|

Inside: What to watch in Sustainable Finance in 2019; Carbon might repeat as the best-performing commodity in 2019; What investors get wrong about backing women-led businesses; Tesla taps two to oversee Elon Musk — Emily Chasan and Eric Roston

What to Watch

Here are 10 trends to watch in Sustainable Finance in 2019:

1) ESG May Steady Rocky Economic Seas

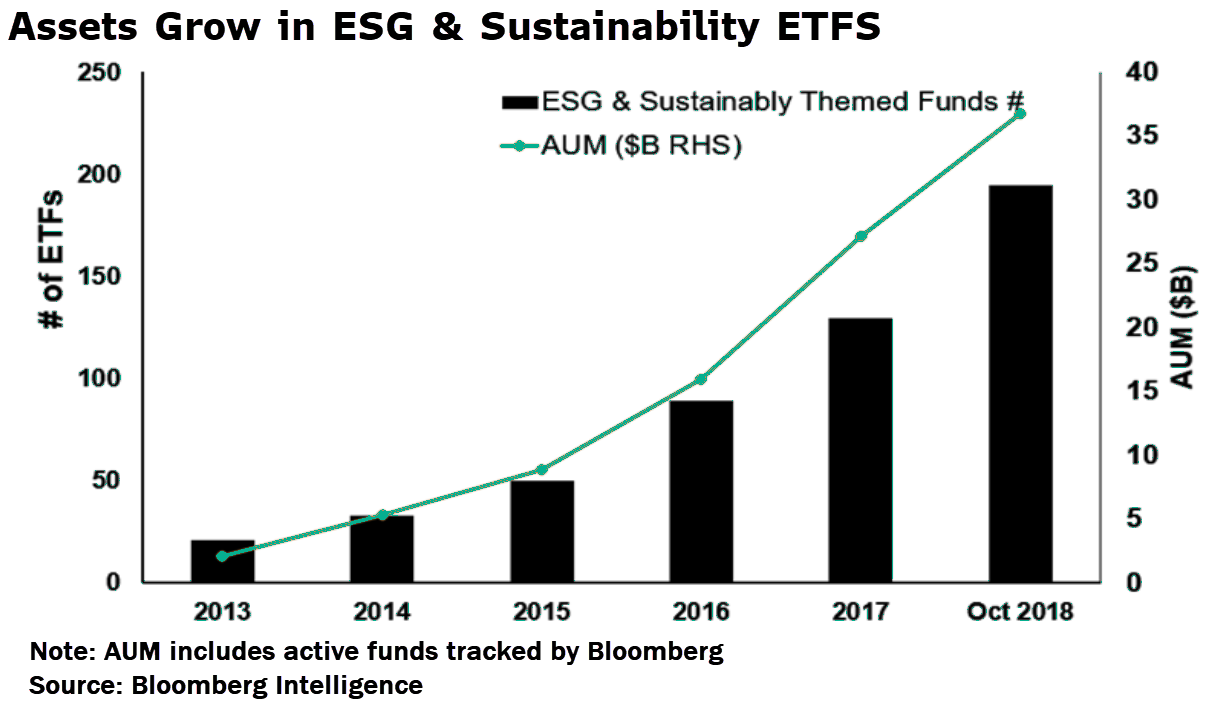

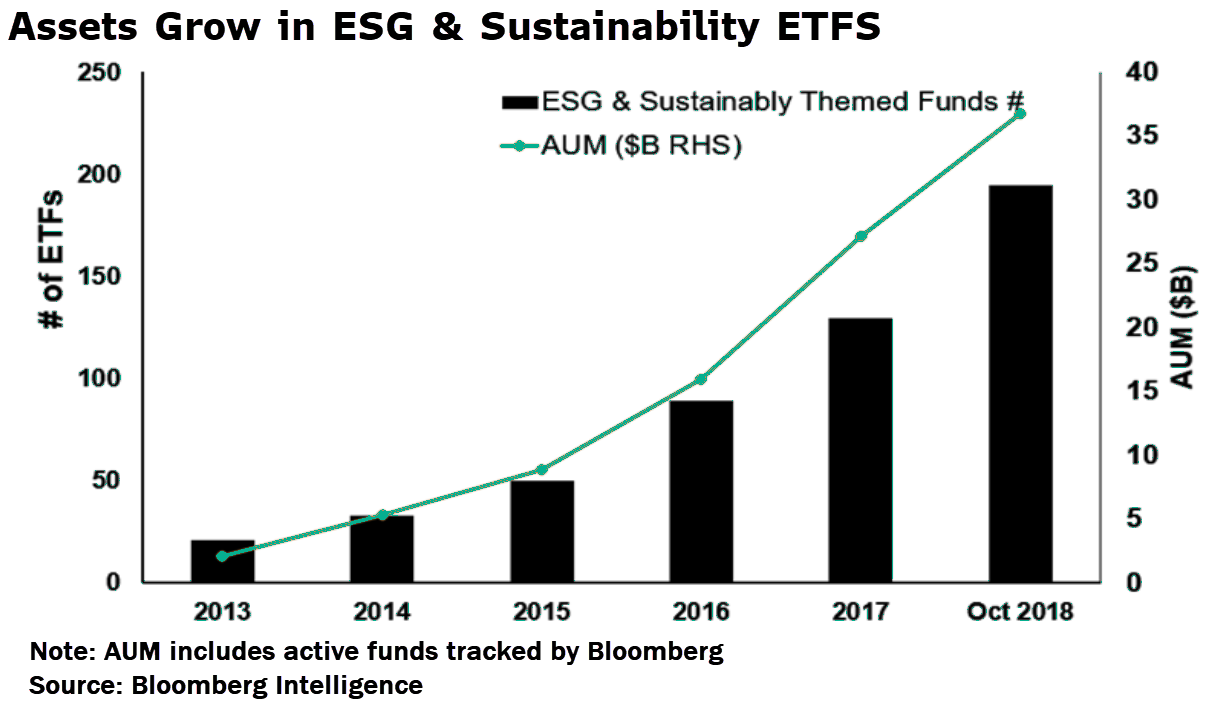

Whether ESG investing really protects investors from risk, will be placed to the test this year amid expectations for volatile financial markets. ESG indexes outperformed their non-ESG complements in 2018, and there’s some evidence that socially responsible investing perform better during downturns, and recover faster, than conventional approaches.

