|

|

|

Trump pushes for more China concessions, Turkey's problems seem far from over, and Elon Musk has a lot on his plate. Fair dealPresident Donald Trump is looking for China to bring more to the table ahead of an effort to restart trade negotiations. Trump’s demand for a package of measures that slashes the bilateral trade deficit continues to be the major sticking point, as the feeling in China is that the president is trying to thwart the country’s rise as a global power. For investors, a trade war between the world’s two largest economies remains the main risk facing assets in Asia. UnstabulThe recent respite for Turkey’s lira may prove fleeting, with a flare-up in tensions with the U.S. possible as an appeals court in Izmir is set to rule by tomorrow on a bid to release American pastor Andrew Brunson. Treasury Secretary Steven Mnuchin warned that Turkey will face more sanctions if Brunson is not released. Later today, S&P Global Ratings is scheduled to update financial markets on how it views the country’s creditworthiness, with Bloomberg Opinion’s Mark Gilbert saying a downgrade is “inevitable.” While the lira added to gains yesterday after Turkey’s Treasury and Finance Minister Berat Albayrak promised that there would be no imposition of capital controls in response to the crisis, the currency was back in the red today. Tweet regret?Tesla Inc.’s Elon Musk said in an interview with the New York Times that he wrote his tweet about taking the company private while driving to the airport. With shares in the company now having more then erased their gains in the aftermath of that tweet, Musk writing a blogpost where he attempted to explain what he meant by “funding secured,” and Tesla receiving a subpoena from the U.S. Securities and Exchange Commission over his plans, it is little wonder that he said in the interview he’s having trouble sleeping. Tesla shares were trading down almost 1 percent at $332.50 in the pre-market. Markets quietOvernight, the MSCI Asia Pacific Index climbed 0.5 percent, while Japan’s Topix index closed 0.6 percent higher amid optimism over the restarting of trade talks. In Europe, the Stoxx 600 Index was 0.2 percent lower at 5:45 a.m. Eastern Time with the region’s equities in something of a mid-August volume slump. S&P 500 futures pointed to a slightly lower open, the 10-year Treasury yield was at 2.848 percent, and gold was a little higher. Coming up…At 10:00 a.m., August University of Michigan consumer sentiment is published. At 1:00 p.m., Baker Hughes releases the weekly rig count. That’s pretty much it for the economic data today. Unless you’re an emerging-market currency trader, probably a good day to book a long lunch. What we've been readingThis is what's caught our eye over the last 24 hours.

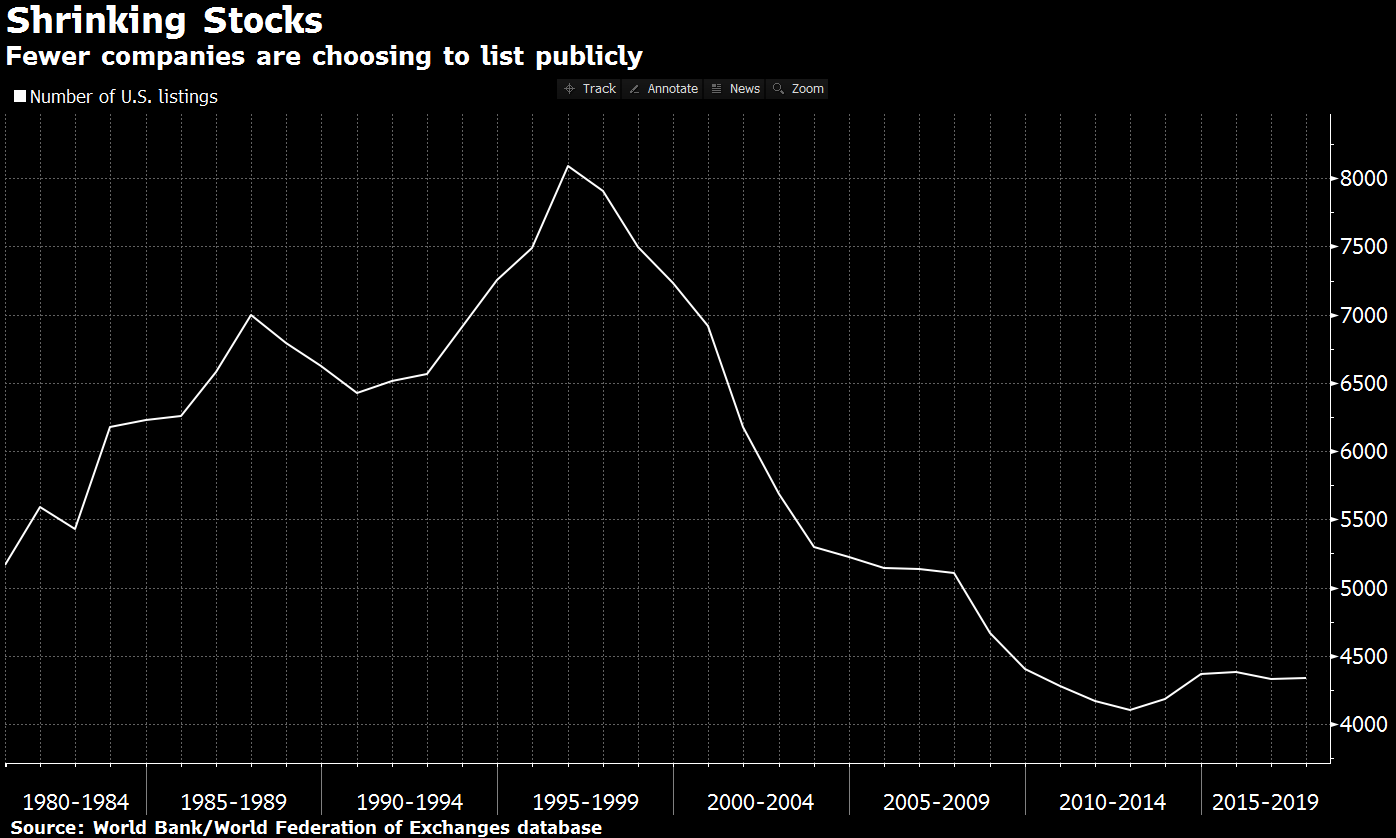

And finally, here’s what Dani's interested in this morningElon Musk's road to take Tesla private seems to be an increasingly well-traveled one. Public markets are shrinking -- the last time the Wilshire 5000 total stock market index had 5,000 companies was back in 2005. Ohio State University's Rene Stulz has a great report on this topic in the National Bureau of Economic Research. And by sheer coincidence just as Musk was tweeting about de-listing, I picked up "Bad Blood" by John Carreyou, which follows the implosion of blood diagnostic start-up Theranos. Perhaps because I had Stulz's piece on my mind, the saga read to me like a worst-case scenario of what can go wrong without hyper-observant public markets. That's not to say listed companies can't or don't engage in devious behavior. But a lot of alleged red flags were missed in the Theranos story, and you have to wonder if constant pestering from analysts could have spared investors. Most of Theranos's backers were VC firms, well versed in tech startups but less so in health care. Some of the sell-side researchers assigned to Theranos would have been biotech experts, who, at least in theory, could have spotted sketchy sounding claims. But thanks to ultra-low interest rates and investor hunger for returns buoying private equity's financing power, companies have a much easier route to avoid the scrutiny of public markets.

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

|

FOLLOW US |

SEND TO A FRIEND |

| You received this message because you are subscribed to Bloomberg's Five Things newsletter. |

| Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |