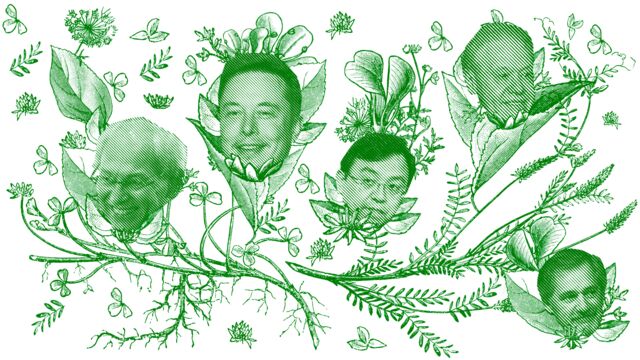

These Billionaires Made Their Fortunes by Trying to Stop Climate Change

They’re among the first to profit from climate solutions—but they won’t be the last.

Four shareholders in China’s giant supplier of electric-vehicle batteries have built a combined fortune of $17 billion. An Australian businessman has created a $7 billion net worth from recycling. A ten-figure stake in a hydrogen fuel cell trucking company has minted an American billionaire.

These are among the 10 largest fortunes derived primarily from the growing business of climate solutions, according to data compiled by Bloomberg. With a combined green net worth of $61 billion at the end of 2019—about three times the market capitalization of oil services firm Halliburton—the billionaires on this list represent the emergence of a superrich vanguard in the fight against global warming.

The list exemplifies the green economy’s growing heft and diversity. It ranges from household names such as Tesla Chief Executive Officer Elon Musk to the lower profile founders behind some of China’s biggest companies. Their rise to the apex of capitalism has been underpinned by fervent investor demand.

Investments in businesses that address climate change or encourage sustainable practices are surging. Assets managed using a broad definition of this approach—integrating environmental, social, and governance factors into investing decisions—reached $30.7 trillion at the start of 2018, about a third more than two years earlier, according to a report funded by a group of financial companies, including Bloomberg News parent Bloomberg LP. The popularity of green investments, one of the fastest-growing areas in finance, is now so large that European lawmakers are working on rules to define them.

“The next big success story is green finance,’’ William Russell, the Lord Mayor of the City of London, said in a December interview on Bloomberg Radio. “The momentum in that space is enormous.’’ The capital and interest flowing into sustainable enterprises is helping underpin a new breed of fortunes, as exemplified by those on the list.

“Sustainability is now a key offering for many of our clients,” says Eléonore Bedel, head of sustainable and responsible investing and impact investing at BNP Paribas Wealth Management.

Researching the ranking revealed only a handful of climate-focused fortunes that crossed into ten-figure territory. In the next decade there are likely to be many more, including from startups developing solar-powered grills and electric planes.

Growing demand for plant-based foods could soon produce two billionaires: Beyond Meat founder Ethan Brown and Impossible Foods CEO Patrick Brown (no relation) both own stakes worth hundreds of millions of dollars in their respective companies. Both firms have created a market for a meat replacement that doesn’t come with the environmental cost of livestock, which accounts for 14.5% of global greenhouse gas emissions.

“There’s so much pent-up demand in ESG institutional money,” says Bill Tarr, co-founder of Motiv Partners. “When a Beyond Meat comes along, money floods in.”

It’s a shift from the narrative of wealth creation that dominated the 20th century. John D. Rockefeller became the first billionaire in history on the back of Standard Oil, followed swiftly by dynasties built on emissions such as the Fords and DuPonts.

But the carbon economy remains dominant. Oil tycoons, industrialists, and car titans make up more than a quarter of the world’s 500 richest people tracked by Bloomberg, including wildcatters such as Harold Hamm, refiner Mukesh Ambani, and BMW’s Susanne Klatten. The world’s most valuable company—by far—is newly listed Saudi Aramco, with its $1.8 trillion market cap.

Greenhouse gas emissions have risen at a rate of 1.5% a year over the past decade. Government funding for renewable technology has been shrinking, squeezing many of the fortunes on the ranking, while those backed by fossil fuels have enjoyed a renaissance these past few years. Aloys Wobben's wind turbine maker Enercon has said it faces “grave” challenges to its business in Germany after a nationwide wave of legal challenges launched against new wind parks choked orders.

“Green wealth is highly dependent on innovative technologies succeeding, which means these fortunes can be wiped out in a heartbeat,” said Kingsmill Bond, energy strategist at Carbon Tracker, a think tank that examines the impact of climate change on capital markets and investment in fossil fuels. “But people who successfully carve out new niches in this new economy will be the owners of the wealth of the future.”

Take Mário Araripe, a Brazilian tycoon who first built a fortune in property before being converted to the lucrative promise of wind power. “Brazil’s national anthem says the country is a giant by its own nature,” he said in 2017. “People always thought that was because of gold or other underground treasures, but I don’t believe that. I think it’s because there’s wind.”

Such sustainable fortunes are likely to be bolstered by capital. Investors—especially the family offices of the super rich—are increasingly making sustainability central to their strategies. TCI Fund Management, the company that hedge fund manager Christopher Hohn runs, recently warned companies in its portfolio to step up their climate change action or risk divestment.

If such a sentiment continues to take hold, it could eventually remake the world’s wealth rankings.

Zeng Yuqun, Huang Shilin, Pei Zhenhua, Li Ping

$16.7bn

CATL

China

$16.7bn

Elon Musk

$27.6bn

Tesla

United States

$14.6bn

Aloys Wobben

$7.3bn

Enercon

Germany

$7.3bn

Anthony Pratt

$6.8bn

Pratt Industries

Australia

$6.8bn

Li Zhenguo, Li Chunan, Li Xiyan

$3.4bn

Longi

China

$3.4bn

Jose Manuel Entrecanales

$4.9bn

Acciona

Spain

$2.9bn

Lin Jianhua

$2.9bn

Hangzhou First Applied Material

China

$2.9bn

Wang Chuanfu

$4.2bn

BYD

China

$2.4bn

Somphote Ahunai

$2.4bn

Energy Absolute

Thailand

$2.4bn

Trevor Milton

$1.3bn

Nikola Motor

United States

$1.3bn

Methodology

Net worth figures are as of Dec. 31, 2019 and are based on calculations by the Bloomberg Billionaires Index. To qualify, the majority of a fortune valued by Bloomberg must be derived from and actively focused on business activities that reduce greenhouse gas emissions such as renewable energy or electric vehicles. Fortunes derived from the same company are grouped together. The green net worth figure excludes any portion of the fortunes not derived from such activities. The value of pledged shares are excluded from the calculation.

Photography: Getty

With assistance from Venus Feng, Andrew Heathcote, Blake Schmidt, Feifei Shen, Jack Witzig, Brian Parkin, Pierre Paulden, and Charles Penty