2) Mission Accomplished in the "War on Coal?"

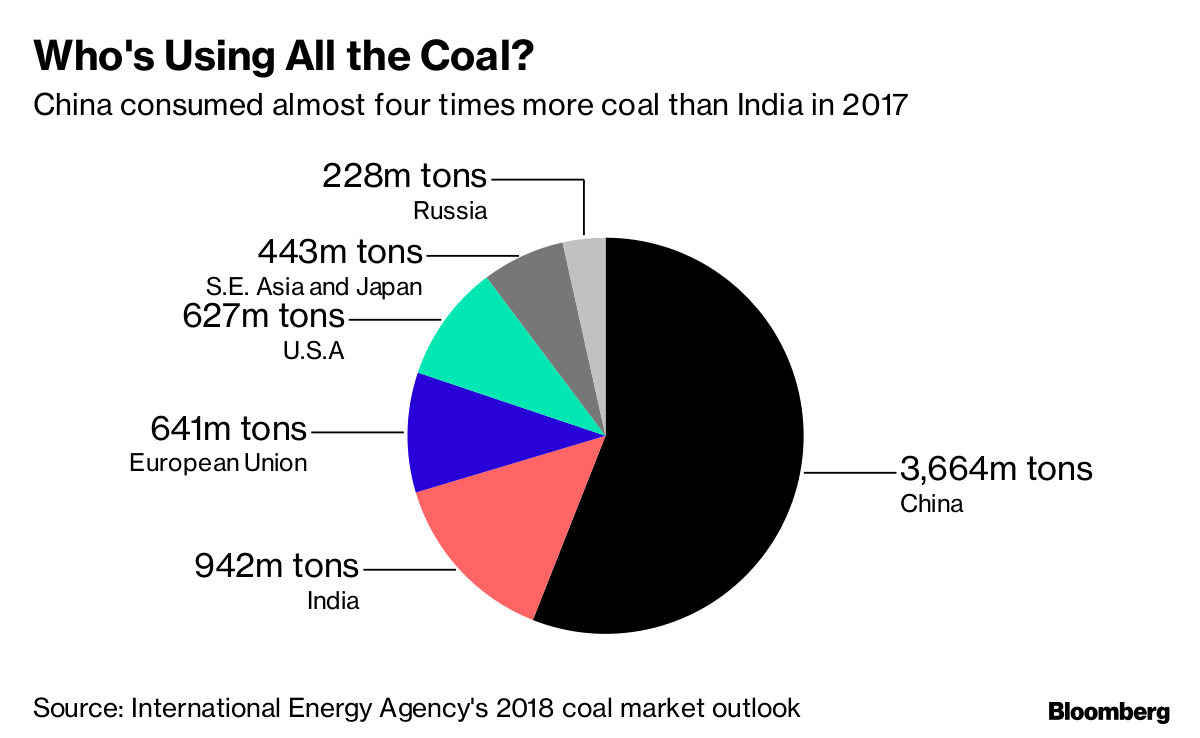

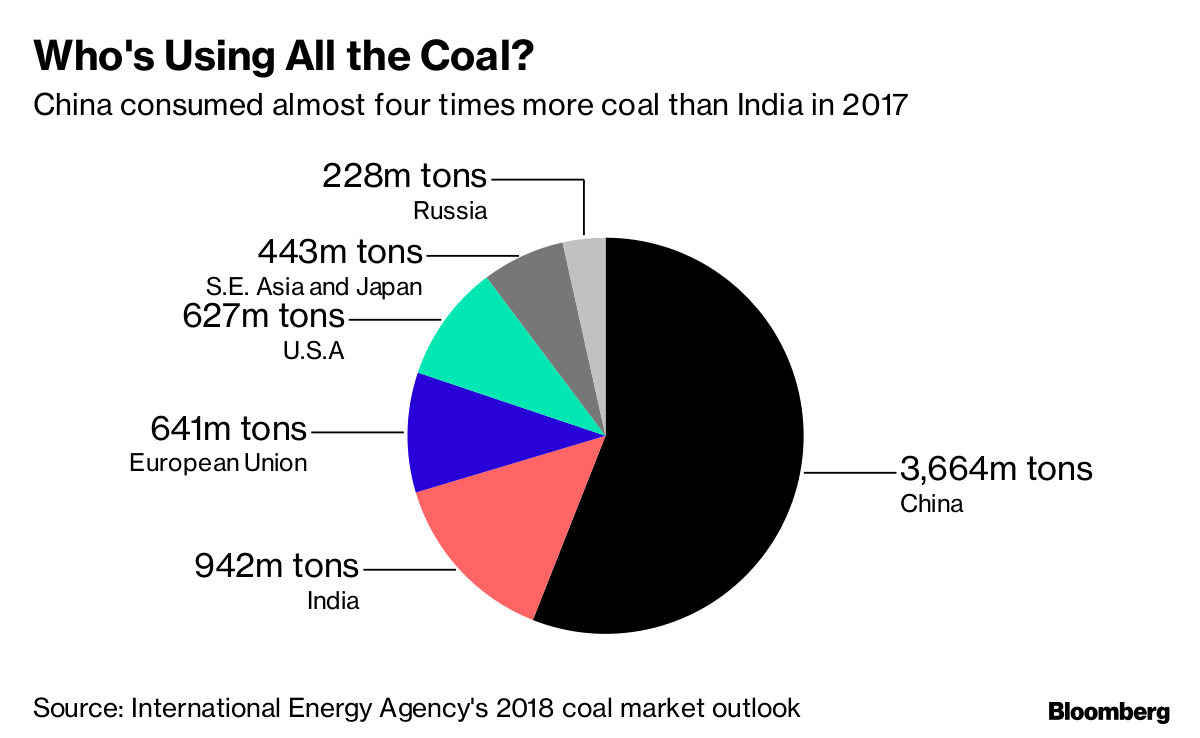

If there’s a war on coal, then most everybody is in on it. U.S. natural gas, which has upended the energy industry in the last decade, is expected to gain again. That will cut coal’s share of power generation to 26 percent in 2019, from 30 percent in 2017, according to the U.S. Energy Information Administration. While the White House is trying both to rewind Obama-era climate policies and enact support for coal, development banks are only the latest to turn away from the fuel.

