Kathryn Neel is a managing director, Olivia Voorhis is a senior associate, and Jacob Giordano is an associate at Semler Brossy Consulting Group, LLC. This post is based on their Semler Brossy memorandum

As the COVID-19 pandemic and stay at home orders continue to change the way we live, work, and spend, corporations have been forced to continue evolving in response. Without an obvious rebound in consumer spending in sight, workforce reductions and furloughs are an unfortunate but necessary tactic to help companies weather the drought. The impacts of dramatic shifts in consumer behavior have not been felt evenly across sectors, however, with discretionary spending—and spending related to travel and leisure—hit hardest, while necessities like consumer staples and utilities have either remained unaffected or rebounded from March lows.

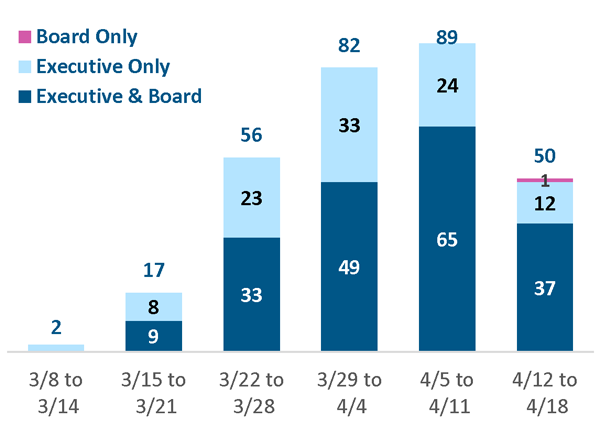

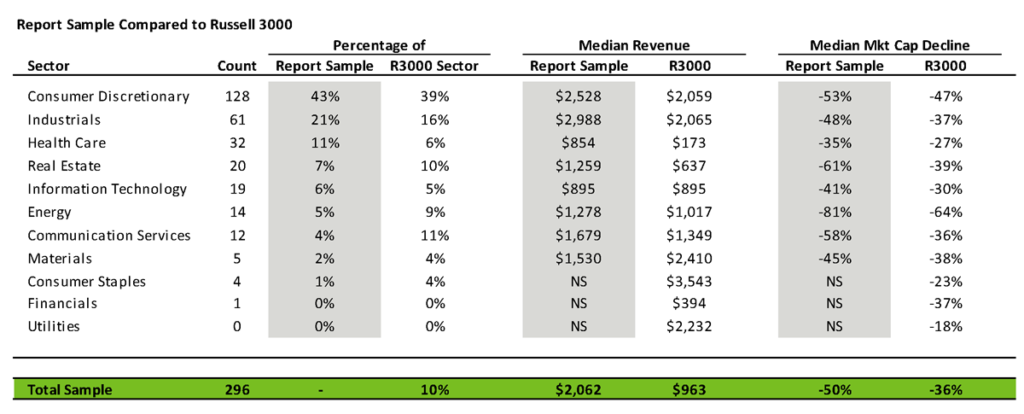

As the pandemic endures, companies have continued to enact pay cuts for company leadership to demonstrate solidarity. Semler Brossy has been tracking executive and director pay actions among Russell 3000 companies announced since early March in response to the pandemic. For the week beginning April 12, 50 companies have been added to the list of identified pay actions impacting executives and/or non-employee directors, bringing our total sample to date to 296 companies, approximately 10% of the entire Russell 3000. In this volume, we take a closer look at Consumer Discretionary and Industrials companies, the two highest represented sectors in the sample.

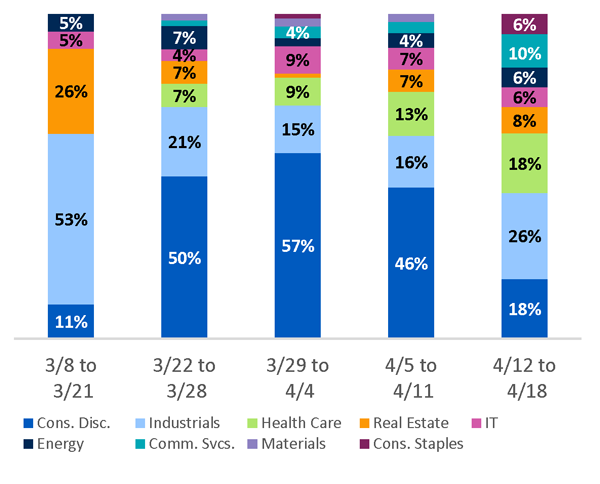

Timing of Pay Action Announcements

The number of pay actions announced every week increased throughout March and early April, although the weekly increase was slowing, and showed its first decrease the week of April 12.

Industrial companies, including airlines and hospitality-focused real estate firms, were heavily represented in early announcements, followed closely by a swell of Consumer Discretionary companies peaking at the end of March. Recent weeks have seen increasingly even representation across sectors as Consumer Discretionary announcements have dropped.

