|

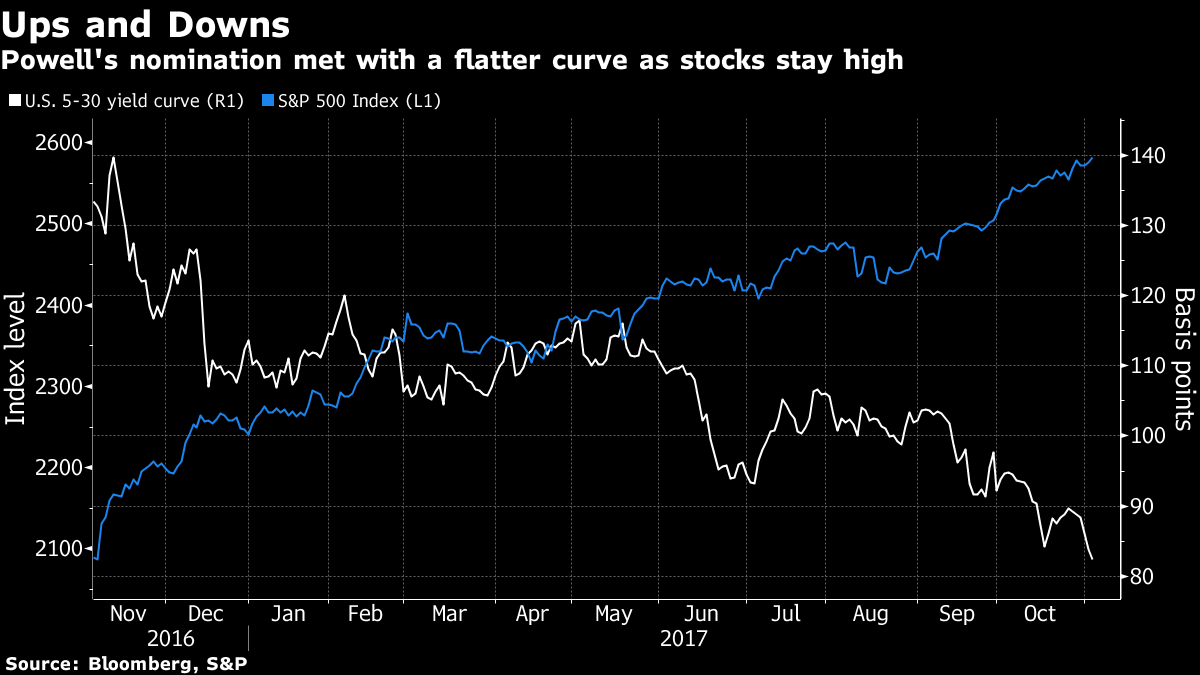

Welcome to the Weekly Fix, where we look at President Donald Trump's pick to lead the Fed, Venezuela's decision to seek a debt restructuring and the latest from China's bond markets. Treasuries Curve Flattens as New Chair Seen Same as OldMeet the new boss, same as the old boss! That seemed to be the message from bond investors who drove down longer-end yields after President Donald Trump said he will nominate Jerome Powell to run the Federal Reserve from February.  The gap between 5- and 30-year Treasury yields shrank to the narrowest in almost a decade, while equities held near record highs. That probably fits well with the president's goals -- at one stage he leaned toward keeping current Chair Janet Yellen based on her stewardship of a recovering economy where rates were still fairly low and stocks kept hitting records. Powell, whose comments on policy are collated here, vowed to be on guard against financial market risks. He has shown a Yellen-esque sensitivity toward emerging markets, and the new chair comes in just as the Fed is starting to win over bond markets to its rates guidance. He is broadly seen extending the path that U.S. central bankers reinforced at this week's meeting -- a hike in December and more to come in 2018. The new central bank chief will face plenty of challenges as he seeks to navigate the twilight of the age of easy money. Meantime, Trump himself has about $340 million of debt with interest rates that will rise or fall depending on policy settings that will be overseen by Powell. Elsewhere in the world of central banks, Japan's Prime Minister Shinzo Abe is assumed by market watchers to be leaning toward reappointing Haruhiko Kuroda at the BOJ. And Bank of England Governor Mark Carney managed to make the U.K.'s first rate hike in a decade sound so dovish that bonds reacted as if he had cut. U.S. Set to Borrow Less Even as Debt Cap Deadline LoomsAnother key pivot point for bonds this week was the Treasury's quarterly refunding announcement. The U.S. government's borrowing plan was cut almost in half, even as concern about the approach of the fresh debt cap deadline of Dec. 8 put a kink in bill yields. And at the longer end of markets, Treasury Secretary Steven Mnuchin said now is not the time to be selling bonds with maturities longer than 30 years. Even with the prospect of less supply, the Fed's plans to trim its balance sheet are likely to push Vanguard and BlackRock to buy more Treasuries, even if they end up holding their noses as they do so.

|

|

Venezuela Gives Up on Fight to Avoid RestructuringIt might have taken longer than some market players expected, but Venezuela finally announced this week it will seek to restructure its global debt; one estimate puts the overseas debt owed by the government and state entities at about $143 billion, including some $52 billion in bonds. The Latin American country had long struggled to avoid default. The local economist who had urged President Nicolas Maduro to default is now concerned that any restructuring will be very painful, and may do little to help the country as a whole. The government did say that state-run oil company PDVSA was making payments that fell due late October, which may relieve some traders. The saga left Mark Mobius happy he had stayed away ever since Hugo Chavez came to power in 1999. China Soothes Bond-Market AngstFixed-income markets in China started to look a little less heated as November got going, after the yield spikes that came at the end of the 19th Communist Party Congress. The country also reportedly decided to approve more sales abroad by its companies after the success of China's first sovereign U.S. dollar bond sale since 2004. There were still plenty of signs of stress, with HNA Group Co. -- once the flagship for China’s insatiable appetite for overseas assets -- selling the country’s most expensive short-term dollar bond ever. Back in the domestic market, when all the holders of some bonds sold by Dandong Port Group Co. exercised an option to turn the securities in for repayment, the company failed to make full repayment. Amid concern that corporate bonds may follow the selloff that hit onshore Chinese government debt, one oddity has been an outperformance of junk-rated notes. Demand Staying Strong From Europe to Canada and JapanWith plenty of help still available from loose monetary policy, appetite remains extremely strong across the globe for all manner of bonds. Europe's ultra-low rates saw issuance there surpass all of 2016 with two months left in the year, and international sales of Schuldschein -- securities that combine elements of bonds and loans -- are also surging. Japanese borrowers are tapping into Asian demand for dollar bonds, while Canadian junk-rated companies are on track for a record year of offerings. GE May Lose AAA, EM Debt's Allure, What Term Premium?Wrapping up what's been a hectic week, here are three of the more thought-provoking offerings I've seen. General Electric Co. is on the verge of joining the ranks of companies to lose their top credit rating as they focus on pleasing shareholders. Europe's biggest fund is sticking with its bets on hard-currency emerging-market bonds despite the Fed's tightening plans. And finally, here's a fascinating look at what a term premium is and why they have been turned on their heads. |

|

| You received this message because you are subscribed to The Weekly Fix newsletter. | Unsubscribe Bloomberg.com Contact Us | Bloomberg L.P. 731 Lexington Ave. New York, NY 10022 |

|---|