3) Gender Will Become a Bigger and Broader Investment Theme

A shift toward thematic ESG strategies and increased transparency around gender pay gap issues should support the growth of more gender funds in 2019, according to Bloomberg Intelligence analyst Shaheen Contractor. ETFs focused on gender issues recorded $179 million on inflows in the first three quarters of this year, as eight new funds were created. Investors are also likely to start thinking more broadly about gender -- focusing on opportunities and products for lower- and middle-income women. "Globally, we're seeing increasing focus on how people can think about creating more economic opportunity for women through employment or through products and services," said Amit Bouri, CEO of the Global Impact Investing Network.

4) Will China Drive Green Bonds Again?

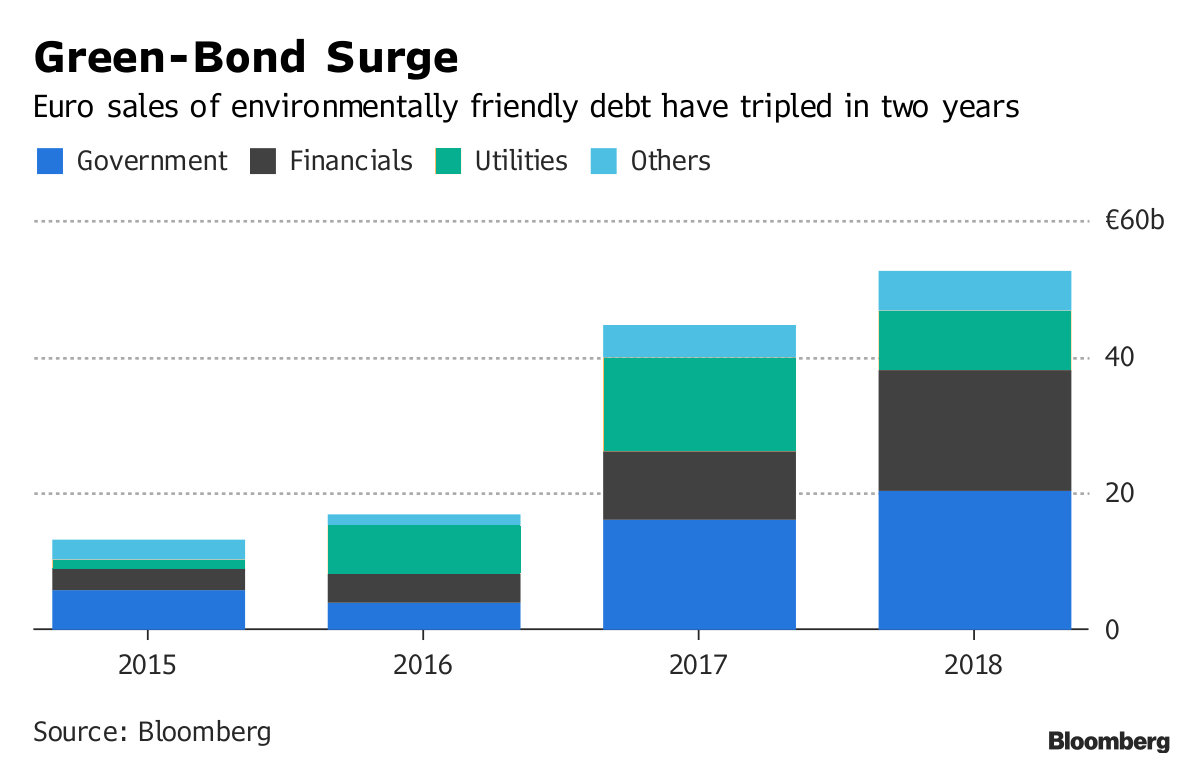

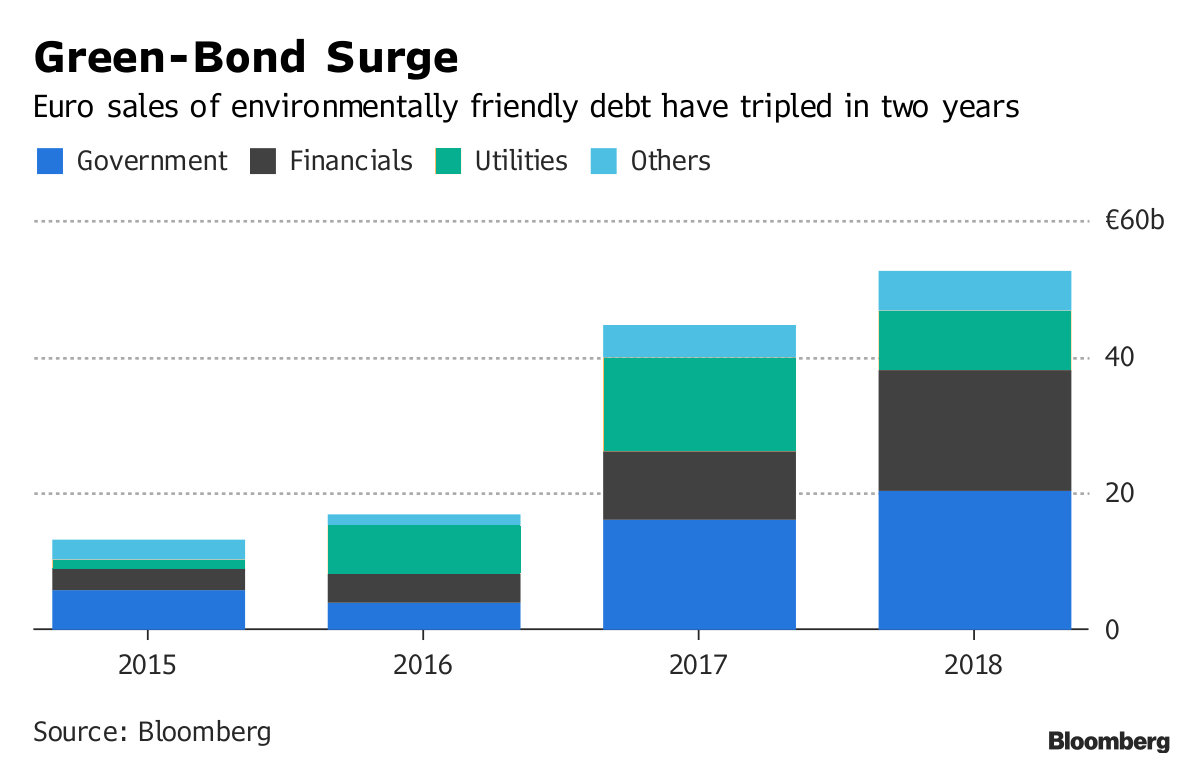

Green bonds rose 9 percent in 2018 to $175 billion. Unless interest rate increases but a damper on the market, 2019 may see continued growth, particularly if China sees a resurgence in issuance: November saw $30 billion issued in green bonds, with 40 percent of them coming from China, according to Bloomberg NEF.

