New 2021 Forecast Policy Scenario from IPR shows rapid policy acceleration by 2025 would bring ‘below 2C’ Paris Agreement within reach

Pursuing 1.5C requires immediate ramp up in Energy & Land Use policy action: Transport Electrification, Coal Retirement, End to Deforestation

The latest scenarios from IPR forecasts a dramatic acceleration of climate policy is likely by the 2025 Paris Ratchet, which could result in warming being held to below 2C. The new IPR Forecast Policy Scenario (FPS) - which provides a high conviction forecast of likely policy developments and assesses the impact on the real economy - finds that a significant acceleration in climate policy by 2025 is likely.

Building on the influential 2019 Forecast, which helped reset how investors approach climate policy risk and opportunity, this year’s FPS update covers 21 major economies at a granular level and sees total CO2 emissions fall by 80% by 2050, giving a one in two chance of keeping warming to well below 2 degrees at (1.8 degrees).

The Inevitable Policy Response (IPR) Forecast Policy Scenario anticipates that over the coming years policymakers will be pushed to make the changes necessary to reach a below 2C pathway by 2025. Changes will be driven by a combination of:

- investor, corporate and civil society pressure around Net Zero,

- climate impacts,

- volatile weather patterns and

- low-carbon technology developments

Reductions in emissions are driven by forceful policy in the 2020s across the energy and, crucially, food and land systems:

Land sector emissions fall 125%, from around 6 GtCO2 in 2020 to around -1 GtCO2 per year by 2050, returning land to be a net CO2 sink.

Energy Systems

The 2021 Forecast Policy Scenario (FPS) outlines how sweeping policy changes in the next decade lead to a transformation across the energy system, including

- Zero emissions vehicles make up around 30% of all vehicles on the road by 2030, accelerating the demise of oil, which is already near its all-time peak, and declines significantly after 2026/27.

- Wind and solar power will represent over 30% of global electricity generation by 2030, over triple today’s levels (around 10%). 2

- Energy sector emissions fall 75%, from around 34 GtCO2 in 2020 to around 9 GtCO2 in 2050.

Nature Based Solutions

Rapid changes in the food and land systems, often overlooked in climate scenarios, also play a critical role. Huge shifts in food production see land use becoming a net carbon sink within 30 years as the world reaches ‘peak meat’ consumption in 2030, and Nature Based Solutions (NBS) accelerate. Land sector emissions fall 125%, from around 6 GtCO2 in 2020 to around -1 GtCO2 per year by 2050, returning land to be a net CO2 sink.

Closing the gap to 1.5C: The Required Policy Scenario (RPS)

Even with this rapid transformation, the forecasted changes in the FPS would not yet be enough to keep warming to 1.5C – the temperature the IPCC has defined as critical to avoiding the worst impacts and most costly effects of climate change.

New analysis via a Required Policy Scenario (RPS) highlights the key actions to deliver a 1.5C outcome, including:

- An end to deforestation across the entire globe, ideally by 2025.

- If not, the energy system has to absorb greater reductions, potentially through BECCs. (Bioenergy and CCS)

- Eliminate unabated coal in most advanced economies including China by 2035.

- Phase out of new fossil cars in almost all markets by 2040 o Transition to 100% clean power globally by 2045.

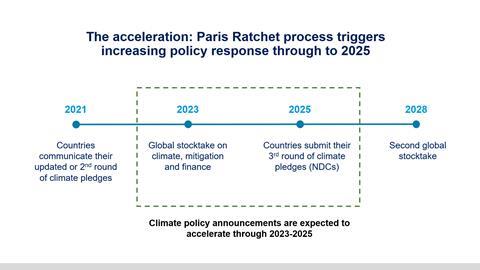

2023-25: The Paris Stocktake and Paris Ratchet- A policy tipping point

The Forecast Policy Scenario is based on a detailed review of key climate policy developments in all major countries alongside an extensive survey of 200+ leading experts in national climate policy.

Analysts found the doubling of net zero commitments by countries, now representing 70% of global GDP, have made a forceful and accelerated policy response to climate change even more likely than before the pandemic: 48% of 124 forecasts show higher policy ambition, and only 6% lower, versus IPR’s 2019 outlook.

The forecast finds the period of 2023 to 2025 will become a key trigger moment with two major pressure points converging to pressure governments to accelerate forceful policy:

- In 2025, countries under the Paris Agreement submit their third round of climate pledges following the Global Stocktake in 2023, which will detail how far the world is from meeting the Paris goals and act as a crucial forcing mechanism for governments to accelerate policy. 4

- At the same time, as technology costs fall and the realities and impacts of climate change become increasingly visible, civil society, business and investor pressure on governments will increase around the globe.

