|

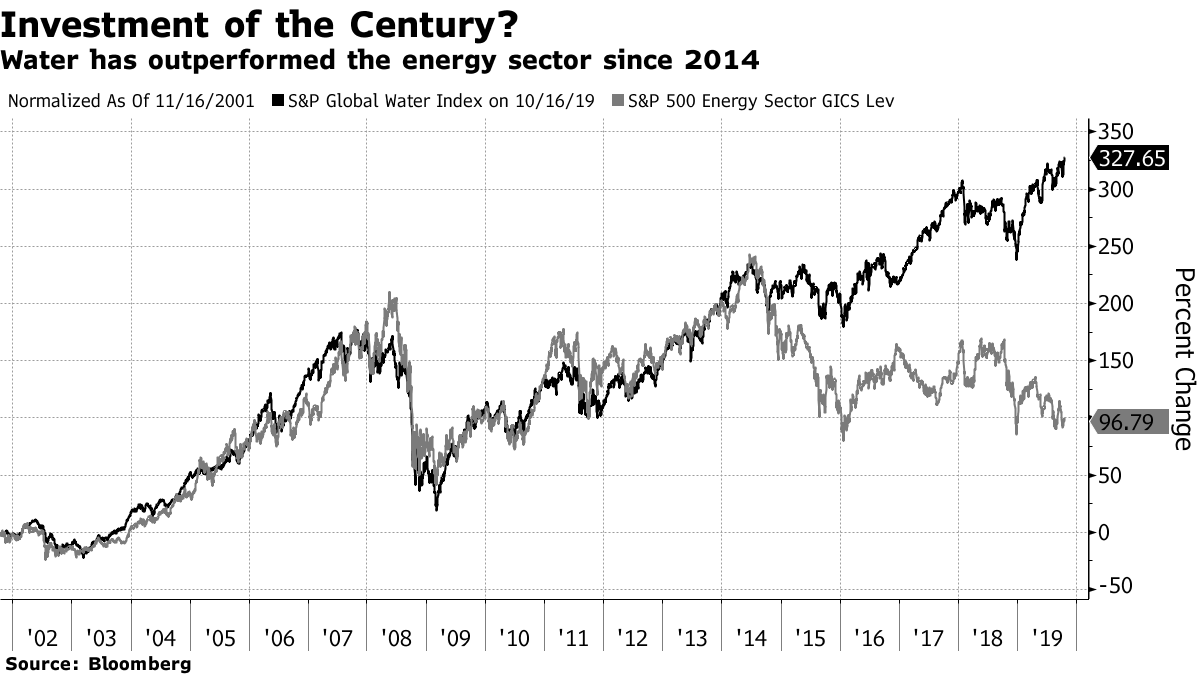

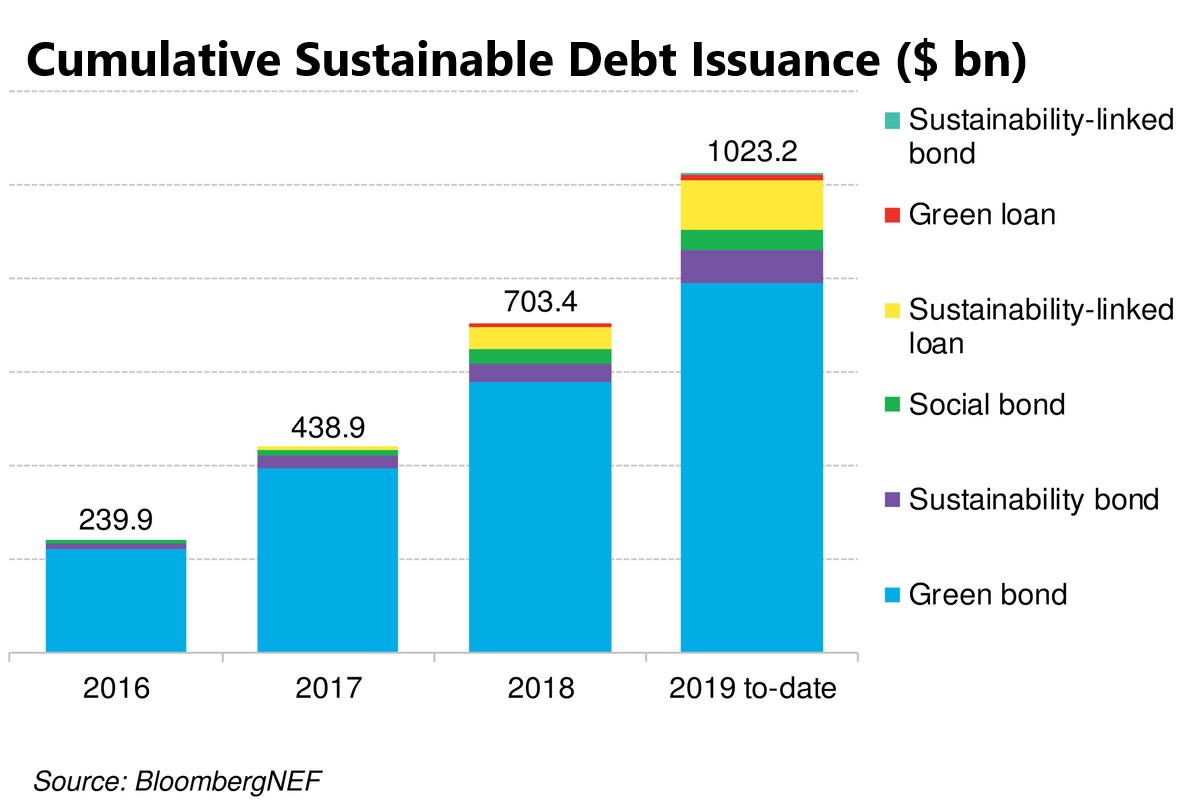

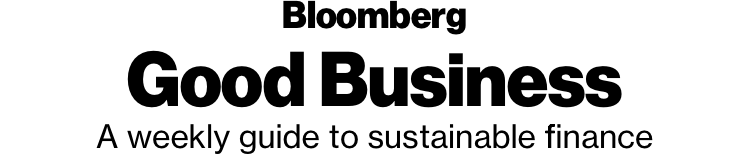

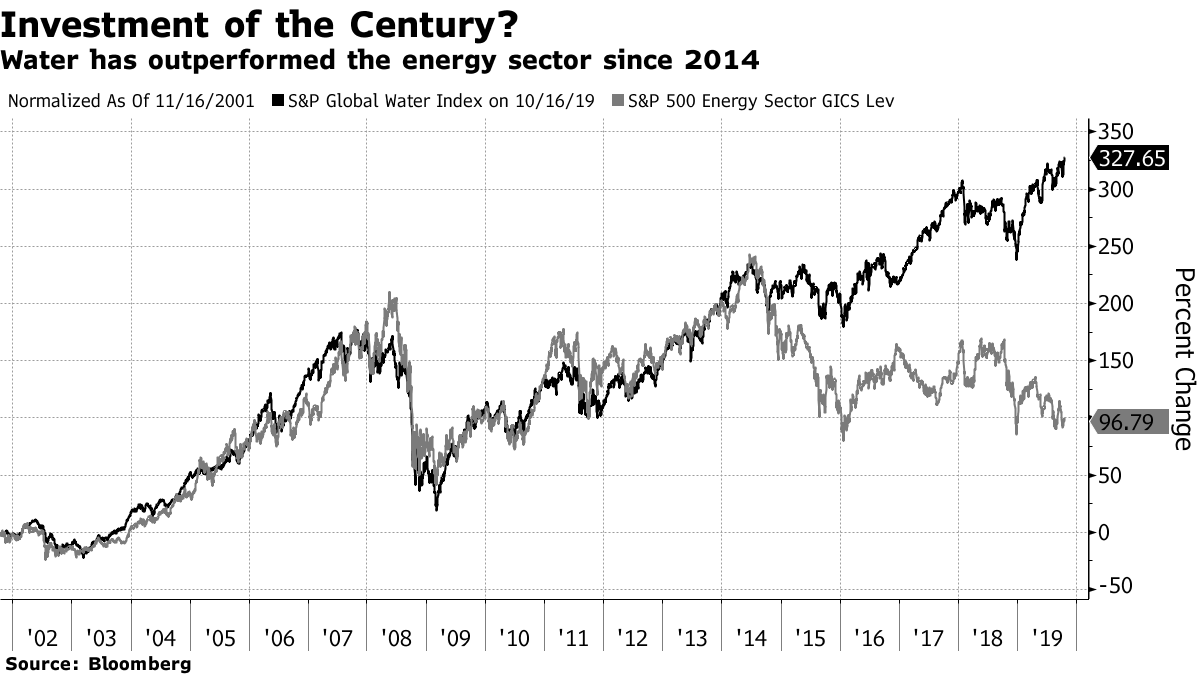

Inside: Drought fears are turning water into the investment of the century. Norway gives Rio Tinto a reprieve. Sustainable debt hits $1 trillion. Green power isn't growing fast enough. Female CFOs outperform male peers by $1.8 trillion. Big oil's day in court finally arrives and it's an accounting case. — Emily Chasan

Sustainable Finance

Rising drought risk has investors pouring the most cash into water funds in a decade. Water-related exchange-traded funds attracted more money in the nine months through September than in any full year since 2007, data compiled by Bloomberg show.

Investors holding $11 trillion in assets told Australia's mining industry to stop funding lobbying groups that promote policies inconsistent with the goals of the Paris climate accord.