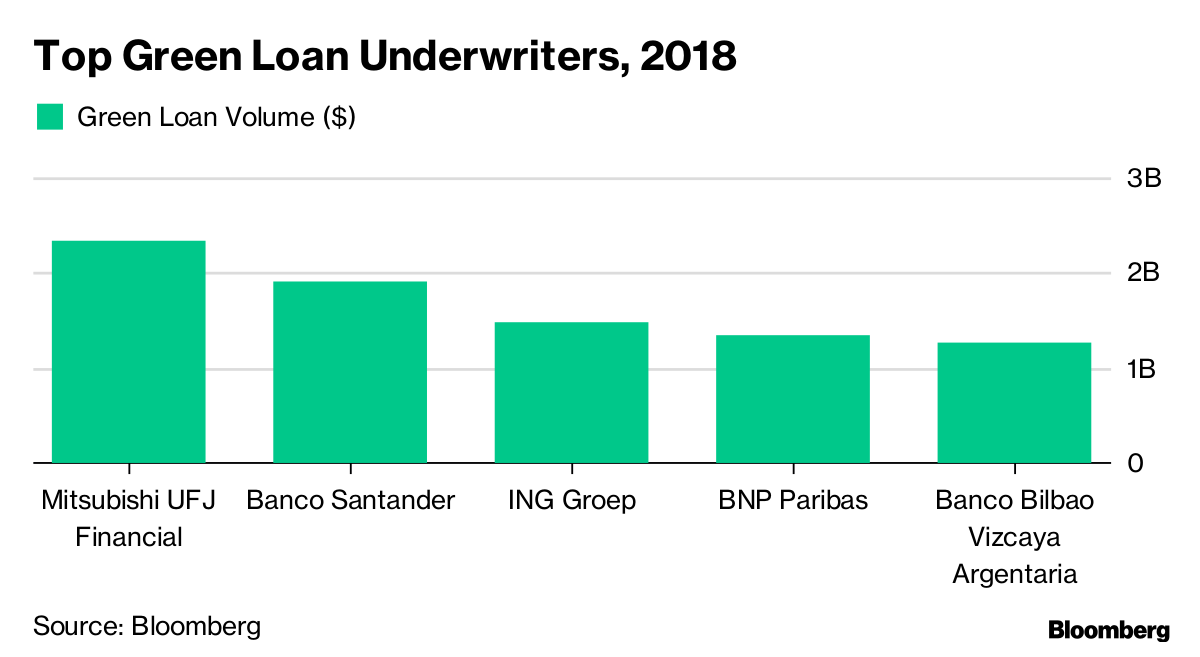

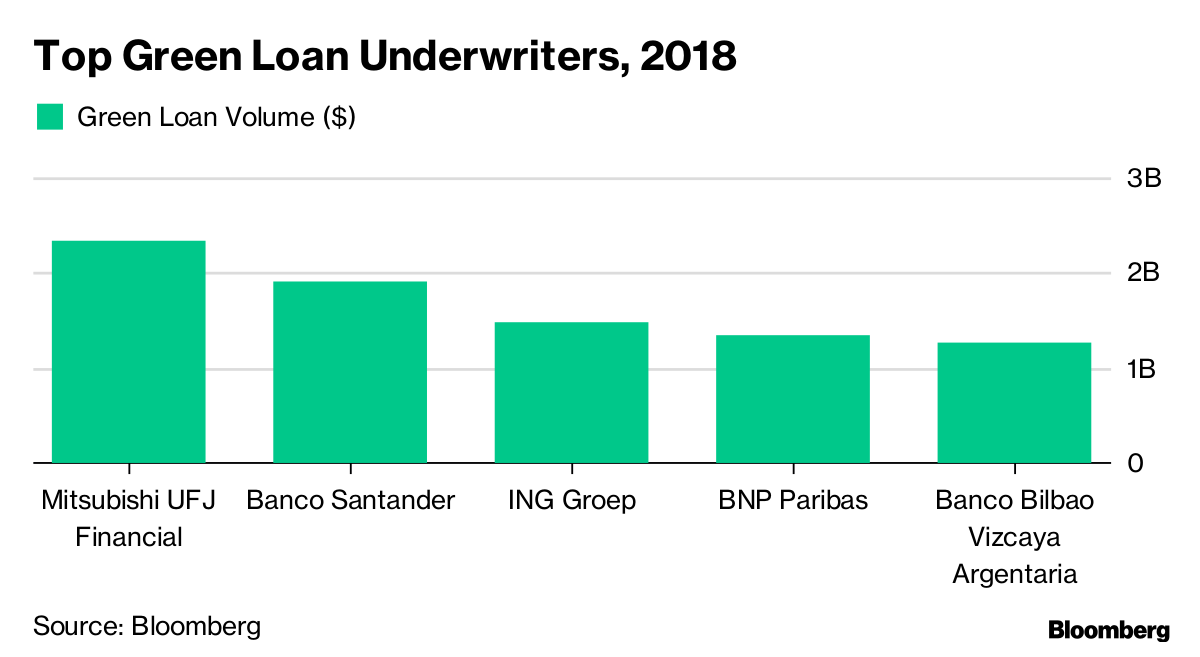

5) Sustainability and Green Loans To Take Off

The green loan principles are written, and banks are eager to do more deals linking performance on sustainability targets to the rates companies pay on their debt. Many of Europe's biggest banks have already pledged to overhaul their corporate lending portfolios for a 2 degree global warming scenario already, and others are likely to follow their lead.