Next Steps for Investors

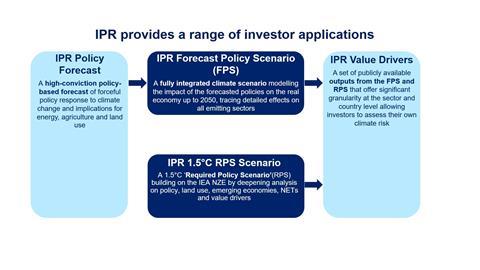

IPR has worked with its strategic partners to define which data elements are key for asset owners and managers for application in company and sector valuation models.

In December, IPR in conjunction with the PRI has published its next significant update, an investor-based announcement, releasing the FPS & RPS Value Drivers Database for both Energy Systems and Food and Land Use forecasts, including full data sets for investors to produce portfolio level analysis.

Download the 18th October Launch Media Release

IPR FPS 2021 Energy and Land Use System Results Summary

IPR 2021 Emissions & 1.5°C Required Policy Scenario Policy Summary

IPR FPS 2021 Detailed Land System Results

IPR FPS 2021 Detailed Energy System Results

IPR Supply Chain Analysis

The 2021 Forecast Policy Scenario (FPS) is IPR’s current assessment of what is anticipated, in terms of future policy developments and the subsequent impact on emissions reduction and temperature outcomes.

The 2021 1.5C Required Policy Scenario (RPS) is IPR’s current assessment of future policy developments needed to accelerate emissions reduction and hold global temperature increase to a 1.5 Degree outcome.

Fiona Reynolds, former CEO, Principles for Responsible Investment:

”Global finance has an increasingly vital role to play in rapidly moving capital markets and corporations towards sustainable outcomes. IPR is now a significant tool for investors committed to making that a reality.”

“IPR scenarios for investors encompass both the large-scale market shifts to come in carbon, energy and land use as well as invaluable granular analysis to help guide investment directions. The 2021 IPR forecasts signal to investors that they must focus on the transition, 2030 and net zero pathways and the investment opportunities emerging as policy makers respond to growing climate challenges.”

PRI / IPR Webinar Events

9th November PRI COP26 investor event with IPR: live from Glasgow

Watch on demand

22nd Nov, 3rd Dec, 8th Dec PRI IPR Regional Events: Inevitable Policy Response – Signatory Deep Dive on 2021 FPS and on 8th Dec Value Drivers

(Delivered by Julian Poulter Head of Investor Relations IPR, with hosting by respective regional PRI staff)

i) UK/EU Event 22nd NOV 8:30 GMT

Watch on demand

ii) Asia Pacific 3rd DEC 10:30 HKT

Watch on demand

iii) Americas US 8th DEC 16:00 ET/13:00 PT (Also Launch of full FPS & RPS - Value Drivers for Investors)

Watch on demand

To better understand how the Inevitable Policy Response could be of use to your and your investment team, please get in touch.

Get in touch

Downloads

18th October Launch Media Release

PDF, Size 1.87 mbEmissions & RPS Policy Summary

PDF, Size 1.02 mbFPS land and energy systems summary

PDF, Size 1.43 mbFPS - Detailed Land System Results

PDF, Size 1.7 mbFPS - Detailed Energy System Results

PDF, Size 1.28 mbRPS - Detailed Land System Results

PDF, Size 1.92 mbRPS - 2021 Detail Energy

PDF, Size 1.31 mbIPR Investor Brief - Asset Managers

PDF, Size 3.72 mbIPR Investor Brief - Asset Owners

PDF, Size 1.8 mbIPR value drivers database guide

PDF, Size 0.49 mb1.8C FPS 2021 Macroeconomic Results

PDF, Size 13.24 mb1.5C RPS 2021 Macroeconomic Results

PDF, Size 13.16 mbIPR FPS 2021 value drivers

Excel, Size 3.01 mbIPR 1.5C RPS 2021 value drivers

Excel, Size 2.34 mb1.8C FPS Macroeconomic databook

Excel, Size 1.12 mb1.5C RPS 2021 Macroeconomic databook

Excel, Size 1.12 mb

What is the Inevitable Policy Response?

- 1

- 2

Currently reading

Currently readingThe Inevitable Policy Response 2021: Forecast Policy Scenario and 1.5C Required Policy Scenario

- 3

- 4

- 5

- 6

- 7