The Principles for Responsible Investment asked U.S. members to push more urgently with regulators for more sustainable financial policies, amid fears that an outdated concept of fiduciary duty in the country could be disadvantaging U.S. investors. Globally, more than 500 policies support or require investors to consider long-term issues like ESG, according to the final report on the industry group's four-year project to clarify fiduciary duty issues for ESG investors.

The sustainable debt market has finally hit more than $1 trillion in cumulative issuance since it started in 2007, according to Bloomberg NEF, which expects over $100 billion of deals by year end. Here's a user's guide to ESG debt.

In Brief

- Norway's $1 trillion sovereign wealth fund bought a 1.4% holding in Rio Tinto after shunning the stock for more than a decade over a dirty mine it has now sold.

- The UN Global Compact said 30 companies and investors, including PepsiCo and Norges Bank, have signed onto its Sustainable Ocean Principles.

- The world's second biggest lithium-ion battery cell manufacturer, LG Chem, plans to invest $417 million in its Chinese business to tap demand from electric cars.

- ING has appointed Dan Shurey as its vice president for sustainable finance in the Americas.

- The European Union launched the International Platform on Sustainable Finance to boost green transition funding from private capital.

- Volkswagen's $50 billion moonshot bet on an electric hatchback.

Environment

Air quality was improving three years ago in America, but now it's worse, according to a new working paper published by the National Bureau of Economic Research. The change signals a potential deadly change in U.S. environmental health, writes Bloomberg's Eric Roston.

