru says. —Dina Bass

Liu He

Vice premier, People’s Republic of China ●

Liu’s elevation to the vice premiership in March cemented him as President Xi Jinping’s primary economic adviser and made him pivotal to the relationship between China and the U.S., in which total trade is on course to surpass last year’s record $661 billion.

After years of shaping policy behind the scenes, Liu has a job leading oversight of China’s central bank, as well as finance and securities regulators, giving him the equally crucial task of reining in the nation’s swelling $34 trillion debt pile. The world got a hint of Liu’s growing importance in January when he represented China at the World Economic Forum’s annual meeting in Davos, Switzerland. He pledged that his nation would make the financial sector more welcoming to foreign companies and reduce levies on imports as a way of marking the 40th anniversary of Deng Xiaoping’s first steps to open the economy. Life got tougher for the Harvard-trained official in May, when President Trump scrapped a trade truce Liu and Treasury Secretary Steven Mnuchin seemed to have pulled together. Since then he’s been active in China’s efforts to deal with the trade war while ensuring that debt doesn’t further overwhelm the country. —Malcolm Scott

Ryan Coogler

Director, Black Panther ●

The movie is the highest-grossing superhero film ever in the U.S. and has earned $1.35 billion globally.

When Black Panther hit theaters in February, moviegoers were treated to a $200 million Marvel film with all the usual trappings: good guys, bad guys, car chases, explosions, and futuristic technology. But they were also asked to grapple with themes such as slavery, colonialism, inheritance of ancestral lands—and with how those legacies complicate what it means to be black not only in fictional Wakanda but also in the real world of 2018. Arriving right before this year’s Academy Awards—which were on Year 4 of the #OscarsSoWhite campaign that aims to spotlight the academy’s poor track record of honoring anyone who’s not white—the film was a worldwide smash. Coogler dethroned Straight Outta Compton’s F. Gary Gray as the black director with the highest-grossing movie in history, further dispelling the long-held myth that films with predominantly black casts don’t resonate with wider audiences (much as Crazy Rich Asians did for films with Asian casts). Black Panther is widely viewed as a contender for best picture at next year’s Oscars—so much so that when the academy announced it would delay a new award for blockbusters, the backpedaling was attributed by some to public outcry over the possibility that it would hurt the movie’s chances in the more prestigious category. Next year, Coogler will team up with the Los Angeles Lakers’ LeBron James to make the sequel to the 1996 movie Space Jam. —Jordyn Holman

Cathie Wood

CEO, Ark Investment Management LLC ●

Ark’s exchange-traded funds almost tripled their assets thanks to Wood’s success investing in tech companies.

Ninety-eight percent of ETF managers buy an index of stocks or bonds, but Wood takes a more active approach, picking industry disrupters and raising or lowering her stakes every day. The strategy is working. Two of her six funds are among the 10 best-performing ETFs of the year, out of more than 1,800. Her largest technology fund has returned 16 percent, and another that focuses on DNA technology has gained 18 percent. That’s attracted investor cash, bringing ETF assets to $2.3 billion, up from $843 million at the end of 2017. (Overall, Ark-managed assets are up to more than $6.4 billion as of late November, from $3.2 billion last year.) Wood’s top picks this year include Invitae Corp., a genetic testing company that doubled its stock price, and the cancer research company Juno Therapeutics Inc., for which Celgene Corp. paid $9 billion. —Rachel Evans

Gavin Barwell

Chief of staff to U.K. Prime Minister Theresa May ●

May’s government calculates that leaving the European Union without a deal by the March 29 Brexit deadline could cost the country as much as 11 percent in gross domestic product over the next 15 years, and Barwell’s skills as a political fixer are essential to ensuring that doesn’t happen.

