Why Is Everyone Talking About Evergrande?

What You Need To Know

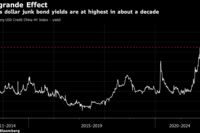

Evergrande is the biggest financial worry in China right now, and it’s fast becoming a problem outside of the nation’s borders. In a nutshell, the giant real estate developer is $300 billion in debt and defaulted for the first time on dollar bond interest payments whose grace period expired Dec. 6.

The group owns 1,300 projects in more than 280 cities. But its reach goes way beyond building homes. Its billionaire owner Hui Ka Yan has his fingers in pies from electric vehicles and media production to mineral water and soccer.

The company’s woes started in 2020, when Evergrande reportedly sent a letter to the provincial government of Guangdong, warning officials of a potential liquidity crisis. Evergrande later disputed the letter’s authenticity and eventually crisis was averted when a group of investors waived their right to force a $13 billion repayment. But there’s plenty of debt still coming due and ratings agencies see default on the cards.

So what could save Evergrande from its downward spiral? In short, Beijing. And now investors around the world are holding their collective breath to see whether the government will step in and offer a bailout, or demand a restructure of the company. Or whether it will let fate run its course and risk Evergrande’s collapse and all the chaos that could bring.

Key Coverage

By The Numbers

- 2 trillion yuan The amount Evergrande has in assets, equivalent to 2% of China's GDP, according to Goldman Sachs.

- 3 red lines Metrics the government says developers have to meet if they want to borrow more.

- 1.4 million The number of individual properties Evergrande was committed to building as of the end of June.

Why It Matters

Bondholders, stock investors and rating agencies had predicted an Evergrande default and said a debt restructuring is almost inevitable. Shockwaves are already being felt across global stock markets, triggering losses even in companies with no clear link to China or property. But authorities in Beijing are expected to engineer a resolution, rather than allow a chaotic collapse into bankruptcy.

The state runs most of the banks and can exert pressure on creditors, suppliers and other counterparties, keeping systemic risk to a minimum. While Evergrande investors would recover only a small portion of their money, the company’s operations would remain protected and unfinished properties would be delivered to their owners.

An uncontrolled downward spiral, on the other hand, could prove catastrophic for China’s economy, one of the major engines of global growth. Aggressive controls to curb outbreaks of Covid-19 are already hurting retail spending and travel in China, while measures to cool home prices are taking a toll. A correction in China’s property market, which comprises 28% of China’s economy and 40% of household assets, poses a risk to social stability.

In a worst-case scenario, Evergrande-related stress spreads across the world’s financial system and freezes the global credit market. That would be China’s Lehman moment, risking a repeat of the global financial crisis and dragging the global economy down with it. Think a real estate crash, surging unemployment, lower wages and protracted economic recessions. China has a lot of tools to prevent that, of course, and much of Wall Street believes Beijing will use them if necessary.

Who are these shell companies issuing $300 million of debt in the Chinese developer crisis? Pull down your masks.

Timeline

-

3 years ago The Economic Lessons of Evergrande

-

3 years ago Evergrande Fire Sale Just Getting Started