The iHeartMedia direct listing is different than other direct listings and could have a market-defining impact.

In 2008, iHeartMedia (then doing business as Clear Channel) was set on a path to bankruptcy following a leveraged buyout that brought nearly $20B of debt onto the company’s balance sheet. Now, 10 years later, iHeartMedia is listing on Nasdaq Global Select after emerging from a Chapter 11 restructuring that allowed the company to shed about $10B of that debt from the balance sheet. iHeartMedia began trading today after a series of meetings with investors earlier this week.

iHeartMedia has decided it will not be conducting an initial public offering, but will instead directly list its Class A common stock, similar to Slack and Spotify. This decision to direct list is notable because iHeartMedia is not the kind of business that industry professionals would consider ripe for a direct listing.

Why this direct listing is different

Despite its $8.5B valuation post restructuring, iHeartMedia isn’t necessarily a powerhouse brand like Spotify and Slack. Industry experts have suggested that a lack of brand recognition could prevent meaningful analyst coverage and research, stifle the support of retail and passive asset managers, and ultimately lead to liquidity shocks and price volatility.

While iHeartRadio’s business generated over $6B in revenue in 2018, it has seen virtually no revenue growth YoY, and is part of a radio broadcast sector that is under pressure from the rise of streaming and other online content providers. It enters the public markets in a sector facing significant disruption with $5.5B of fresh debt and no real “war chest” of cash on the balance sheet, which may make some investors wary of moving into long-term positions until the business hits performance targets and pays down debt.

It’s also noteworthy that iHeartMedia chose to list on Nasdaq over the New York Stock Exchange (NYSE), which won both Spotify and Slack’s direct listings. While Nasdaq has won a handful of small, niche direct listings, iHeartMedia arguably represents the highest profile direct listing for the Nasdaq in recent memory. NYSE has marketed its direct listing business as the only real option because of the designated market maker’s (DMM) role in the IPO auction process.

The DMMs are marketed as “specialists” on the floor with abilities and insight that help guide a stock’s entry into the market, but in truth—they’re a legacy role whose importance in the modern market is waning. Although, in the context of direct listings, the DMM arguably plays a more important role in discovering price because supply and demand is more uncertain. Citadel Securities, which operates as a DMM on the NYSE and makes markets in equities on virtually every U.S. stock market, won the role of DMM for both Spotify and Slack. By choosing Nasdaq, iHeartMedia will not only tell us whether direct listing is a viable path for a mid-cap business with flat revenue and average brand recognition, but it may be a tipping point in the sales battle for direct listings.

The (digital) trading floor

The NYSE trading floor is now little more than a television studio, as NYSE has migrated towards a more modern and primarily electronic trading platform (like most other exchanges around the world).

On most NYSE trading days, the market opens and closes electronically, with no meaningful involvement from the DMM. However, the NYSE IPO auction, which is also used for direct listings, is explicitly a manual process that is typically driven by the underwriters and the DMM, who work together to ensure all interest is on the book before the DMM prices the opening auction. This “hands on” NYSE process seems well suited for a direct listing, where supply and demand can be far less certain and there is no party responsible for price stabilization.

Nasdaq’s existing IPO cross trading rules (which define the mechanisms that determine a stock’s initial price) include underwriter safeguards designed to offer them some control over the opening price. These controls were created years ago in the wake of the Facebook IPO debacle to compete with the underwriter control offered by the NYSE through the DMM. But electronic security exchanges have come a long way since 2012, and after recent changes to its cross trading rules, Nasdaq now extends more control to broker-dealers that are serving as financial advisers in connection with a direct listing. You could argue that Nasdaq’s controls offer companies a semi “hands-on” direct listing process.

Controls or not, Nasdaq’s market is not (and never was) a market designed to directly account for the “traders intuition”. A successful direct listing for iHeartMedia would be another win for the electronification of US equities, and a proof point in challenging NYSE’s promotion of the DMM.

The private placement market

There’s another wrinkle in the iHeartMedia direct listing: Its class A common stock is currently trading on the Pink Sheets OTC market. Under Nadaq’s listings rules, issuers are required to meet certain valuation standards that are established based on either an independent valuation, or the most recent trading price in a “private placement market,” whichever is lower.

Nasdaq’s rules state that if a security has sustained recent trading in a private placement market, they will rely on these recent trades to determine a “reference price” and use it as a tiebreaker during the initial auction, in addition to other things.