Barwell lost his seat in Parliament when May’s gamble on an early election backfired in 2017. So she appointed him to his current job, and against all odds he’s helped keep her in office. Hard as it was negotiating the divorce with Brussels, it proved easier than fighting with various political factions in London. Barwell will need all of his powers of persuasion to get enough lawmakers to back the deal in a crucial vote on Dec. 11. Throughout the Brexit process, he’s deftly kept rebellious Conservatives in check, arguing that if they don’t get in line, they could be fighting for their jobs in fresh elections. Now he’s working to stop pro-Brexit hard-liners from blocking what they see as a sellout agreement in Parliament. For them, leaving without a deal would be better than the close partnership with the EU that May has signed up for. —Tim Ross

Rose Marcario

CEO, Patagonia Inc. ●

Patagonia Action Works, a digital platform that connects customers with grassroots environmental organizations, is on target to raise more than $1 million this year and facilitate about 10,000 hours of volunteer activity, the latest chapter in Patagonia’s 40-year history of activism.

Bloomberg News reporter Kim Bhasin talked to Marcario about Patagonia’s environmental advocacy and its effect on business. Excerpts:

How is Action Works different from Patagonia’s regular championing of outdoor causes?

It gives people the ability to get involved in events, petitions, fundraising, volunteering. There are people showing up to our stores who are just there for the activism. We have stores and dealers everywhere in the country, and we’ll build those communities, and they’ll be their own little action centers around air, water, and soil issues in their neighborhoods.

The tone of Patagonia’s activism has shifted of late. There seems to be more urgency behind your message.

We’ve had rollbacks of some 70 protections of endangered species and public lands. And then the national monument reversal in Utah—the first time ever in American history where a president undid the work of three past presidents who established a national protected wilderness.

Why did Patagonia seize on the particular issue of Bears Ears and Grand Staircase-Escalante?

It was the largest elimination of public lands in history. It was almost 3 million acres. We joined with conservationists and native American tribes in filing a lawsuit because we felt it was an illegal action and set a terrible precedent.

Is that kind of activism good business for Patagonia?

It hasn’t hurt our business at all. We’ve had an incredible year. We don’t do it with the mind of, “Oh, this is going to generate business or not generate business.” We do it with the mind that these places need defense and protection, and we want to help bring awareness.

Can businesses stay neutral on these topics anymore?

We’re living in a time when it’s important for business to drive a new kind of economy, an aspirational view of the future where business is a force for good. We have to get out of this quarterly mentality.

When customers buy a Patagonia fleece, do you want that action to prompt them to think about these causes?

We hope if they’re getting outdoors and enjoying wild places, they go there to protect them for future generations.

How do you know if it ever becomes too much activism? Is there a line?

People expect it now. Younger customers are much more educated. They look at a product multiple times before they purchase it, and they do a lot of research. They vote with their dollars much more. If you’re a brand and you’re ignoring that, you’re going to lose long term.

Brian Roberts

CEO, Comcast Corp. ●

Comcast spent $39 billion on British satellite-TV giant Sky Plc to gain a foothold in Europe and reduce its dependence on the declining cable-TV market in the U.S.

After buying Sky, Comcast, the second-largest cable company in the U.S., became a major competitor in the U.K. Entry didn’t come cheap. It paid more than twice what Sky was worth when it first went up for sale in 2016, borrowing heavily to make it happen. But the deal gave Roberts a key victory over his chief rival, Walt Disney Co. Chief Executive Officer Bob Iger, who snatched 21st Century Fox Inc. away in a bidding war this summer. Owning Sky helps Comcast address perhaps its biggest weakness: cord cutting. While Comcast already owns NBCUniversal, home to a movie studio and TV networks such as MSNBC and USA, it’s been losing thousands of cable customers as Netflix Inc., Amazon.com Inc., and other online services entice people to drop their cable subscriptions. Sky, however, is still adding to its 23 million subscribers in countries such as the U.K., Italy, and Germany. The deal is also another sign of how Roberts has transformed the company he inherited from his father into a global entertainment empire that both owns the films and shows people watch and the cable and internet connections that deliver them. —Gerry Smith

Tim Sweeney

CEO, Epic Games Inc. ●

Epic’s megahit video game, Fortnite, claims 200 million players worldwide, five times the number at the start of the year, and it’s made billions of dollars for the company.