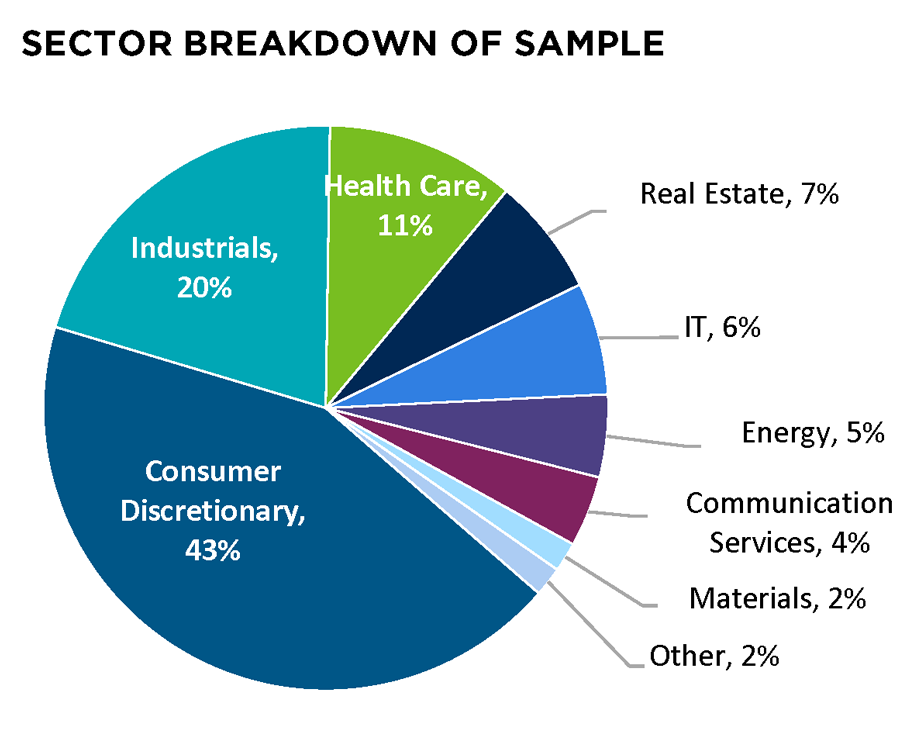

Sample Composition

The fifth-largest sector in the Russell 3000, Consumer Discretionary companies continue to comprise the largest portion of the sample, though the latest week’s additions have dropped its weighting by 500 bps. Industrials remain the second most represented sector followed by Health Care. There remain three sectors with little to no representation within the sample, including Financials, the largest sector within the Russell 3000 by count.

- Consumer Staples

- Financials

- Utilities

Companies enacting leadership pay changes have higher median revenue than that of the Russell 3000 as a whole. Many of the index’s smallest constituents are in the Health Care and Financials sectors, which are under-represented in the sample. Size skew by sector is less significant, except for Healthcare and for Real Estate, for which announcements to date have centered around larger hospitality-focused REITs.

These companies have experienced larger reductions in market value than the broader index, both by sector and in total. As of the dates these companies announced pay actions, they had experienced a median market cap decline of 50% (total sample) from their average trading prices during January 2020, as compared to a median decline of only 36% among the overall Russell 3000.

As one of the sectors with the biggest drops in market cap, nearly 40% of Consumer Discretionary companies in the Russell 3000 have announced pay actions to date. On the other end of the spectrum, the Utilities and Consumer Staples sectors experienced the lowest median market cap reductions and are underrepresented among the sample. Financials, however, stands out as a sector with similar losses to other hard-hit sectors, but despite composing the largest portion of the Russell 3000 it’s one of the least represented sectors in the sample.

Executive Pay Reductions Full Sample

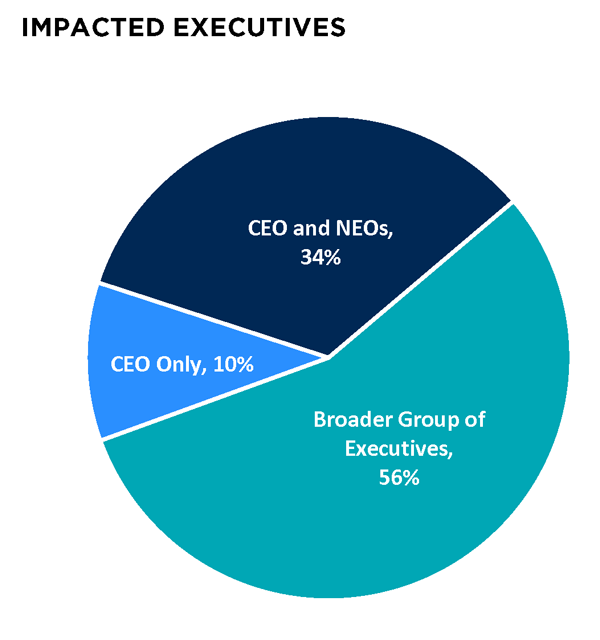

As of April 18th, only 10% of companies are enacting pay changes for CEOs only, down from the 13% as of the end of the prior week. Another third of companies are enacting pay changes for only CEOs and other Named Executive Officers (NEOs), but most companies have extended reductions beyond the top five to a broader group of executives for a greater cost impact.