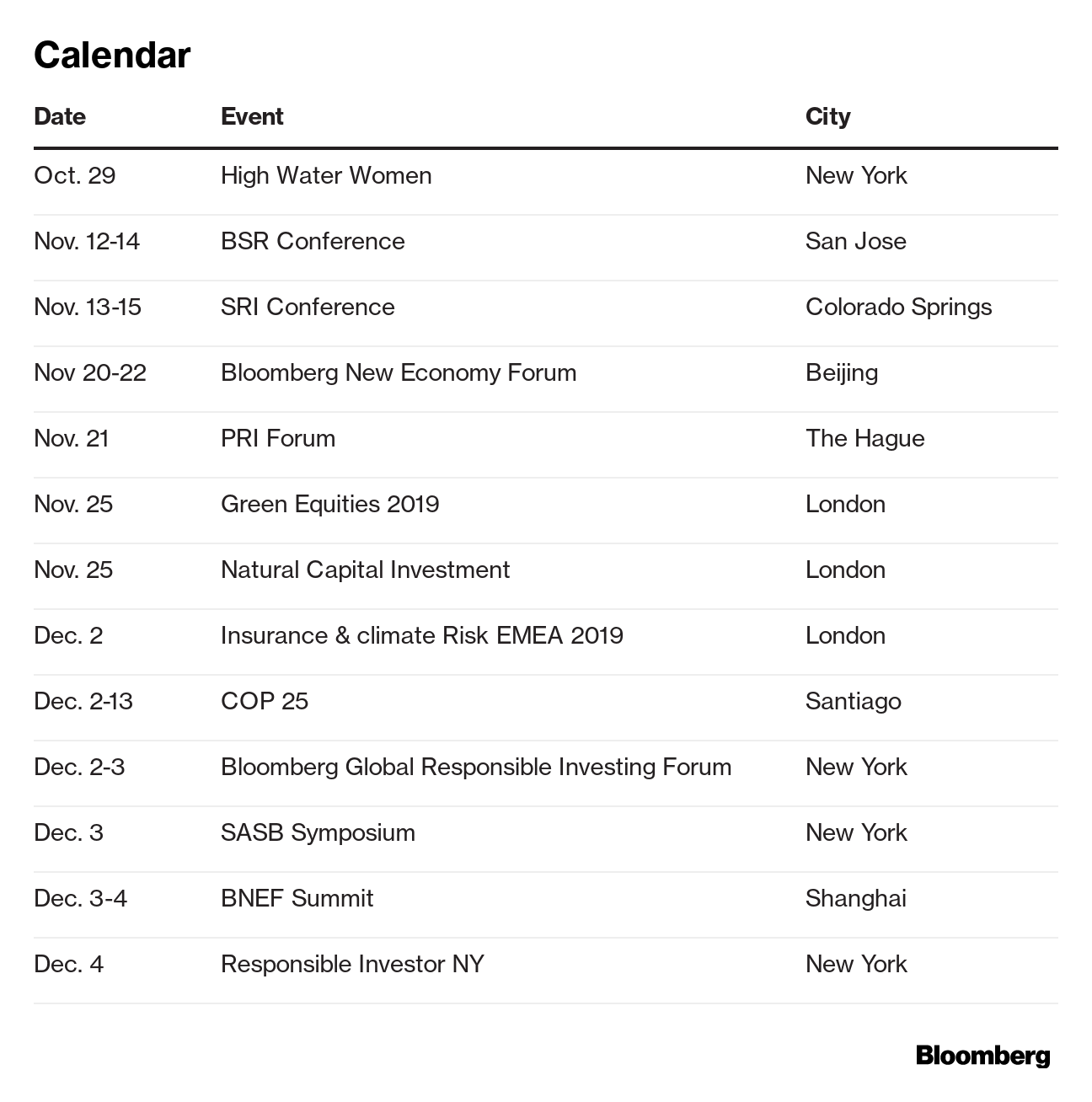

Claire Perry, The U.K's envoy who will lead the 200 UN climate talks in Glasgow next year, said at the BloombergNEF summit she sees a bigger role for carbon offsets and wants to push for policies that absorb carbon directly from the air.

The world's first completely renewable-powered chemicals plant was proposed in India. The plant, which produces plastic, will co-locate with wind and solar generation.

Plastic is not the enemy, Terracycle CEO Tom Szaky said at a Bloomberg Sustainable Business Summit in New York. It can be less emission-intensive than producing glass and might be more reusable. The real issue with plastic packaging is that it is single-use, he said. Similarly, disposable "compostable" products are also not winning any fans with composting companies who have trouble selling the material and may landfill it instead, he said.

China almost killed the U.S. market for paper recycling, but green consumers pushing manufacturers to swap plastic for paper are coming to the rescue. Plastic bottles are losing their cool.

Can a digital beehive save pollinators? Swedish researchers have connected 160,000 bees to the Internet.

There's a push to get big batteries on the U.S. electric grid. This one is already there — and is 16 years old.

Flying shame is real and consumer guilt around its carbon footprint is likely to raise costs for airlines and boost the offset market, Citi analysts said. One startup is betting the plunging price of hydrogen fuel could replace jet fuel and make private planes carbon free.