In Fortnite, a player uses his weapons and wits to become the last person alive on a rapidly shrinking island. The free game’s cartoonish characters have proved palatable to kids and parents, and its victory dances have been performed by elementary school students and NBA stars alike. Sweeney’s genius was in making Fortnite easily accessible across game consoles and smartphones; avatars, gadgets, and other in-game perks generate revenue. Fortnite’s popularity has also been fueled in part by its battle royal format and its appeal as a spectator sport: The contests are the most-viewed on Twitch, Amazon.com Inc.’s game-streaming service, and the game’s top “athlete,” Tyler Blevins, earns $500,000 a month. Sweeney is pressing his advantage: He’s declined to put Fortnite in Google’s app store as part of a dispute about revenue sharing, a move that threatens the fee structure that Google and Apple Inc. have enjoyed for years. —Chris Palmeri

José Andrés

Founder, World Central Kitchen, and chef-owner, ThinkFoodGroup ●

In the wake of natural disasters—wildfires in California, hurricanes Florence, Michael, and Maria in the U.S., and earthquakes in Indonesia—his nonprofit served more than 2.5 million meals to victims and first responders this year.

When Andrés arrived in Wilmington, N.C., on Sept. 15, Florence had already forced thousands of residents to evacuate, caused five deaths, and prompted a nuclear plant shutdown. Working out of two industrial kitchens, his organization fed 20,000 people that day. Two months later, operating out of Chico State University, he prepared 7,000 pounds of turkey and 100 gallons of gravy so families displaced by California’s Camp Fire and emergency workers could celebrate Thanksgiving. Andrés, a Michelin two-starred chef with 31 restaurants in the U.S., Mexico, and the Bahamas, started his charity in 2010 after an earthquake in Haiti. He’s become so expert at providing food service in disaster areas that last year the Federal Emergency Management Agency awarded him about $11 million in grants to continue his work in the aftermath of Maria. In addition to dispensing 3.7 million meals in Puerto Rico and organizing more than 19,000 volunteers, he started the Plow to Plate Partnerships Program, which has bestowed in 2018 more than $384,000 to businesses on the island. —Kate Krader

Guilherme Benchimol

CEO, XP Investimentos SA ●

Brazil’s central bank in August approved the sale of a significant minority stake in XP, which wants to be the country’s answer to Charles Schwab Corp.; the transaction valued the brokerage at 12 billion reals ($3.1 billion) and confirmed that Brazil’s big banks see value in the smaller financial companies that have been challenging them.

Co-founded by Benchimol in 2001, XP changed the asset management industry in Brazil by giving the middle class access to sophisticated investment products and trading platforms that didn’t charge brokerage fees. The deal that the central bank approved with Itaú Unibanco Holding SA makes Benchimol worth more than 2.7 billion reals—he started the company when he was 24 with 10,000 reals in his bank account after being fired from a brokerage firm. “We thought we would go broke every day,” he recalls. After Itaú—Latin America’s biggest bank by market value—announced the acquisition, analysts expected XP to lose clients because it wasn’t independent anymore. The opposite happened: Customers liked that XP now had a big bank as a partner. Assets under custody are up 51 percent this year, to more than 190 billion reals through October, while the number of clients has risen 51 percent, to 815,000. XP is planning to offer digital banking services and a standalone cryptocurrency exchange (without Itaú). It also plans to have 10,000 investment advisers by 2020, from 3,700 now. “I want, in maybe 10 to 20 years, to be even bigger than Itaú itself,” Benchimol says, adding that he’d value XP at about 30 billion reals today. He’s got a ways to go: Itaú is valued at more than 300 billion reals. —Cristiane Lucchesi and Felipe Marques

Sonia Cheng

CEO, Rosewood Hotel Group ●

Her competitors generally tackle one opening every few years, but Cheng introduced four hotels in locations from Bermuda to Phnom Penh and announced seven more, part of an aggressive expansion for the luxury chain.

