China's hostile meddling threatens Hong Kong market demotion

The downgrading of the territory's status could see tens of billions of dollars being withdrawn from the former British colony.

Monday 16 November 2020 13:14, UK

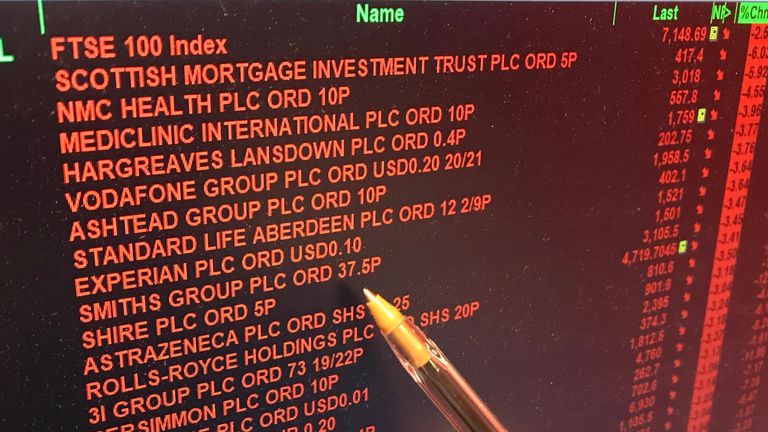

Hong Kong's stock market could find itself relegated to the status of an emerging market if Chinese interference in the territory intensifies, the former boss of one of the world's leading index providers has warned.

Mark Makepeace, who stepped down last year as chief executive of the global index provider FTSE Russell, told Sky News he expected the index providers "to really follow Hong Kong closely".

Mr Makepeace said index providers always sought to make decisions not on political issues but on financial ones.

He added: "Hong Kong is going to be interesting. Whilst the regulators in Hong Kong remain independent, and the rules and regulations of Hong Kong remain independent of mainland China, I think they should continue to keep Hong Kong the way it is.

"But if that changes, and the regulation is driven from mainland China and the capital controls are decided by Beijing, then Hong Kong should be treated in the same way as China - and that would lead to a demotion of Hong Kong to become an emerging market."

Such a decision would have huge implications because, were Hong Kong were to be given emerging market status, a lot of fund managers around the world would have to withdraw money from its stock market.

It would potentially result in tens of billions of dollars being withdrawn from the former British colony.

Many investors are watching recent events in Hong Kong with unease.

The territory is currently without an official opposition after its opposition politicians resigned en masse, on Wednesday, after four of them were expelled from the Hong Kong assembly under a Chinese law aimed at curbing dissent.

The move has been condemned by both the United States and the European Union while Dominic Raab, the foreign secretary, summoned Liu Xiaoming, China's ambassador to the UK, to express his unhappiness on Thursday.

Were index providers to demote Hong Kong to emerging market status, the move would be a blow to Beijing, which has been eager to promote the Hong Kong and Shanghai stock exchanges as attractive places for businesses to raise capital.

That attractiveness has been jeopardised in recent days, however, by a decision to block the flotation of the Chinese fintech giant Ant Group. The IPO would have been the biggest in the world.

The Wall Street Journal reported on Thursday that the decision to block the IPO was taken personally by the Chinese President Xi Jinping.

Mr Makepeace was speaking following publication of his book, 'FTSE: The Inside Story', which chronicles how a small start-up created by the London Stock Exchange and the Financial Times became one of the UK's most famous brand names.

The Footsie was not always the main index on the UK stock market.

The FT30 held sway for much of the last century.

It was devised in 1935 by two young journalists on the Financial News, Maurice Green - later to become editor of the Daily Telegraph - and Otto Clarke, who had the idea of coming up with some sort of index to illustrate how the London Stock Exchange was performing on a particular day.

They came up with an arbitrary list of leading British businesses for inclusion, including the brewer Bass, the tyre maker Dunlop, the fabric maker Courtaulds and the engineer GEC.

It began life as the FN30 and was rechristened when the FT acquired Financial News in 1957.

By the mid-1980s however, the futures market was looking for an alternative similar to the S&P 500 index in the US, which led to the birth of the FTSE 100 in 1984.

Mr Makepeace said: "London took its lead from the US. [Futures market participants] saw that this could be very attractive and they wanted to have an index on which to launch futures.

They looked at the FT30 and they decided that the FT30 wasn't suitable - much, I think, to the disappointment of the Financial Times.

"[So] the London Stock Exchange, working with the futures market Liffe, designed an index and, originally, it was launched as the SE 100. It was only a month or two later, when the FT joined in the venture, that it became the Footsie.

"It really took off once the two, the London Stock Exchange and the Financial Times, came together - it really then became the index that everyone wanted to follow. And it's been a success ever since.

"People don't realise it was a start-up when we set the company up - there were just nine staff."

Mr Makepeace said the rise of indexation and passive management - where a portfolio is built to replicate the performance of a stock index rather than whether or not they like a particular company's shares - enabled the business to really take off.

The LSE bought full control of FTSE International in 2011 when it paid Pearson, then the owner of the FT, £450m.

The business evolved into FTSE Russell when the LSE bought Russell Investments, a US index compiler, for $2.7bn (£2bn) in 2014.

More than 95% of the world's fund managers now use FTSE Russell's benchmarks and more than $3trn (£2.3trn) worth of money is invested in funds that passively track its indexes.

Mr Makepeace said: "Indexation is very low cost, it's computer driven, data driven, so it doesn't have the expensive fund managers to pay for - and that has really been its success, it's the low cost approach."

The rise in passive investment, which has cost thousands of jobs in the global asset management industry, does have its critics.

During the mining boom, a number of big companies from outside the UK with dubious standards of corporate governance entered the Footsie, giving investors no choice but to buy their shares.

Mr Makepeace admitted: "I think we went through a learning stage - we had a number of Russian companies that listed in London and back in those days, if a company listed in London [and was big enough to merit inclusion], we would have included it in the FTSE-100.

"And, of course, we learned that many of these companies were run from outside the UK, their shareholdings were controlled in that way, so we had to develop rules…that protected investors.

Chancellor Rishi Sunak has just introduced a review of the listing requirements for companies floating on the UK stock market with the aim of encouraging more companies, particularly the most innovative tech companies, to come to the UK.

But Mr Makepeace said it was important the review ensured that standards in the Footsie remained high.

He added: "Once you have a large passive investment following, those people become forced buyers and those people are your pension fund and institutional investors worldwide - and they will not want to take on some of the risks that the lower listing requirements bring to the market.

"People will want to choose to invest in these companies, they may be excited by them, but they will be higher risk - and therefore I would expect the indices to retain their higher standards."