Pay actions continue to center on salary reductions rather than annual and long-term incentive compensation opportunities, likely due in part to ongoing uncertainty around bonus payouts as well as an aim to conserve cash and reduce immediate operating expenses. A small portion of the sample (18 companies) changed the form or timing of executive pay, such as a deferral in the payment of base salary, or a conversion of cash compensation into company stock.

Over half of companies have cut CEO salaries by at least 50%, with the most common CEO reduction at 100%. For NEOs, the most common pay cut falls between 20% and 50%, with a majority of decreases below 50%. Median pay cuts for NEOs are typically half those of the CEO.

Director Pay Reductions Full Sample

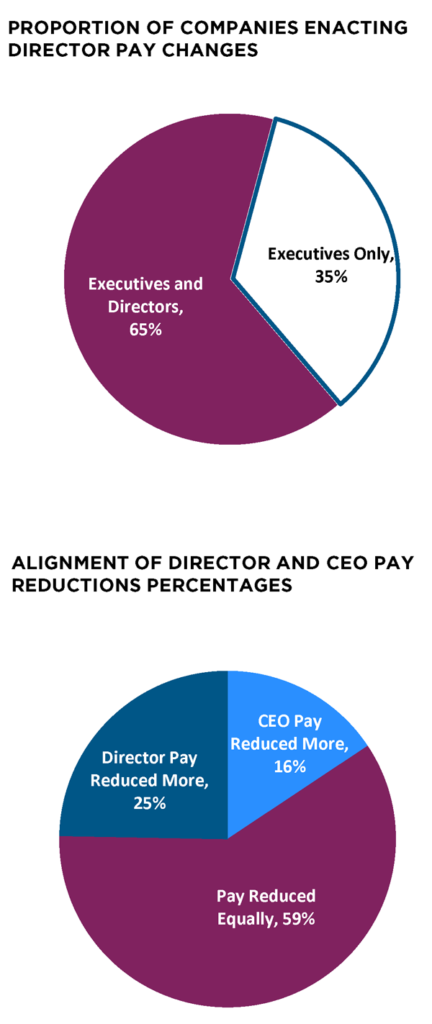

Most companies enacting executive pay changes are also changing pay for the board’s non-employee directors. While 295 companies are changing pay for executives, 194 companies are changing pay for directors, including one company that is cutting director but not executive pay.

Though the most common director pay action by far—comprising nearly the entire sample—is a reduction of fees, eight companies have opted to instead to delay the payment or change the form of compensation for directors (i.e., stock in lieu of cash).

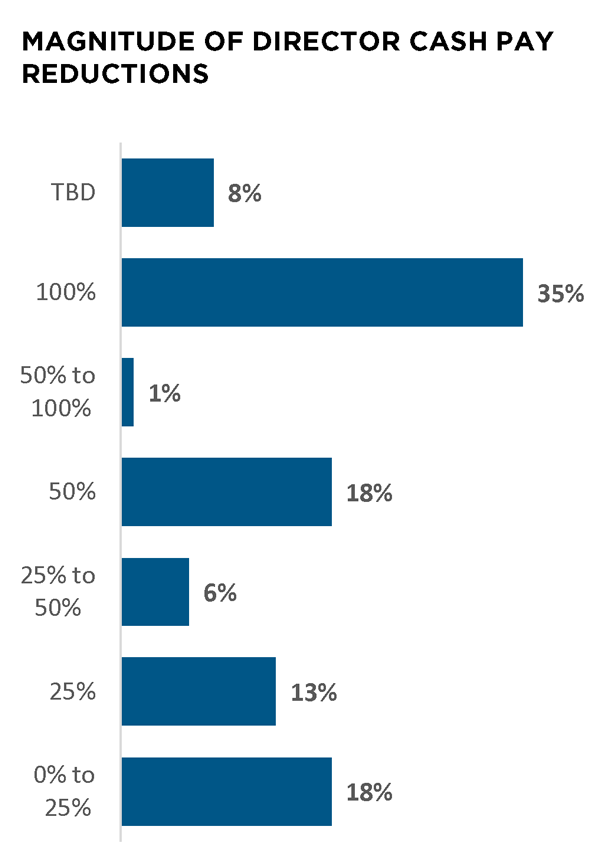

In most cases, the magnitude of the pay cut for directors is aligned with the reduction in the CEO’s base salary. The most common action on board pay is a 100% reduction in cash fees. As it does for executives, equity comprises a large portion of a board’s annual compensation and, so far, few boards have announced changes to equity award practices.

The complete publication is available here.

Print

Print