Cheng’s short-term pipeline will see Rosewood’s 24-property portfolio double by 2023. The company, known for glamorous but unstuffy six-star stays (typically $700-$1,000 a night), is using the expansion in part to broaden its appeal to young parents and millennials, demographics that are vital for long-lasting loyalty. This year, Cheng started an education-driven kids’ club that focuses on cultural exchange (such as crafting traditional dance masks in Bermuda), as well as a wellness program that includes a variety of Eastern therapies. Her next move: a companion brand called Khos that seeks to bridge the gap between lifestyle and business hotels. When it makes its debut next year, Khos hotels will have informal meeting spaces and boutique gyms instead of spas. “I want Rosewood to be the most formidable and progressive hospitality company there is,” Cheng says. —Nikki Ekstein

Xavier Becerra

Attorney general, California ●

The California Department of Justice is fighting the Trump administration in 32 federal lawsuits, more than any other state, to lead the charge against policies that Becerra maintains erode the business climate that makes the state the country’s No. 1 job creator.

Becerra will soon help California set a record for the number of times a state has sued one administration, surpassing the previous mark held by Texas, which took a relatively leisurely eight years to sue Barack Obama 48 times—three suits more than California has racked up in the past two years. This year, Becerra has filed to stop the separation of immigrant children from their families, to prevent a rollback of auto-emission limits, and to block the addition of a citizenship question on the 2020 U.S. census. Other suits include ones seeking to stop President Trump from ending the Deferred Action for Childhood Arrivals program and from limiting access to birth control. “We need to continue to keep creating good jobs, keep California a place where people want to raise their families and start their business,” Becerra says. For its part, the U.S. government has sued California three times over state laws concerning net neutrality, public-lands protections, and public safety and immigrants’ rights.

Becerra often joins fellow Democratic attorneys general in filings, but he takes the lead when California is disproportionately affected or when he has expertise on an issue. He helped draft the Affordable Care Act toward the end of his 24-year tenure as a congressman for parts of Los Angeles, which gave him insight into how best to defend the statute on behalf of the 16 states that filed to keep it alive. Becerra, a father of three daughters and a Stanford Law School grad, won a four-year term in November after being appointed by the governor. He answers diplomatically when asked where voters might take him next. “I never expected to be in elected office,” he says. “I intend to make the biggest difference I can wherever I am.” —Esmé E. Deprez

E. Glen Weyl & Eric Posner

Authors, Radical Markets: Uprooting Capitalism and Democracy for a Just Society ●

At least 16 startups or blockchain projects began this year based in part on ideas in their book.

Weyl, an economist who’s a principal researcher at Microsoft Research New York City, and Posner, a professor at the University of Chicago Law School, argue in Radical Markets that we need to harness market forces to achieve social good. They want to fundamentally alter people’s relationship with private property by having them put a price tag on everything they own and list it online. If you want to keep your home, for instance, you’d have to make it expensive, which means you’d be willing to pay more property taxes on it. The government could use this revenue to cut other taxes, which would incentivize commercial property owners not to sit on vacant lots. Another idea, quadratic voting, lets people express the intensity of their preferences. Each voter gets the same allotment of credits to buy votes. One vote costs one token, but two votes cost four, five votes cost 25, etc. People who feel strongly about an issue would have to concentrate their tokens. Blockchain startup Eximchain Inc. plans to use a version of quadratic voting to govern its platform. —Peter Coy

Reese Witherspoon

Actor and producer ●

In her biggest year as a producer, Witherspoon’s media company, Hello Sunshine, which was created to promote women on both sides of the camera, had more than a dozen projects going.

Along with acting roles in Walt Disney Co.’s A Wrinkle in Time and the second season of HBO’s Big Little Lies, which Hello Sunshine co-produced, Witherspoon has started filming a drama series about a morning TV show for Apple Inc. that will air next year and star Jennifer Aniston and Steve Carell. Hello Sunshine also secured the movie and TV rights to five books; organized a nationwide storytelling tour “for and by intersectional, intergenerational women,” according to a press release; introduced podcasts on breakups and life lessons; and started a book club in conjunction with Amazon.com Inc.’s Audible and a video-on-demand channel with AT&T Inc. Although her book about the joys of Southern living, Whiskey in a Teacup, became a New York Times best-seller, Witherspoon’s most exciting news for longtime fans may be the announcement that she’ll reprise her role as the cult feminist heroine Elle Woods in a third Legally Blonde movie. —Anousha Sakoui

Sarah Friar

CEO, Nextdoor ●

When Friar announced on Oct. 10 that she was leaving her job as chief financial officer of Square Inc. to join Nextdoor, a private social network for neighbors, Square’s stock tumbled more than 10 percent the following day after it had gained almost 150 percent for the year.

