The Blistering Rise of Retail Trading

What You Need To Know

It used to be difficult to trade stocks. Now it’s basically as easy as downloading an app or sending a tweet.

And what’s more, it’s completely free.

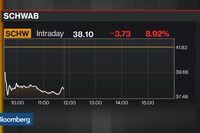

Over the past year, there has been a revolution in how people can access the stock market. After a few companies started offering free trades, a move in late 2019 by one giant brokerage — Charles Schwab Corp. — to eliminate fees rippled through the entire industry.

Then, in an event that poured lighter fluid on the embers, the pandemic hit. People sitting at home during lockdown with no sports to watch or bet on — and a bit of extra cash in their pockets from government stimulus — were drawn to trading platforms such as Robinhood, E*Trade, TD Ameritrade and Schwab. Millions of newly minted investors opened accounts, and measures of trading at brokerages shot through the roof.

Key Coverage

By The Numbers

- 20% of stock trades are made by retail investors, according to Bloomberg Intelligence

- 50% of Robinhood's new customers this year say they are first-time investors

- 75% of all options trades in July expired in less than two weeks, a record, according to Goldman Sachs. Shorter-dated trades are seen as a tell-tale sign of retail investors

Why It Matters

Some call it the democratization of investing. Some call it dangerous. What’s clear is that retail investors have become a force unto themselves in the stock market these days, and evidence shows their influence on stock prices. At first, they gravitated to the likes of airline and cruise line shares. Then they favored companies in bankruptcy. Now, they’re making trades in the options market. With savings accounts paying out nearly nothing and people finding extra time while working from home, amateur investors who’ve gotten a taste of shares are becoming a permanent feature of the stock market.

The rush of new investors flocking to brokerages and trading apps has sparked controversy over how much they’re influencing markets — particularly the world of options. The Robinhood app in particular has drawn the focus of finance-industry professionals and regulators, with worries that the platform gamifies trading and allows users to quickly get into trades using leverage or complicated strategies that would greatly increase the risks they’re taking. One young trader killed himself after his account falsely showed a negative balance of more than $700,000, according to his family. Robinhood changed elements of its options trading platform in response.

Not since the dot-com mania of the late 1990s — when starry-eyed day traders dreamed of quick riches — has a brokerage platform drawn a frenzied following like Robinhood has. Skeptics warn the hype could set up home-bound novices for disaster, while some say it’s a step in the right direction to equalize access to financial markets.

The investment platform’s users are gaining valuable experience without destabilizing stocks.