6) More ESG Regulation Ahead

Socially conscious investors and corporate sustainability strategies will be under more pressure to prove they are doing more than greenwashing, and regulators are increasingly stepping in. Financial firms from banks to insurers to pension plans are likely to see more regulation around ESG issues in the coming year, and there is likely to be broader adoption of recently completed reporting frameworks from groups like the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures. The number of regulations affecting sustainability reporting have doubled in the last three years, across the U.K., U.S. and Canada, according to an analysis by Datamaran.

7) Fee Pressure

ESG investment products will face more fee pressure this year, according to Bloomberg Intelligence's Contractor. That could lead to an even bigger boom in ESG and sustainability-themed exchange-traded funds, which are already up four times since 2015. Low-cost ESG ETFs from Vanguard and BlackRock have highlighted the higher fees of some other ESG products and there will be more competition in 2019, which could have a big impact on inflows, she said.

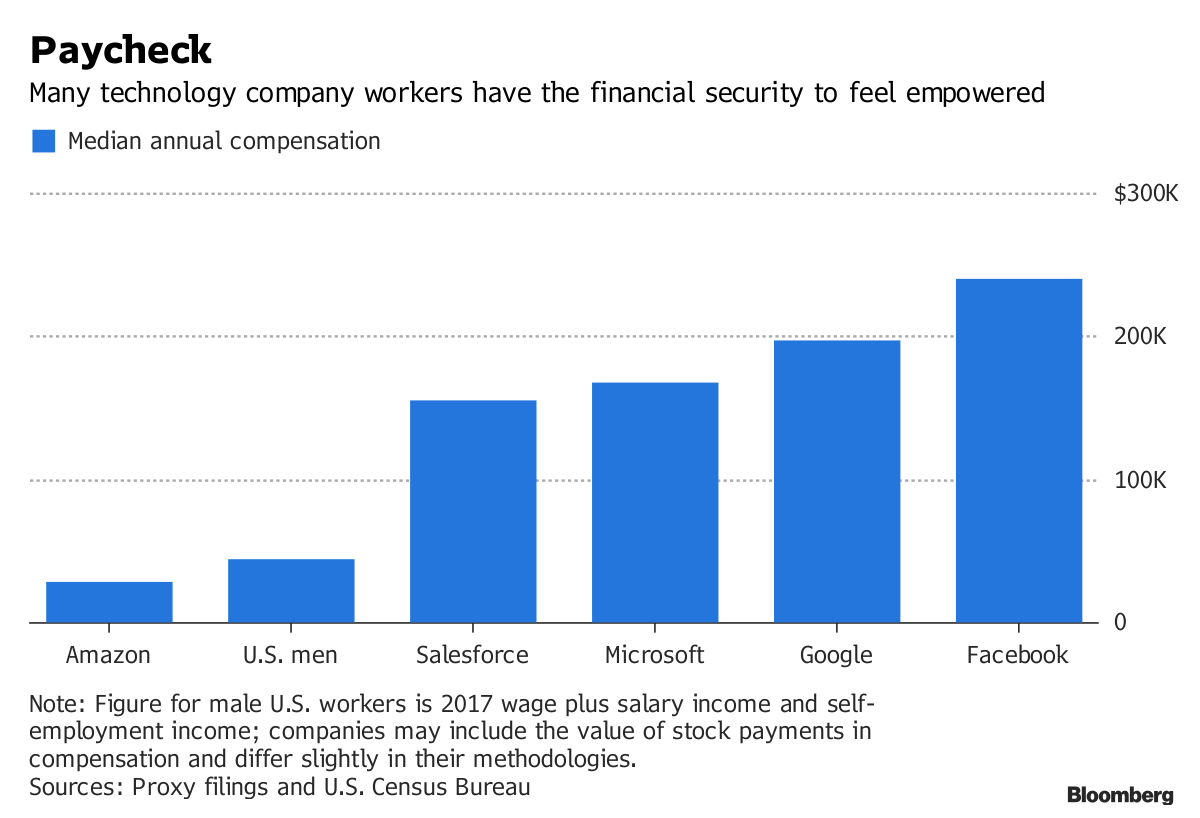

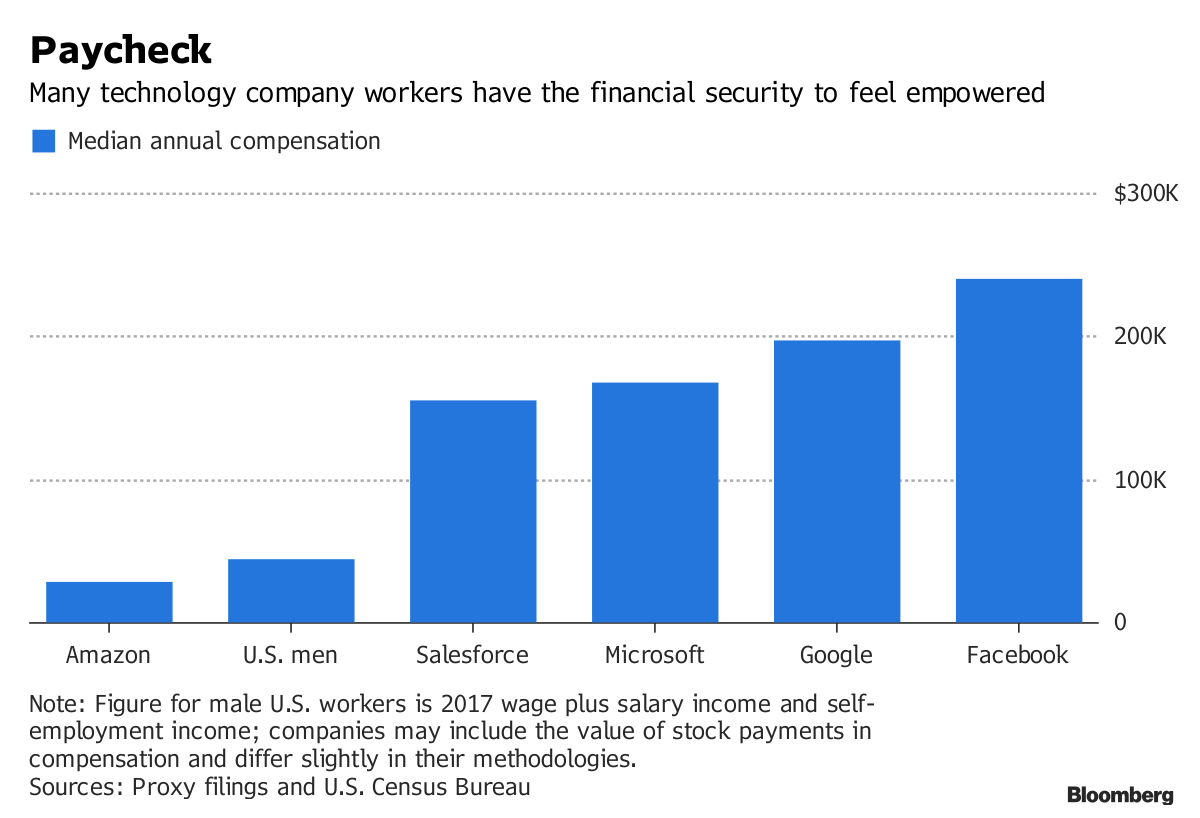

8) Employee Activism

Corporate sustainability initiatives have been a key way for companies to attract passionate employees who want meaning and purpose in their work. But companies are starting to get some backlash if they don't live up to the promise. Google employees in recent months have protested sexual misconduct, unequal treatment of contractors and the company’s involvement in a Chinese search product that censors results. A group of Amazon.com employees tapped their status as shareholders to petition the company for a comprehensive climate change plan. Tech employees may feel particularly emboldened thanks to their high salaries.

9) Opportunity Zones Will Test Impact Investors

So-called "opportunity zones" are sucking up all the energy in the room for impact investors early this year, and may slow down progress in other areas. The U.S. tax overhaul in 2017 included a provision designed to encourage investment in low-income areas dubbed “opportunity zones,” enabling investors to defer, avoid or reduce capital-gains taxes. Family offices and ultra-high-net worth investors seeking are already rapidly deploying billions of capital into projects. Some impact-focused groups are worried the projects won't actually reduce inequality and are working to quickly put in place standards for impact investors focused on the space.

10) A Human Rights Reckoning in Tech

"Investors will grapple with whether and how competition and anti-trust can be used to address tech’s many social shortcomings," said Michael Connor, executive director at the Open Media and Information Companies Initiative, which works with investors focused on the space. He said Amazon could become a lighting rod and investors will focus on "negative externalities" in technology including its impact on human and civil rights, privacy, facial recognition, food waste, workforce diversity, human capital management.

Sustainable Finance

Green bonds were a rare bright spot in Europe's lackluster bond market this year, but the boom could cool as green loans and securitizations start to grab the spotlight, writes Bloomberg's Emma Haslett.

Blackwater founder Erik Prince is launching a fund for electric car metals, aiming to raise as much as $500 million to invest in supply of metals needed for car batteries, the Financial Times reported, citing Prince.

Macquarie arranged $100 million in debt financing for battery-storage systems in Southern California.

Sunrun, the largest U.S. solar company, last week completed a $322 million securitization of long-term customer contracts in 19 states. Credit Suisse and Deutsche Bank were co-structuring agents on the deal.