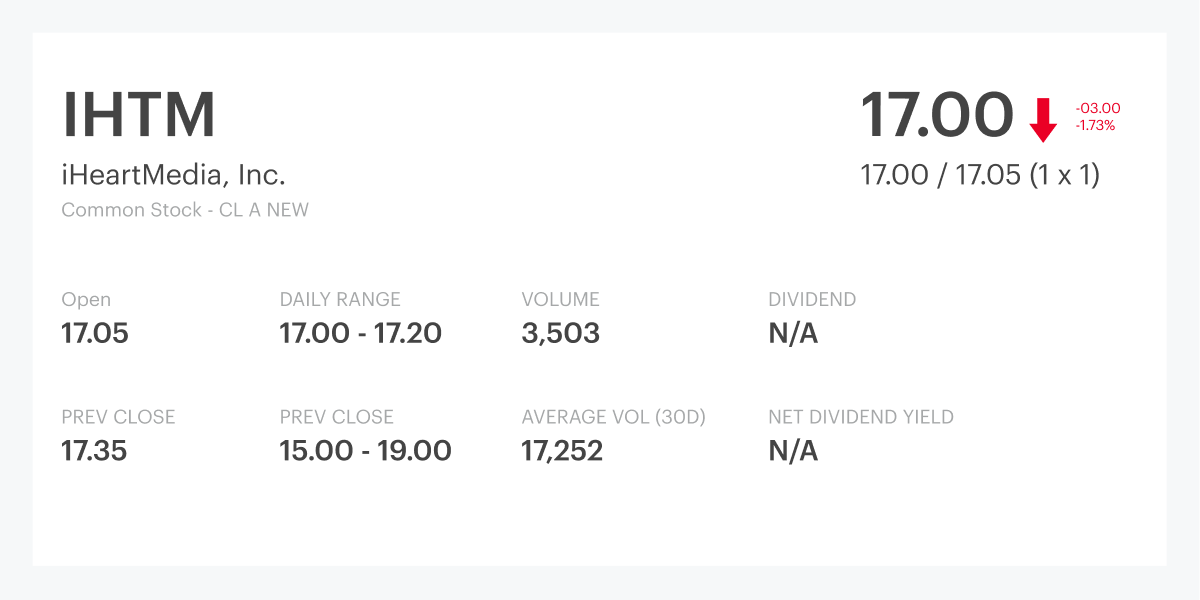

Nasdaq defines “private placement market” as a trading system for unregistered securities operated by a national securities exchange or a registered broker-dealer. The Pink Sheets should technically qualify as a private placement market. A look at the Pink Sheets data shows that iHeartMedia traded 17k shares a day on average over the last 30 days, and has traded between $15-19 over the last 52 weeks.

Based on these numbers, it’s fair to suspect that Nasdaq’s evaluation of iHeartMedia’s share price and market value considered the Pink Sheets trading—and that these trades will influence the price discovery process. Indeed, iHeartMedia ended its first day of Nasdaq trading within its prior Pink Sheets range at $16.50 per share.

Another notable feature of iHeartMedia’s direct listing is that the company seemingly avoided the expensive financial advisory fees that have made many direct listings almost as expensive as paying an underwriter in an IPO. For example, Spotify paid its financial advisers (Goldman Sachs, Morgan Stanley, and Allen & Company) nearly $35M in connection with its direct listing, with all-in expenses topping $45M. With Slack, these costs come down, with over $22M being paid to its advisors, and all-in expenses exceeding $26M. In any case, this is a hefty price tag to go public considering these are cash costs to the company—especially in a direct listing, where no new money is raised for the company’s balance sheet.

Giving companies more choice

If iHeartMedia’s direct listing proves successful, we can expect that Nasdaq will start selling direct listings more aggressively to some of the rumored 2019 candidates, including Airbnb. More interestingly, Nasdaq might also find that direct listings are in fact viable for small and mid-cap businesses that aren’t powerhouse brands or flush with private capital, and offer direct listing rules under the Nasdaq Capital Market and Nasdaq Global listing tiers. If that happens, we can expect for the direct listing market to take a new form in 2020 and beyond.

Today, issuers don’t have many choices as far as private placement markets go, which makes it difficult to avoid at least part of the financial advisers’ services to qualify for a direct listing. Meanwhile, unicorn companies continue to emerge in the private markets in record numbers. These companies are awash in capital and staying private longer, and as a result, much of the growth in US equities is tied up in the private markets. Transactional and regulatory friction makes it difficult for even the most sophisticated investors to allocate capital to the highest growth companies in the private markets. But if companies have more choices for private placement markets, we might have more direct listings that bring more companies public, and free up more resources for companies to grow and expand their business.

Carta has built a fintech infrastructure business that will allow us to bring a transformative liquidity platform to market and start solving these problems. With the support of our investors and a network that includes over 11,000 private companies and over 700,000 security holders, including the world’s leading venture capital and angel investors, we are well positioned to bring choice and liquidity to the private markets.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein. This post contains links to articles or other information that may be contained on third-party websites. The inclusion of any hyperlink is not and does not imply any endorsement, approval, investigation, or verification by Carta, and Carta does not endorse or accept responsibility for the content, or the use, of such third-party websites. Carta assumes no liability for any inaccuracies, errors or omissions in or from any data or other information provided on such third-party websites.