Wall Street’s Favorite Climate Solution Is Mired in Disagreements

Two titans of finance are working with hundreds of executives and scientists to set up a global trade in carbon offsets. It’s messy, and time’s running out.

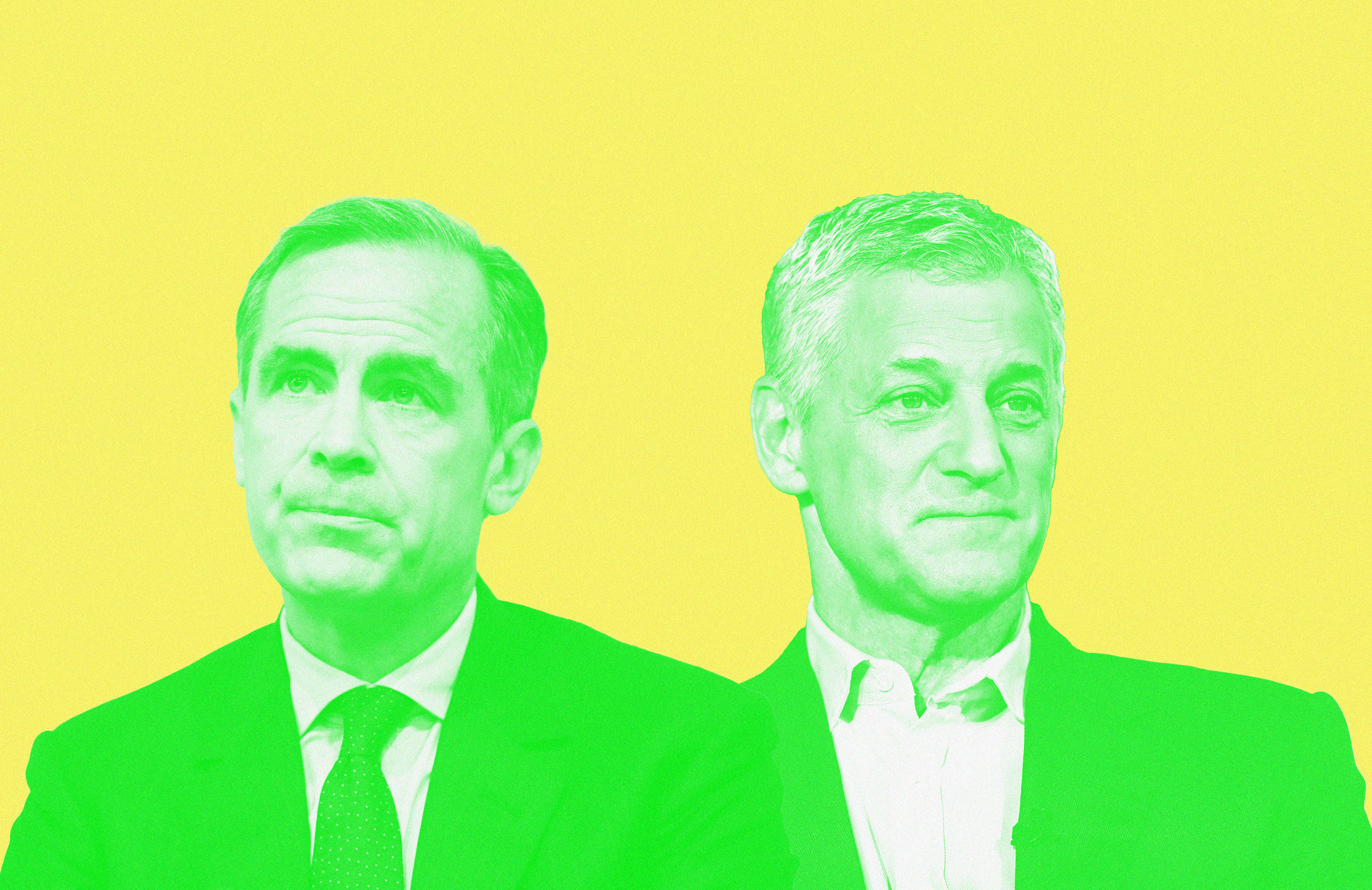

Mark Carney, a former governor of the Bank of England, and Standard Chartered Chief Executive Bill Winters are the organizers of the Taskforce on Scaling Voluntary Carbon Markets.

Photographer: Suzanne Plunkett/AFP/Getty Images; Simon Dawson/Bloomberg

Global warming is the world's biggest market failure, so the solution might just be better trading. On one side of the trade would be the companies clogging the atmosphere with heat-trapping gases; on the other countless projects to eliminate the problem by planting trees or building machines that capture carbon dioxide. Create a market that turns a ton of removed carbon into a commodity just like corn or copper, and money will flow from the emitters to the fixers.

That’s the theory behind the new carbon-offset market being conceived by Mark Carney, a former governor of the Bank of England, and Bill Winters, the chief executive of Standard Chartered Plc. The two financial veterans late last year set up a rule-making taskforce populated by hundreds of bankers, airline executives, sustainability experts, commodities traders, scientists and other business leaders.