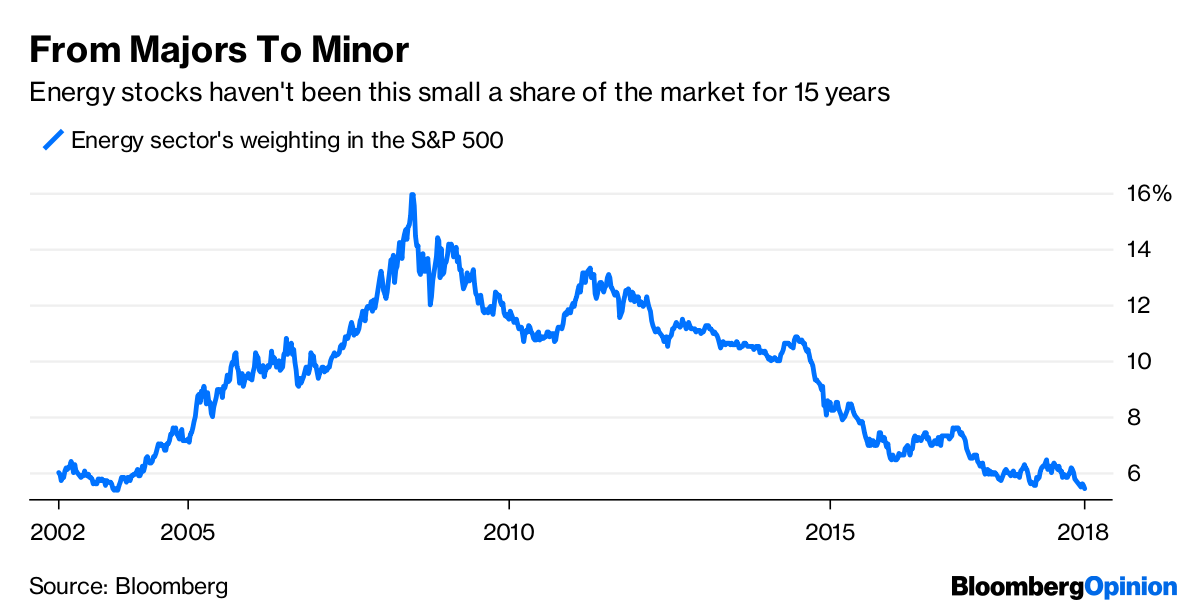

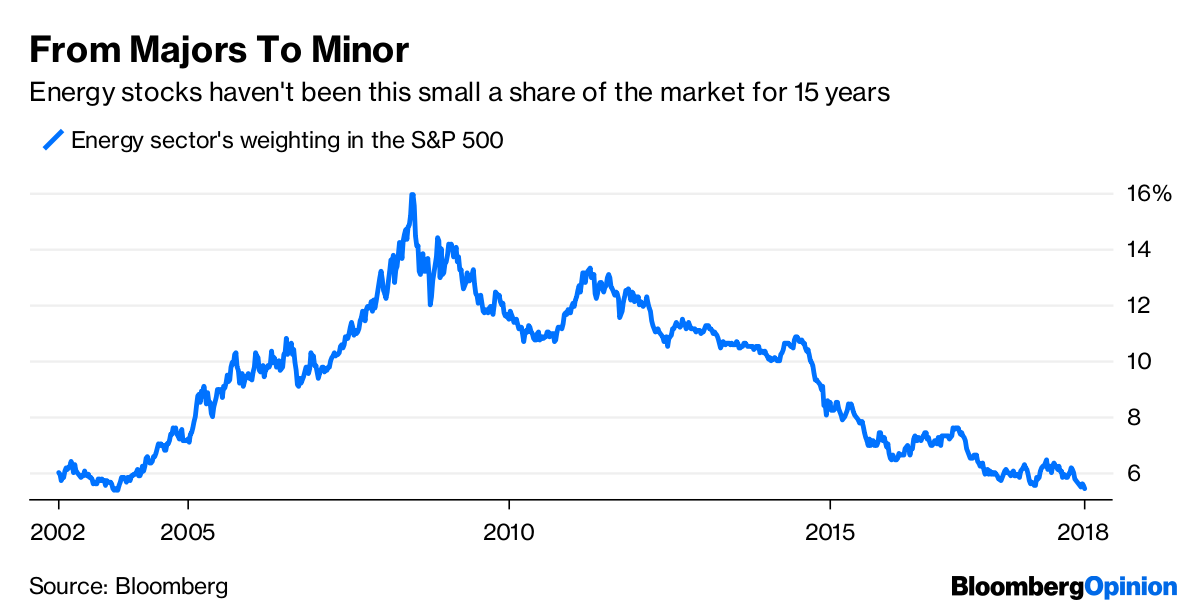

The coming year could be a wild one for energy, writes Bloomberg Opinion's Liam Denning, but how will it impact the market? Energy’s weighting in the S&P 500 is now less than 5.4 percent, the lowest in 15 years.

