Quartz members, check out our conference call on Tuesday to talk about Deutsche Bank and the future of banking (more details to come). Sign up here to receive this free email every week.

Hello readers!

One of the ways I come up with story ideas is by reading news articles and then calling up the people in those stories and pestering them with more questions. Like, for example, this interesting story in The Economist (paywall) about startups that keep track of shares issued by private companies:

“Some hot startups in Silicon Valley, including some ‘unicorns’ worth $1bn or more, have a problem: they are not sure who owns them. As fast-talking founders pitch to deep-pocketed investors, junior staff back at the co-working space maintain simple spreadsheets with investors’ names and the number and type of shares they hold. They often get things wrong. This may lead to disputes when a company lists, is acquired—or goes bust.”

And:

“Enter ‘equity managers’, which offer to help keep track of stakes. Carta, a seven-year-old pioneer of the industry, hosts data for 11,000 companies. Ledgy, a Swiss rival founded in 2017, caters to around 300. In Britain Capdesk’s 400-odd clients include Nutmeg, a hit fintech startup.”

This is a real thing as companies stay private longer, go through multiple funding rounds, and have more investors with more sophisticated terms. Errors happen, leading to lawsuits.

And if the hundreds of email pitches I’ve received over the years are any indication, this is a job for blockchain! CB insights listed stock trading as one of the top 50 potential use cases for the technology. Keeping track of private company investments would seem a great fit for blockchain, as there’s no centralized exchange for the shares to begin with. There was no mention of distributed, tamper-proof databases in The Economist’s article, so I contacted the companies to see if I was missing something.

Yoko Spirig, co-founder of Ledgy, a Swiss startup created by physicists, said they get this question a lot. She said the company sees the potential, but blockchain isn’t conducive to the legal framework right now. For example, if a private company wants to do a capital increase, it still needs a formal approval by the notary. Over time, when the legal framework is in place, she held out hope that equity records could move to a distributed ledger, and also said that Ledgy’s database could theoretically be migrated to blockchain if needed.

“We are going with the market,” Spirig said.

Capdesk also said it could integrate with blockchain if needed, but is focusing its resources elsewhere for now. “We have met little or no demand from investors or clients for anything like this,” Capdesk marketing associate Anastasia Valti said in an email.

Carta, last valued at $1.7 billion, said it’s not using blockchain either.

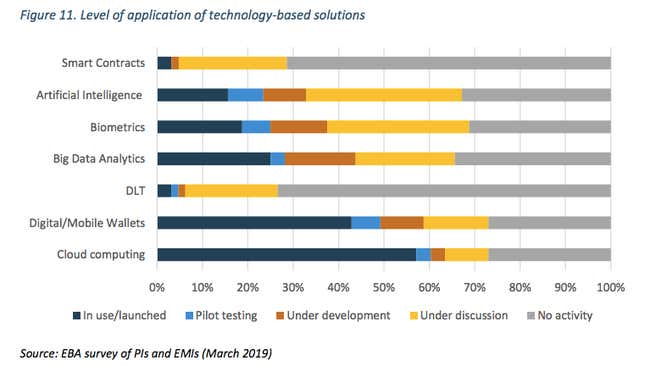

These responses are representative. A recent European Banking Authority survey of payment companies found that distributed-ledger and smart-contract technology lagged behind other buzzy tech when it came to implementation:

For good measure, I emailed another company I had read about called Global PayEx. JPMorgan recently bought a stake in the Mumbai-based fintech firm, which helps companies manage their payments, cash management, and invoicing. Surely this is a case for blockchain! Global PayEX founder Mohan Krishnan said this was a “really pertinent question.” But no.

“We do NOT use blockchain or distributed ledgers in our” accounts receivable system, Krishnan wrote. In such a system, with known counterparties, “blockchain is both unnecessary and is a gross overkill.”

None of this is to say blockchain will never have widespread use. UBS and a group of other banks are still convinced of its utility for settling transactions. Facebook and its partners clearly think there’s potential. Pilot projects have proven over the years that blockchain can be used for lots of things, but the commercial implementation that attracts widespread adoption still isn’t there. For now, it seems over-engineered for many purposes.

In the meantime, companies are signing up customers by tackling problems that distributed ledger enthusiasts rightly point out are a problem—things like cross border payments and tracking share transactions. But they’re doing it without blockchain.

This week’s top stories

1️⃣ There was an avalanche of Deutsche Bank stories this week. For an optimistic take on Deutsche Bank’s future, see this Bloomberg Opinion story. Planet Money discussed the bank’s 18,000 layoffs, and this podcast from May dives into the bank’s ties to the US president.

2️⃣ The Federal Reserve, like just about every financial regulator around the world, is cautious about Facebook’s Libra cryptocurrency. Bank of England governor Mark Carney‘s latest comments on Libra have gotten even tougher, and even US president Donald Trump is skeptical.

3️⃣ The SEC gave Blockstack the OK to sell digital tokens as part of a Regulation A+ offering (paywall). These non-equity tokens are essentially a regulated version of the initial coin offerings that boomed in 2017.

4️⃣ There are some 11,000 fintech startups in Latin America. Goldman Sachs, following its Nubank investment, is looking for deals.

5️⃣ JPMorgan is wheeling out a robo advisor. You Invest Portfolios charges an annual fee of 0.35% of assets and places investments into its ETFs.

Let’s vote on it

Did this article convince you to short companies backing blockchain? Or, are you doubling down on your bet that crypto is the future of everything? Take our poll here.

The future of finance at Quartz

Dutch data watchdogs are wary of banks using personal data from payments for targeted ads. These “data can thus refer to payment transactions with hospitals, pharmacies, casinos, sex clubs or otherwise.”

As Germany’s biggest bank announced a major retreat from the US, Berlin-based N26 is launching there, aiming to go head-to-head with America’s financial startups and banking titans alike.

China’s Tencent created a digital token 14 years ago, it just didn’t use crypto. “The technology is already mature,” CEO Pony Ma said of Facebook’s Libra. “It depends more on whether the regulations allow it.”

Bitcoin demand is soaring in Zimbabwe after the government banned foreign currencies. Banks are blocked from dealing in crypto, so locals resort to peer-to-peer methods.

Richard Branson’s Virgin Galactic is going public through a “blank check” maneuver. Last year, the company launched the first humans into space from US soil since 2011.

Always be closing

- SoftBank led a $231 million round of financing for Creditas, a Brazilian lending platform valued at $750 million.

- Remitly raised $135 million in equity and $85 million in syndicated debt financing. The Jeff Bezos-backed startup processes processes around $6 billion (paywall) of remittances annually.

- London-based Soldo raised €54 million ($61 million). The corporate-expense management startup plans to use some of the money to move to Ireland ahead of Brexit.

- OPay raked in $50 million. The mobile payment company’s investors included IDG Capital and is looking to expand in Africa and into motorbike ridesharing and food delivery.

- Crypto custodian Anchorage raised $40 million from the likes of Visa and Andreessen Horowitz.

- Royal Bank of Canada bought WayPay, a cloud-based accounts payable fintech.

- Venture capital firm Andresseen Horowitz is preparing to make more bets on fintech. It’s hiring Credit Karma’s Anish Acharya as its newest general partner.

I hope your weekend is invigorating and profitable (pick your own metric). Please send any blockchain opinions, tips, and suggestions to jd@qz.com.