Anyone who’s ever left a job could only wish for the kind of praise Friar’s performance inspired. Although Jack Dorsey is Square’s chief executive officer (in addition to his other gig heading Twitter Inc.), Friar “essentially ran the company” and was “a key architect in building Square’s business model,” wrote Citigroup Global Markets Inc. analyst Peter Christiansen. Friar’s six years at Square “is the stuff of Silicon Valley legend,” wrote venture capitalist Bill Gurley of Benchmark, who’s on the board of Nextdoor. On Friar’s watch, Square evolved from a credit card reader for food trucks into a payments-processing company helping more than 2 million global retailers with payroll, loans, accounting, inventory tracking, website building, and more; the company forecasts 60 percent growth this year on more than $3 billion in revenue. Friar hasn’t said much publicly about her new role with Nextdoor. “I am excited to join this extraordinary team where we can build … a force for good in the world,” Nextdoor’s official press release quoted her as saying. Before she left Square, she told Bloomberg Businessweek that she wants her work to have global impact: “I feel like I’m going through my own journey of how to make the world a better place.” —Selina Wang

The Parkland activists

In the wake of the Feb. 14 shooting that killed 17 people at Marjory Stoneman Douglas High School in Parkland, Fla., pressure from students helped persuade more than a dozen major corporations to cut ties with the National Rifle Association.

Outspoken Parkland students such as David Hogg, Emma González, Delaney Tarr, and Ryan Deitsch, who are founding members of March for Our Lives, a pro-gun-control coalition, used youth to their advantage, embarrassing the adults who tried to defuse teen anger with “thoughts and prayers” and other empty gestures. When Education Secretary Betsy DeVos announced a visit to Marjory Stoneman, González tweeted: “Good thing I was already planning on sleeping in tomorrow.” In the months following the massacre, they also helped pit corporate America against Second Amendment supporters, using their social media megaphones to needle companies and politicians who, they said, enable such killings. This activism encouraged Delta Air Lines, Hertz, MetLife, LifeLock, and Wyndham Hotel Group to sever ties with the NRA. Citigroup Inc. instituted a policy prohibiting corporate customers from selling bump stocks or firearms to those who are younger than 21 or haven’t passed a background check. Bank of America Corp. stopped lending to companies that manufacture assault-style weapons for civilian use. First National Bank of Omaha stopped issuing an NRA-branded credit card that offered rewards on sporting goods purchases, including firearms. Spurred by these successes, Parkland students and parents tried their hand at politics, with mixed results. A super PAC launched by Parkland families to fund anti-gun-violence candidates sought to raise $10 million but took in only $230,000. That doesn’t mean there’s a lack of enthusiasm for their cause: Of the 307 candidates endorsed by the Giffords Law Center to Prevent Gun Violence, more than 80 percent won their seats. —Polly Mosendz

The New Populists

The turmoil that wracked political establishments across Europe in 2017 (not to mention the U.S. in 2016) is now visiting emerging markets from Mexico to Malaysia, and the wave of poll booth surprises shows no signs of abating. Dominant political parties were shaken, if not cast aside, by popular disgust at their failure to deliver broad-based prosperity. The trend was most recently exemplified on Oct. 29, when a populist former army captain, Jair Bolsonaro, won Brazil’s presidential election and Germany’s pragmatic, centrist chancellor, Angela Merkel, announced a phased political exit. Nostalgic for Brazil’s dictatorship and dismissive of minorities, women, and democratic niceties, Bolsonaro will join a growing camp of populists when he takes office on Jan. 1, including the leaders of Ethiopia, Mexico, Malaysia, and South Africa. The cause of conventional government in emerging markets hasn’t been helped by a strong dollar and rising short-term U.S. interest rates, which suck away funds. Slowing growth in China is contributing to the tough environment for incumbents, too. —Marc Champion

Andrés Manuel López Obrador

President, Mexico ●

López Obrador won more than 50 percent of the vote in July, the first time in 30 years that a Mexican presidential candidate claimed a majority.