Environment

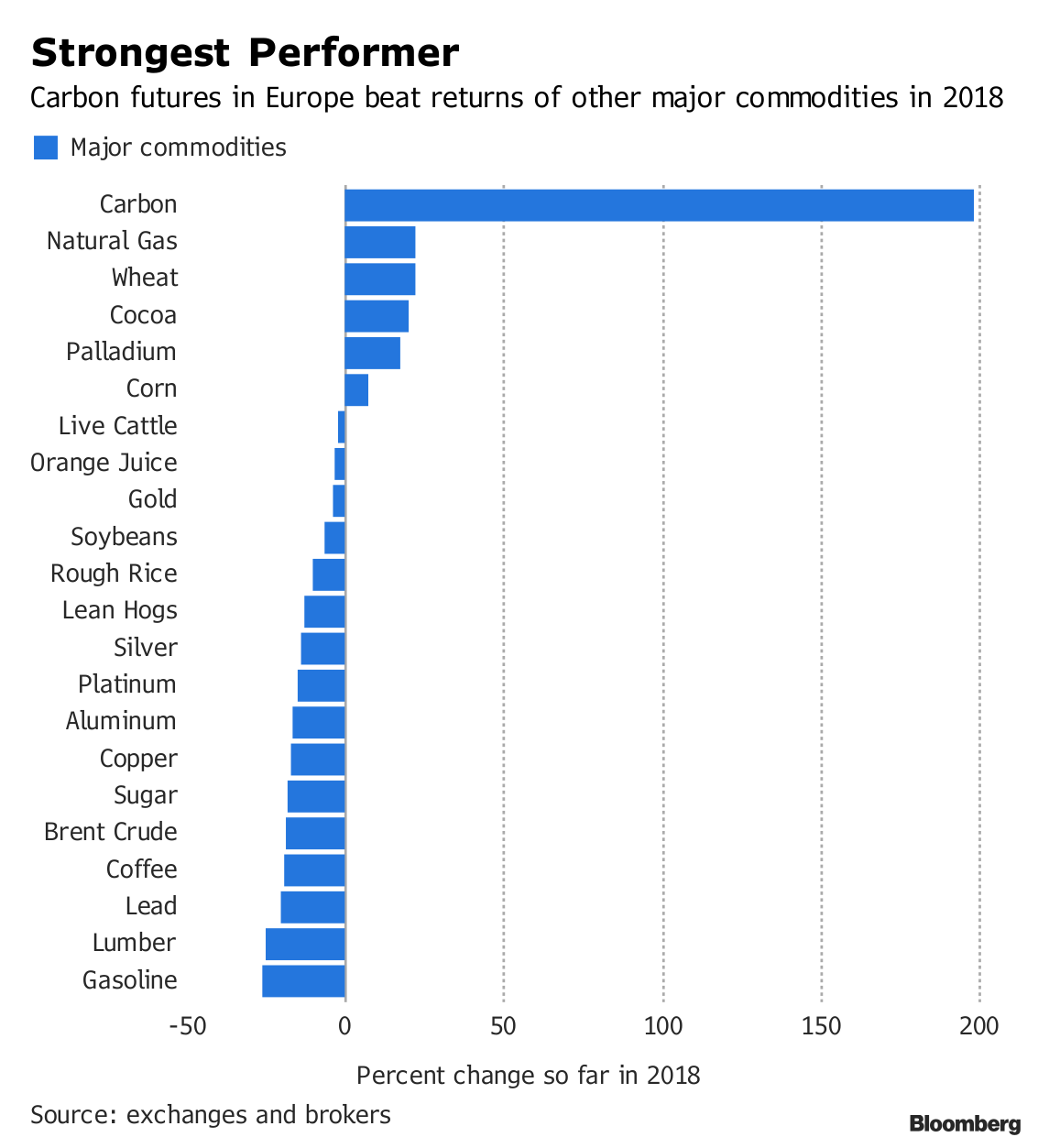

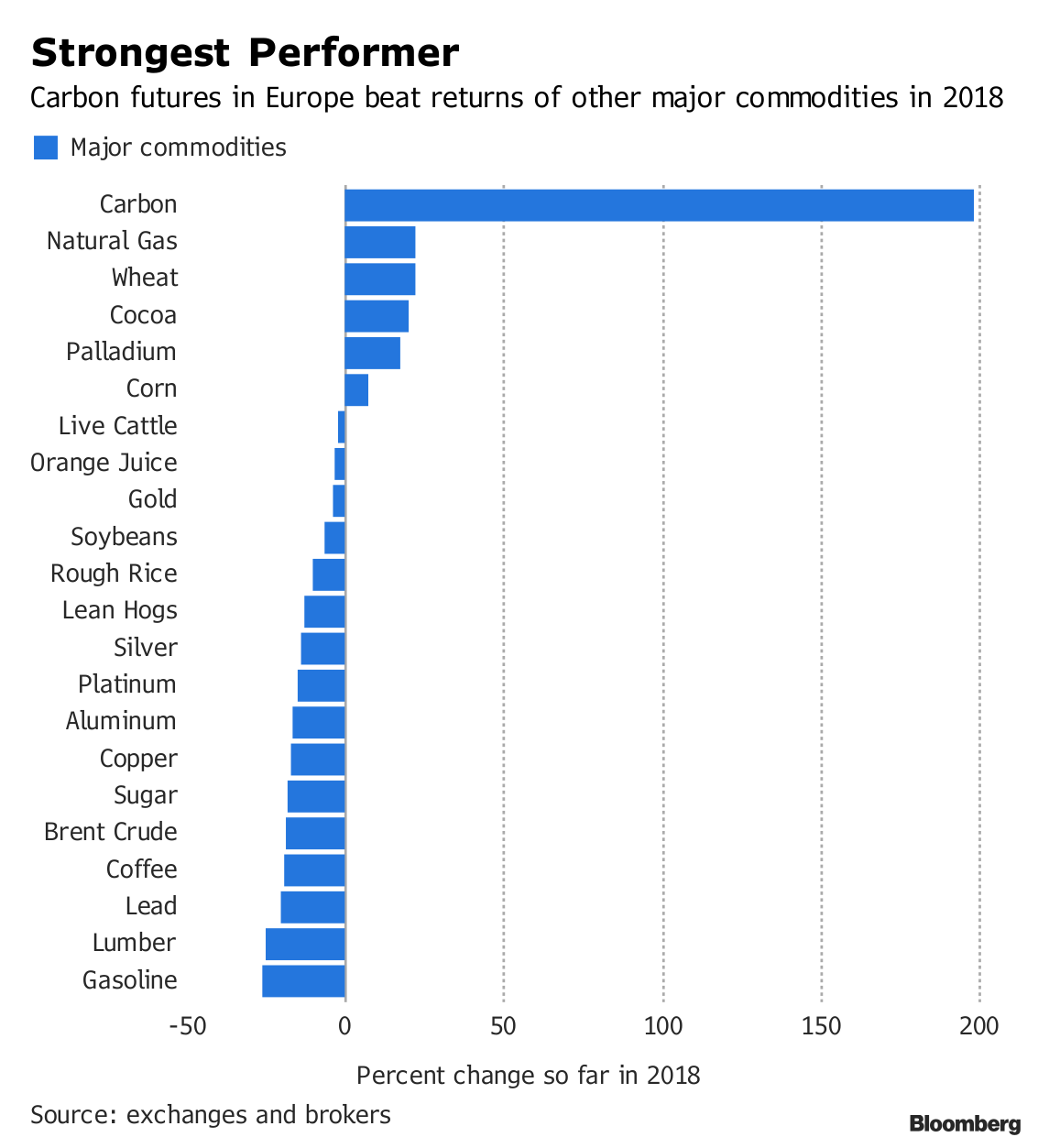

Carbon was the best performing commodity in 2018, and it could he headed for a repeat surge in 2019, writes Bloomberg's Mathew Carr. Carbon futures could near $29 a ton for the first time this year, and the gains are already driving up power prices in Europe.

Earth has seen a spike in global warming before, and it didn't end well, writes Bloomberg Opinion's Faye Flam. While scientists know how much emissions are likely to warm the planet, they still don't know how that will play into system feedbacks and if the heat will take off on its own, she says.

Cargo ships that carry over 80 percent of world trade produce as much carbon dioxide annually as Germany, and they can go green with new technologies, Bloomberg's Editorial Board writes. Listen to a Bloomberg Opinion podcast on green shipping here.

As luxury fashion goes green, plastic hangers are out.

Floods are pushing homes higher in climate-affected regions, and the disabled risk getting pushed out.

U.S. wind and solar companies are looking to Maine and New Mexico, after newly elected Democratic governors said they have plans to support clean energy development. Solar and wind could hit 10 percent of U.S. electricity generation in 2019, up from 8 percent in 2017.

Social

#MeToo pushed companies to seek new resources and rethink policies reporting and preventative training for sexual harassment and assault.

Seoul fund manager Meritz Asset Management wants to prove gender diversity can pay off even in South Korea, which ranks low in Asia and globally on equality.