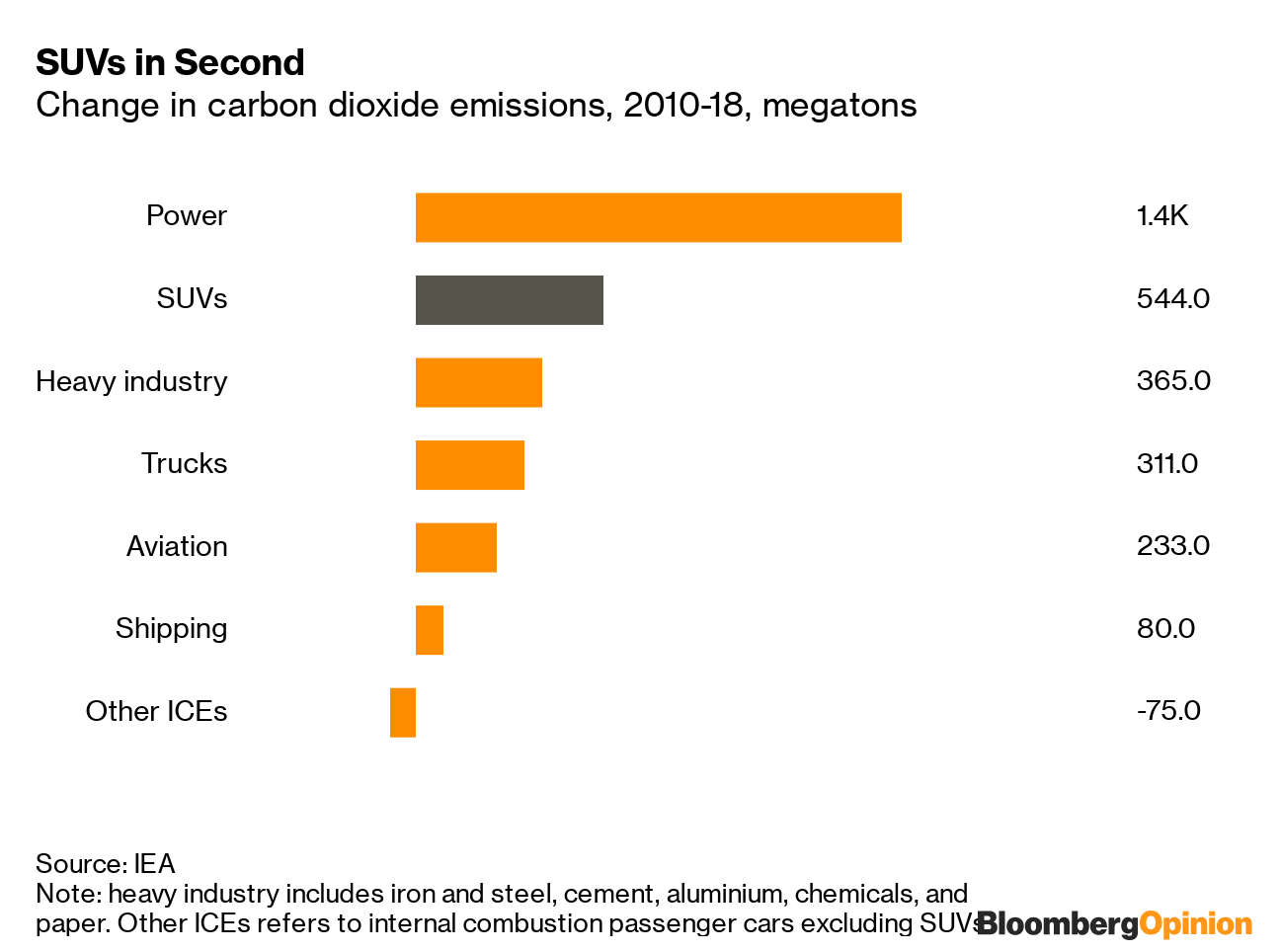

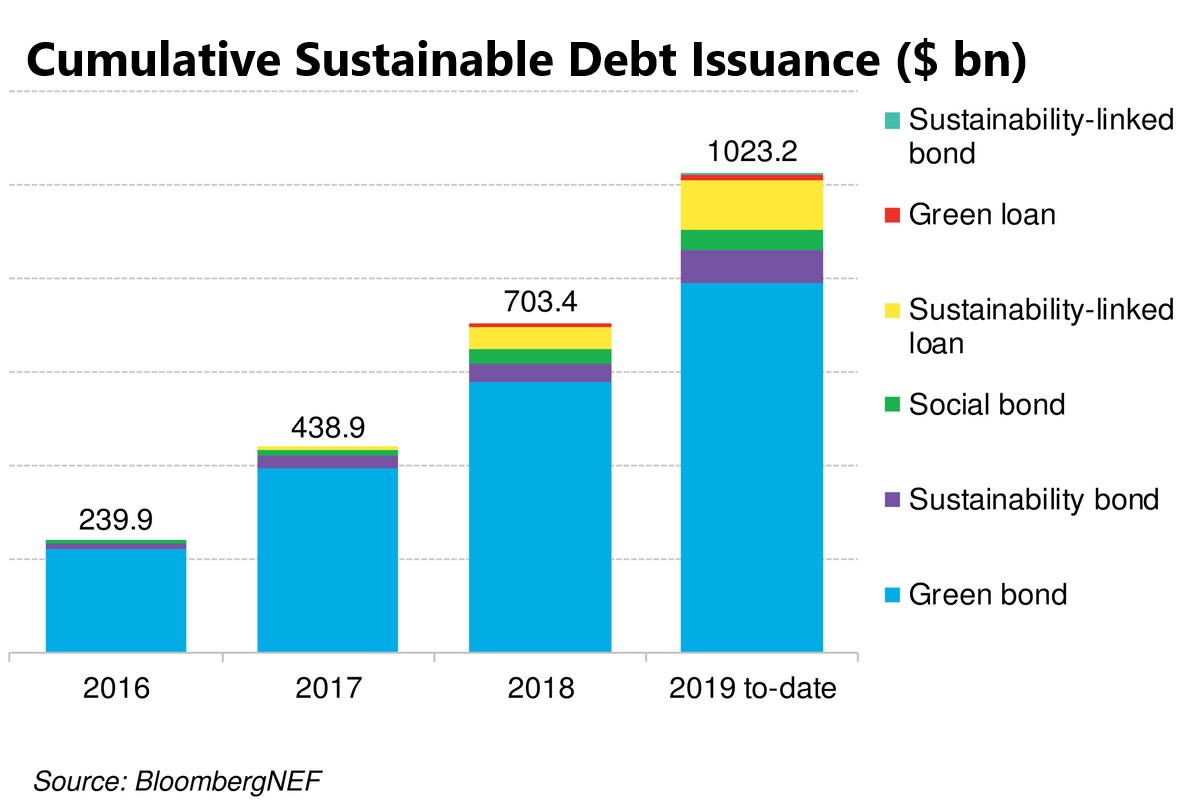

Green power is booming but it's not enough to meet climate targets. Expansion has to speed up by as much as 50% in the next five years, the International Energy Agency said. Meanwhile, Bloomberg Opinion asks, are bigger cars cooking the planet? SUV's are the second-biggest contributor to the rise in carbon emissions globally, according to the IEA.

Social

India plans to introduce rules to regulate social media -- including Twitter and Facebook — because it can cause "unimaginable disruption" to democracy, Prime Minister Narendra Modi's government said.

Cocoa growers in the Ivory Coast and Ghana, where 60% of the world's cocoa is produced, are planning to suspend sustainability programs run by private companies.

Women face a higher bar to win top financial roles, but female CFOs are outperforming their male peers by $1.8 trillion on profits and better stock returns, according to an S&P Global Market Intelligence study that looked at 6,000 companies over the last 17 years.

Impossible Foods wants to sell its plant-based burgers in the EU.

Governance

Big oil's climate reckoning finally arrived in court. New York's $1.6 billion lawsuit to hold Exxon liable for global warming has ended up being an accounting case. New York claims investors were told that the true cost of climate change and related regulations were baked into Exxon’s financial projections, when in fact, the state argues, the company was low-balling numbers for the so-called proxy cost for carbon in its annual calculations.Exxon's lawyer slammed the case as "twisted" in court. Separately, the U.S. Supreme Court let government officials press ahead with three lawsuits that accuse more than a dozen oil and gas companies of contributing to climate change.

WeWork's former leader Adam Neumann is set to walk away with as much as $1.2 billion from the company, even as thousands of employees face layoffs after the company agreed to take a bailout from SoftBank.

China said it would allow mainland investors to buy dual-class stocks listed in Hong Kong.

Women hold more than a quarter of S&P 500 board seats for the first time, Spencer Stuart found.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net.

New subscribers can sign up here. To see this on the web, click here.

Get unmatched expertise on private market investing: Join Carlyle Group Principal and Head of Impact Megan Starr along with OMERS European Head of Private Equity Jonathan Mussellwhite for a breakfast briefing Nov. 13 in London. They will provide you with deep insight into which sectors, partnerships and regions are offering the most compelling returns. Register here with code BBGNEWS.

|