AMLO, as López Obrador is known, is only Mexico’s third president from outside the Institutional Revolutionary Party since the 1910-20 revolution. He campaigned against government corruption and the “mafia of power” in business, then beat back establishment challengers after the Mexican government, which worked to curb spending and stabilize the economy, couldn’t boost real wages. It’s unclear if the leftist firebrand will merely adjust Mexico’s modernization policy of the last quarter century—economic liberalization, fiscal discipline, and foreign trade and investment—or take a more statist path of renationalization and subsidies. —Marc Champion

Abiy Ahmed

Prime minister, Ethiopia ●

After winning election as Ethiopia’s prime minister in March, Abiy has announced economic and political reforms that seek to shore up already stellar growth: The International Monetary Fund anticipates a 10.9 percent expansion this year, the most of any African nation.

Machinations within the ruling coalition that’s controlled Ethiopia since the overthrow of a military junta in 1991 precipitated Abiy’s rise to power. The retired lieutenant general was named its leader in March, a month after Hailemariam Desalegn abruptly resigned, having failed to halt almost three years of sporadic antigovernment protests by citizens who were excluded from the nation’s extraordinary run of economic growth. The unrest had threatened to derail a boom in the state-planned economy that’s included projects such as the $6.4 billion Grand Ethiopian Renaissance Dam, one of the world’s biggest hydropower plants. Abiy, who at 43 is Africa’s youngest serving leader, has pledged to open up the telecommunications, shipping, power, and aviation industries to private investors; promised multiparty democracy; and ended two decades of acrimony with neighboring Eritrea. While his unbanning of opposition and rebel factions stoked long-suppressed rivalries among ethnic groups, he’s offered a salve by appointing a cabinet that includes representatives from historically marginalized communities, half of them women. —Paul Richardson

Cyril Ramaphosa

President, South Africa ●

Since assuming the presidency in February, Ramaphosa has been trying to attract $100 billion in investment to revive the flagging South African economy; companies and foreign governments have already committed to spending more than half that amount on new mines and manufacturing plants, among other projects.

The African National Congress, which has been in power since 1994, replaced Jacob Zuma with Ramaphosa to restore faith in its brand before national elections next year. The party has hemorrhaged support because of public anger about the alleged pillaging of the economy by businesspeople close to Zuma and his son and about an unemployment rate that’s topped 27 percent. Within weeks of taking office, Ramaphosa instigated a crackdown on graft, fired ministers, and revamped the management of state companies that were allegedly plundered during Zuma’s rule—moves that were cheered by investors. Yet polls show the public has wearied of the long-dominant party: Only 52 percent of adults surveyed by the Institute of Race Relations this summer said they would vote for the ANC. It won 62 percent backing in the last national election in 2014. —Mike Cohen