Investors might be looking for gender balance in the wrong places. A study by Calvert Impact Capital found that diversity in senior staff had a greater impact than the number of female directors or the gender of its founder.

New Jersey followed California in regulations aimed at getting more women on boards.

Governance

Corporate boards are anticipating another year of heightened activism, writes Bloomberg Law's Andrea Vittorio. Globally, a record 284 companies with a market value greater than $500 million publicly faced activist investor demands in 2018, according to data from Activist Insight as of Dec. 21. Boards will also likely see BlackRock, Vanguard, and other passive fund giants continue their shift toward more active oversight of their shares, voicing concerns on issues including guns, opioids, and climate change.

Tesla tapped Larry Ellison and Kathleen Wilson-Thompson to join its board, picking a controversial Silicon Valley luminary and a respected human-resources expert to show securities regulators that it’s giving Elon Musk more oversight. Tesla shares are lower though, as the company announced a $2,000 price cut on each of its vehicles to help make up for a shrinking U.S. tax credit.

The prospect of a billion-dollar payout made this CEO uneasy. Now he's fixing it.

New York State Comptroller Thomas DiNapoli has filed shareholder proposals asking corporate boards to consider pay for rank-and-file workers when setting executive pay, rather than benchmarking only against other CEOs. Microsoft, CVS, and a handful of other companies have already pledged to explain more about how they will do this.

Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net.

New subscribers can sign up here. To see this on the web, click here.

|