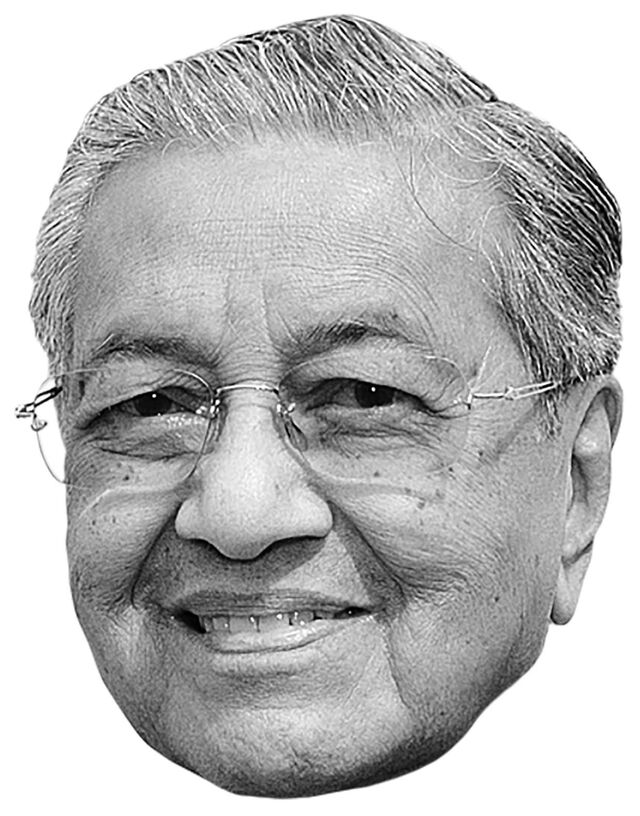

Mahathir Mohamad

Prime minister, Malaysia ●

Mahathir’s defeat of Prime Minister Najib Razak in May led to the nation’s first democratic change of regime.

Mahathir, a Malay nationalist who ran against his own former party in a surprise return to power, now heads a multiethnic opposition coalition. He’s moved quickly, canceling an unpopular sales tax, suspending more than $20 billion in Chinese “Belt and Road” initiative investments that the previous government had approved, and warning against a “new version of colonialism” while visiting China in August. He made good on campaign promises to crack down on corruption, too. In recent months, Malaysian courts have charged Najib with dozens of counts, including money laundering and accepting bribes. (Najib has pleaded not guilty to all of them.) —Marc Champion

Steven Maijoor

Chairman, European Securities and Markets Authority ●

The commissions that European stockbrokers earn are on course to fall more than 30 percent after the biggest overhaul to hit EU financial markets in at least a decade.

Maijoor’s job is to ensure that European Union investors are treated fairly. The latest update to the Markets in Financial Instruments Directive (called MiFID II), implemented by him in January, targets the cozy relationship between fund managers and brokerages, in which funds pay brokers whenever they buy and sell shares—an expense that ultimately comes out of the fund investors’ pockets. Prior to the rules, brokers could bundle those trading costs with other services such as research and swanky conferences, so it wasn’t always clear that fund investors were getting the best deal. Now research and brokerage have to be priced separately. Maijoor, who’s from the Netherlands and worked for the Dutch financial markets regulator before assuming his current role in 2011, has been fighting for decades to reduce barriers to the free movement of money and to bolster the size of Europe’s capital markets. He’s said he wouldn’t be surprised if transparency on trading fees becomes the global standard. —Elisa Martinuzzi

Whitney Wolfe Herd

Founder and CEO, Bumble Trading Inc. ●

The dating app has expanded beyond matchmaking, growing to almost 50 million users in November, more than double the number from the year before.

As a co-founder and vice president for marketing at Tinder, Wolfe Herd saw firsthand the cesspool of slurs and all-caps rants that women often had to wade through when they tried online dating. After suing the company and another co-founder for sexual harassment in 2014—the lawsuit was settled without any admission of wrongdoing—she started Bumble. Her belief was that a few tweaks—verifying users’ identities, banning people who make demeaning comments or physical threats, requiring that it be women who initiate conversations with men—could make the internet safer for women and, by extension, men. (It’s not just for straight people, either; those of all sexual orientations can use the app.) Bumble is now valued at $1 billion and has moved into new corners: Bumble BFF is for women who want to make friends, and Bumble Bizz, introduced in October 2017, helps women establish professional contacts beyond those LinkedIn requests. Next year the company plans to expand into digital entertainment. “We’re focused on being a full-fledged social media platform,” Wolfe Herd says. Facebook Inc. and Twitter Inc. largely allow users who leave racist or misogynistic comments to continue using the services, but Bumble’s 4,000 moderators have no problem kicking people off. They’ll need good ones when Bumble expands to India. Dating apps are a tricky business there: Violence against women has increased 80 percent in the past decade, and some villages have outlawed women from using social media. Bumble will let women hide their names so they won’t be targeted. “This isn’t an easy move for us, but it’s one where we can have an impact,” Wolfe Herd says. —Claire Suddath

Donna Strickland

Physics professor, University of Waterloo ●

In October she became the first woman in more than 50 years to win the Nobel Prize in physics for her work on lasers, having discovered ways of manipulating pulses of light that have led to life-changing inventions such as laser eye surgery.